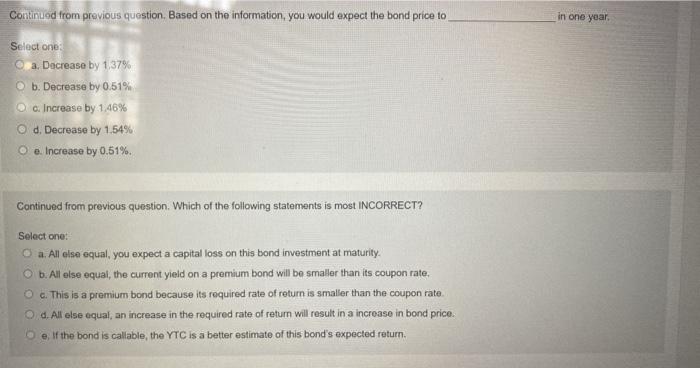

Question: in one year Continued from previous question. Based on the information, you would expect the bond price to Select one a. Dacrease by 1.37% b.

in one year Continued from previous question. Based on the information, you would expect the bond price to Select one a. Dacrease by 1.37% b. Decrease by 0.51% c. Increase by 1.46% Od. Decrease by 1,54% Oe. Increase by 0.51% Continued from previous question. Which of the following statements is most INCORRECT? Select one: a. All else equal, you expect a capital loss on this bond investment at maturity O b. All else equal, the current yield on a premium bond will be smaller than its coupon rate, c. This is a premium bond because its required rate of return is smaller than the coupon rate. O d. All else equal, an increase in the required rate of return will result in a increase in bond price. e if the bond is callable, the YTC is a better estimate of this bond's expected return in one year Continued from previous question. Based on the information, you would expect the bond price to Select one a. Dacrease by 1.37% b. Decrease by 0.51% c. Increase by 1.46% Od. Decrease by 1,54% Oe. Increase by 0.51% Continued from previous question. Which of the following statements is most INCORRECT? Select one: a. All else equal, you expect a capital loss on this bond investment at maturity O b. All else equal, the current yield on a premium bond will be smaller than its coupon rate, c. This is a premium bond because its required rate of return is smaller than the coupon rate. O d. All else equal, an increase in the required rate of return will result in a increase in bond price. e if the bond is callable, the YTC is a better estimate of this bond's expected return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts