Question: please solve : - please use the same format when solving the problem. - show on excel - show work - show formulas -explain Thank

please solve :

- please use the same format when solving the problem.

- show on excel

- show work

- show formulas

-explain

Thank you!

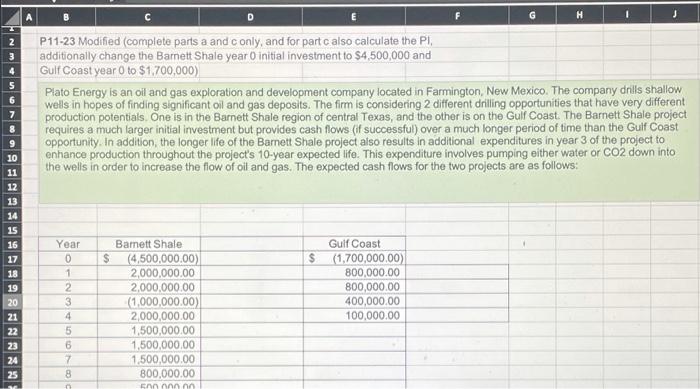

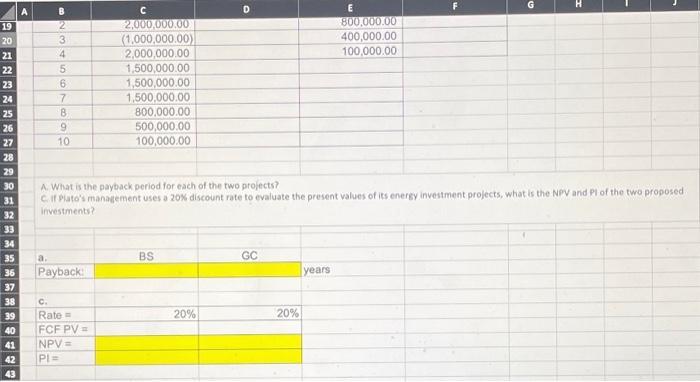

F G H 5 LONGO P11-23 Modified (complete parts a and conly, and for partc also calculate the PI, additionally change the Barnett Shale year 0 initial investment to $4,500,000 and Gulf Coast year 0 to $1,700,000) Plato Energy is an oil and gas exploration and development company located in Farmington, New Mexico. The company drills shallow wells in hopes of finding significant oil and gas deposits. The firm is considering 2 different drilling opportunities that have very different production potentials. One is in the Barnett Shale region of central Texas, and the other is on the Gulf Coast . The Barnett Shale project requires a much larger initial investment but provides cash flows (if successful) over a much longer period of time than the Gulf Coast opportunity. In addition, the longer life of the Barnett Shale project also results in additional expenditures in year 3 of the project to enhance production throughout the project's 10-year expected life. This expenditure involves pumping either water or CO2 down into the wells in order to increase the flow of oil and gas. The expected cash flows for the two projects are as follows: 10 11 12 13 14 15 16 $ $ $ ASUNNE SEE 17 18 19 20 21 22 23 24 25 Year 0 1 2 3 4 5 6 7 8 Bamett Shale (4.500.000,00) 2,000,000.00 2.000.000.00 (1,000,000.00) 2,000,000.00 1,500,000.00 1,500,000.00 1,500,000.00 800,000.00 EN Gulf Coast (1,700,000.00) 800,000.00 800,000.00 400,000.00 100,000.00 LOWN G D C B 2 800,000.00 400,000.00 100,000.00 O GO ON 6 7 2,000,000.00 (1,000,000.00) 2,000,000.00 1,500,000.00 1,500,000.00 1,500,000.00 800,000.00 500,000.00 100,000.00 9 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 A What is the payback period for each of the two projects Cif Plato's management uses a 20% discount rate to evaluate the present values of its energy investment projects, what is the NPV and Pl of the two proposed investments BS GC a Payback years c. 20% 20% 40 Rate FCF PV NPV = PI 41 42 43

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts