Question: please answer fully and completely for a guaranteed thumbs up. please do it in a timely manner as well! let me know if more info

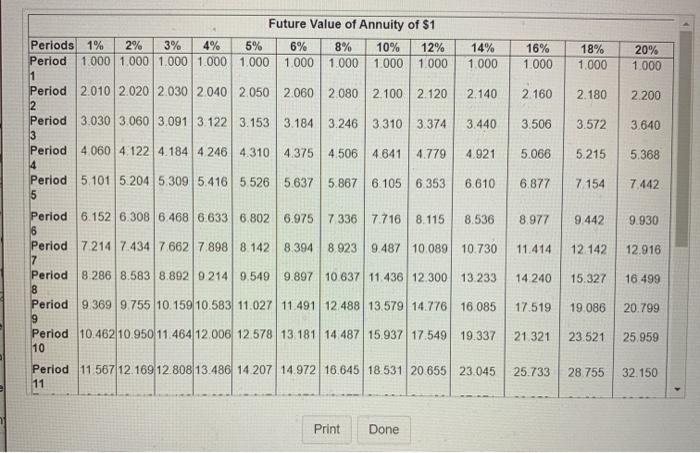

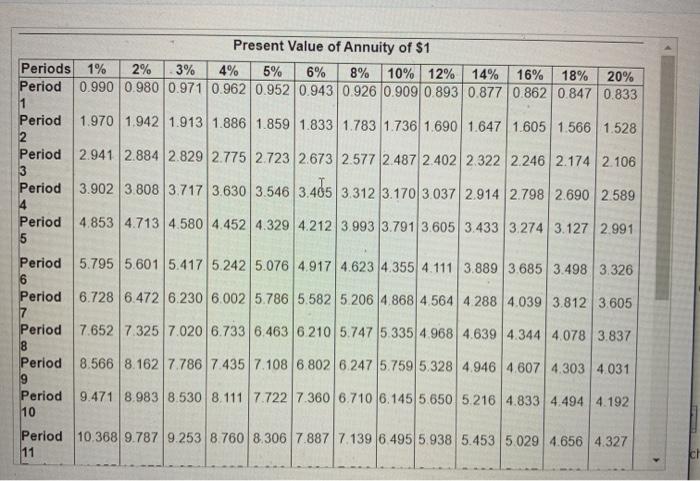

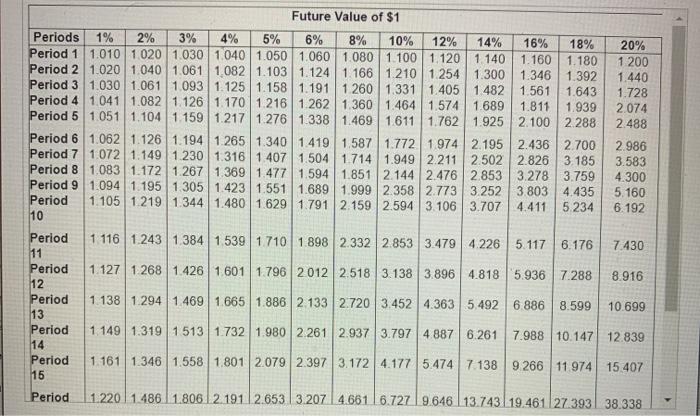

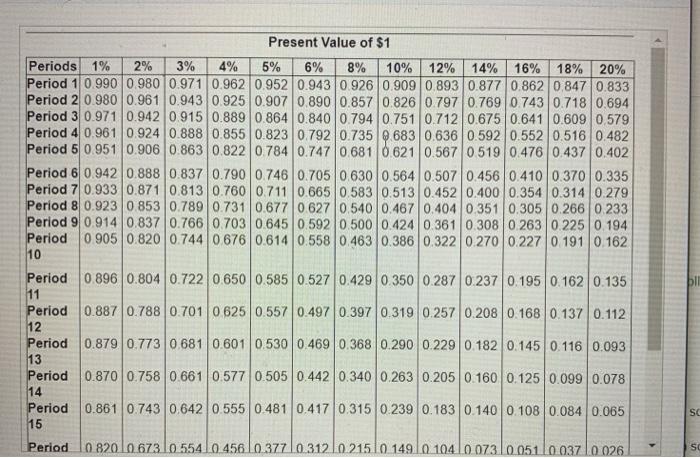

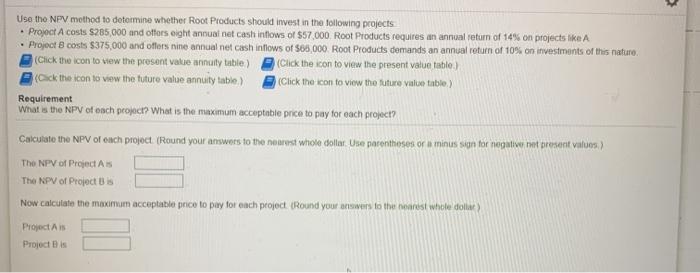

2% 16% 1.000 18% 1.000 20% 1.000 2 160 2.180 2.200 3.506 3.572 3.640 5.066 5.215 5.368 6.877 7 154 7.442 Future Value of Annuity of $1 Periods 1% 3% 4% 5% 6% 8% 10% 12% 14% Period 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1 000 1 Period 2.010 2020 2030 2040 2050 2060 2080 2.100 2.120 2.140 2 Period 3.030 3.06030913.122 3.153 3.184 3.246 | 3310 3.374 3.440 3 Period 4 060 4 122 4.184 4 246 4.310 4.375 4.506 4641 4.779 4.921 4 Period 5 101 5.2045 309 5.416 5.526 5.637 5.867 6.105 6.353 6.610 5 Period 6.152 6.308 6.468 6.633 6.802 6.975 7 336 7.7168.115 8.536 6 Period 7.214 7.4347 662 7898 8.142 8.394 8 923 9.487 10.089 10.730 7 Period 8.286 8.583 8.892 9.214 9.549 9.897 10.637 11.43612 300 13.233 8 Period 9.369 9.755 10.159 10.583 11.027 11 49112 48813.579 14.776 16 085 9 Period 10.462 10.950 11.464 12.006 12.578 13 181 14 487 15.937 17.549 19.337 10 Period 11 567 12.169 12.808 13.486 14 207 14.972 16.645 18 531 20655 23.045 11 8.977 9.442 9.930 11.414 12 142 12.916 14 240 15.327 16.499 17.519 19.086 20.799 21 321 23.521 25.959 25.733 28.755 32.150 Print Done 6% Present Value of Annuity of $1 Periods 1% 2% 3% 4% 5% 8% 10% 12% 14% 16% 18% 20% Period 0.990 0.980 0.971 0.962 0.952 0.943 0.926 0.909 0.893 0.877 0.862 0.847 0.833 1 Period 1.970 1.942 1.913 1.886 1.859 1.833 1783 1736 1.690 1.647 1.605 1.566 1.528 2 Period 2.9412.884 2.829 2.775 2.723 2.673 2.577 2.487 2.402 2.322 2.246 2.174 2.106 3 Period 3.902 3.808 3.717 3.630 3.546 3.485 3.312 3.170 3.037 2.914 2.798 2.690 2 589 4 Period 4.853 4.713 4.580 4.452 4.329 4.2123.993 3.791 3.605 3.433 3.274 3.127 2.991 5 Period 5.795 5.601 5.417 5.242 5.076 4.917 4.623 4.355 4.1113.889 3.685 3.498 3.326 6 Period 6.728 6.4726.230 6.002 5.786 5.582 5 206 4.868 4.564 4.288 4.039 3.812 3.605 7 Period 7.652 7.325 7.020 6.733 6.463 6 210 5.747 5.335 4.9684.639 4.344 4.078 3.837 8 Period 8.566 8.162 7.786 7.435 7.108 6 802 6 247 5.759 5.328 4.946 4 607 4.303 4.031 Period 9.471 8.983 8.530 8.1117.722 7.360 6.710 6.145 5.650 5.216 4.833 4.494 4.192 10 Period 10.368 9.7879.253 8.760 8.306 7.887 7.139 6.495 5.938 5.453 5.029 4.656 4.327 11 5 8% Future Value of $1 Periods 1% 2% 3% 4% 5% 6% 10% 12% 14% 16% 18% 20% Period 1 1.0101 020 1.030 1.040 1.050 1.060 1080 1.100 1.120 1140 1.160 1.180 1 200 Period 2 1.020 1.040 1.0611 082 1.103 1.124 1 166 1210 1254 1.300 1.346 1.392 1.440 Period 3 1.030 1.061 1093 1.125 1.158 1.191 1260 1.331 1.405 1.482 1.561 1.643 1.728 Period 4 1 041 1.082 1.126 1.1701.216 1.262 1.360 1.464 1.5741.689 1.811 1.939 2.074 Period 5 1051 1.104 1 159 1.2171276 1338 1.469 1.611 1.762 1.925 2.100 2.288 2.488 Period 6 1.062 1.126 1.1941.265 1.340 1.419 1.587 1.772 1.9742.195 2.436 2.700 2.986 Period 7 1.072 1.149 1.230 1.316 1.407 1.504 1.7141.949 2.211 2.502 2.826 3.185 3.583 Period 8 1.083 1.172126713691.477 1.5941.851 2.144 2.476 2.853 3.278 3.759 4.300 Period 9 1.0941 195 1.305 1423 1.551 1.689 1.999 2.358 27733.252 3 803 4.435 5.160 Period 1.1051 219 1.344 1.480 1.6291.791 2.159 2.594 3.106 3.707 4.411 5234 6.192 10 Period 1 116 1.2431384 1 539 1.7101.898 2.3322.853 3.479 4.226 5.117 6.176 7.430 11 Period 1 127 1268 1.4261 601 1.796 2012 2.518 3.138 3.896 4.818 5.936 7.288 8.916 12 Period 1.138 1.294 1 469 1.665 1.886 2.133 2.720 3.452 4.363 5.492 6 886 8.599 10.699 13 Period 1 149 1.319 15131732 1.980 2.261 2.937 3.7974 887 6.261 7.988 10.147 12.839 14 Period 1.161 1.346 1.558 1.801 2.079 2.397 3.172 4.177 5.474 7 138 9 266 11.974 15.407 15 Period 1.220 1.486 1.806 2.1912.653 3.207 4.661 | 6.727 9.646 13.743 19.461 27.393 38.338 Present Value of $1 Periods 1% 2% 3% 4% 5% 6% 8% 10% 12% 14% 16% 18% 20% Period 1 0.990 0.980 0.971 0.962 0.952 0.943 0.926 0.909 0.893 0.877 0.862 0.847 0.833 Period 2 0.980 0.961 0.943 0.925 0.9070.890 0.857 0.826 0.797 0.769 0.743 0.7180.694 Period 3 0.971 0.942 0915 0.8890.864 0.840 0.7940.751 0.712 0.675 0.641 0.609 0.579 Period 40.961 0.924 0.888 0.855 0.823 0.792 0.735 0683 0.636 0.592 0.552 0.516 0.482 Period 5 0.951 0.906 0.863 0.822 0.784 0.747 0.681 0.621 0.567 0 519 0.476 0.437 0.402 Period 60.942 0.888 0.837 0.790 0.746 0.705 0.630 0.564 0.507 0.4560.410 0.370 0.335 Period 7 0.933 0.871 0.813 0.760 0.711 0.665 0.583 0.513 0.452 0.400 0.354 0.314 0.279 Period 8 0.923 0.853 0.789 0.731 0.677 0.627 0.540 0.467 0.4040.351 0.305 0.266 0233 Period 90.914 0.837 0.766 0.703 0.6450.5920.500 0.424 0.361 0.308 0.263 0225 0 194 Period 0.905 0.820 0.744 0 676 0.614 0.558 0.463 0.386 0.322 0.270 0.2270191 0.162 10 Period 0.896 0.804 0.722 0.650 0.585 0.527 0.429 0.350 0.287 0.237 0.1950 162 0.135 11 Period 0.887 0.788 0.701 0 625 0.5570.497 0.397 0.319 0.257 0.2080 1680.137 0.112 12 Period 0.879 0.773 0.681 0.601 0.530 0.469 0.368 0.290 0.229 0.182 0.145 0.116 0.093 13 Period 0.870 0.758 0.661 0.577 0.505 0.442 0.340 0.263 0.205 0.160 0.125 0.099 0.078 14 Period 0.861 0.743 0.642 0.555 0.481 0.417 0.315 0.239 0.183 0.140 0.108 0.084 0.065 15 Period 0 820 10 673 1055410.456 10 377 10 31210 215 10 149.0 10410.073 10.051 10.037 10 026 SC SO Use the NPV method to determine whether Root Products should invest in the following projects Project Acosts $285,000 and offers eight annual net cash inflows of $57,000 Root Products requires an annual return of 14% on projects like A Project costs $375,000 and offers nine annual net cash inflows of 565,000. Root Products demands an annual return of 10% on investments of this nature. (Click the icon to view the present value annuity table) (Click the icon to view the present value table (Cick the icon to view the future value annuity table) Click the icon to view the future value table.) Requirement What is the NPV of each project? What is the maximum acceptable price to pay for each project? Calculate the NPV of ouch project. (Round your answers to the nearest whole dollar Use parentheses or a minus sign for negative not present Valves) The NPV of Projects The NPV of Project is Now calculate the maximum acceptable price to pay for each project. (Round your answers to the nearest whole dollar) Project As Project is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts