Question: In Problem 6, how might we determine whether these ratios reflect a well-managed, creditworthy company Lake of Egypt Marina Inc. Income Statement for Years Ending

Lake of Egypt Marina Inc.

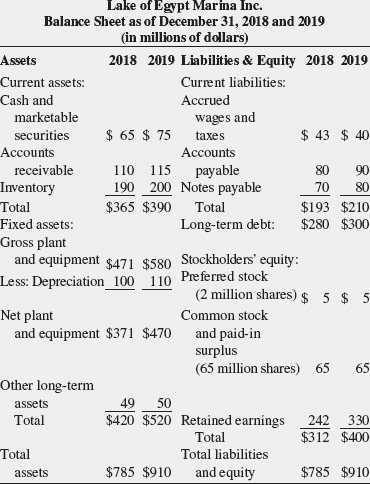

Lake of Egypt Marina Inc.Lake of Egypt Maria Inc. Balance Sheet as of December 31, 2018 and 2019 in millions of dollars) 2018 2019 Liabilities & Equity 2018 2019 Current assets: Current liabilities: Cash and Accrued marketable wages and securities $ 65 $ 75 taxes $ 43 $ 40 Accounts Accounts receivable 110 115 payable 80 90 Inventory 190 200 Notes payable 70 80 Total $365 $390 Total $193 $210 Fixed assets: Long-term debt: $280 $300 Gross plant and equipment $471 $580 Stockholders' equity: Less: Depreciation 100 110 Preferred stock (2 million shares) $ 5 $ 5 Net plant Common stock and equipment $371 $470 and paid-in surplus (65 million shares) 65 65 Other long-term assets Total $420 $520 Retained earnings 242 330 Total $312 $400 Total Total liabilities $785 $910 and equity $785 $910 49 50 assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts