Question: In Table 6 below you will find MONTHLY RETURN data for 4 companies (A, B, C and D) as well as a Major Local Share

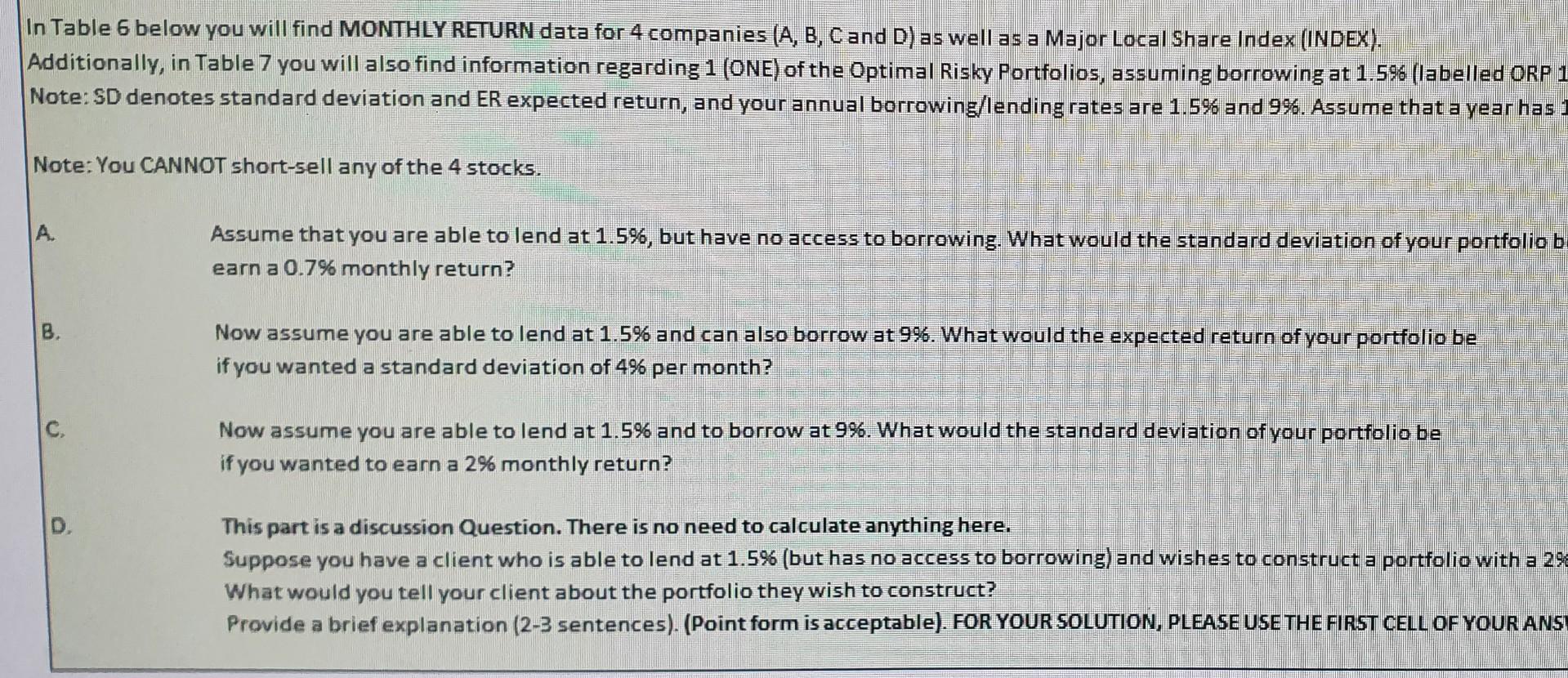

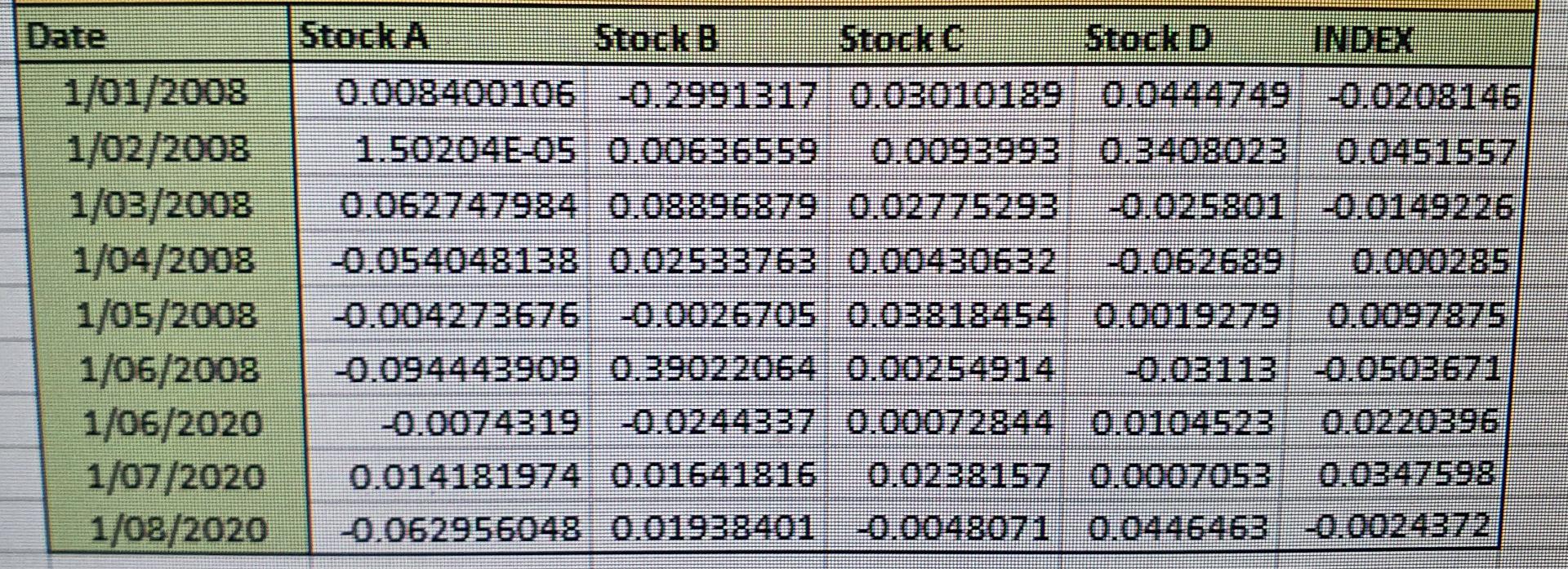

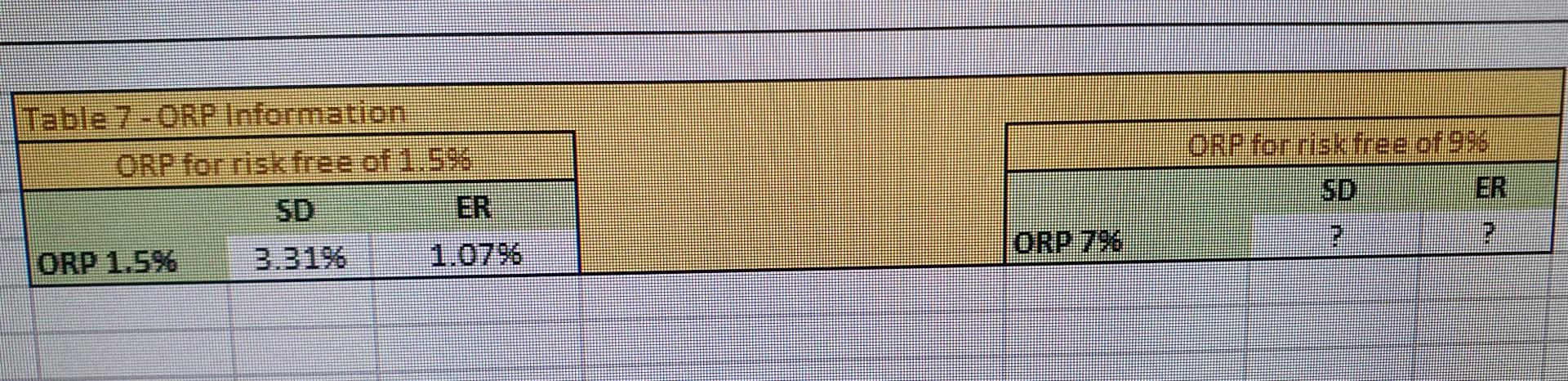

In Table 6 below you will find MONTHLY RETURN data for 4 companies (A, B, C and D) as well as a Major Local Share Index (INDEX). Additionally, in Table 7 you will also find information regarding 1 (ONE) of the Optimal Risky Portfolios, assuming borrowing at 1.596 (labelled ORP 1 Note: SD denotes standard deviation and ER expected return, and your annual borrowing/lending rates are 1.5% and 9%. Assume that a year has Note: You CANNOT short-sell any of the 4 stocks, Assume that you are able to lend at 1.5%, but have no access to borrowing. What would the standard deviation of your portfolio b earn a 0.7% monthly return? B Now assume you are able to lend at 1.5% and can also borrow at 996. What would the expected return of your portfolio be if you wanted a standard deviation of 4% per month? C Now assume you are able to lend at 1.596 and to borrow at 9%. What would the standard deviation of your portfolio be if you wanted to eam a 2% monthly return? D This part is a discussion Question. There is no need to calculate anything here. Suppose you have a client who is able to lend at 1.5% (but has no access to borrowing) and wishes to construct a portfolio with a 29 What would you tell your client about the portfolio they wish to construct? Provide a brief explanation (2-3 sentences). (Point form is acceptable). FOR YOUR SOLUTION, PLEASE USE THE FIRST CELL OF YOUR ANS Date 1/01/2008 1/02/2008 1/03/2008 1/04/2008 1/05/2008 1/06/2008 1/06/2020 1/07/2020 1/08/2020 Stock A Stock B Stock StockD INDEX 0.008400106 -0.2991317 0.03010189 0.0444749 -0.0208146 1.50204E-05 0.00636559 0.0093993 0.3408023 0.0451557 0.062747984 0.08896879 0.02775293 -0.025801 0.0149226 0.054048138 0.02533763 0.00430632 30.062689 0.000285 0.004273676 0.0026705 0.03818454 0.0019279 0.0097875 0.094443909 -0.39022064 0.00254914 30.03113 0.0503671 -0.0074319 -0.0244337 0.00072844 0.0104523 0.0220396 0.014181974 0.01641816 0.0238157 0.0007053 0.0347598 -0.062956048 0.01938401 -0.0048071 -0.0446463 0.0024372 ORP for risk free of 996 | Table 7 - ORP Information ORP for risk free of 1.556 ER ORP 1.596 3.3196 1.0796 SD 2 ORP 796 HE In Table 6 below you will find MONTHLY RETURN data for 4 companies (A, B, C and D) as well as a Major Local Share Index (INDEX). Additionally, in Table 7 you will also find information regarding 1 (ONE) of the Optimal Risky Portfolios, assuming borrowing at 1.596 (labelled ORP 1 Note: SD denotes standard deviation and ER expected return, and your annual borrowing/lending rates are 1.5% and 9%. Assume that a year has Note: You CANNOT short-sell any of the 4 stocks, Assume that you are able to lend at 1.5%, but have no access to borrowing. What would the standard deviation of your portfolio b earn a 0.7% monthly return? B Now assume you are able to lend at 1.5% and can also borrow at 996. What would the expected return of your portfolio be if you wanted a standard deviation of 4% per month? C Now assume you are able to lend at 1.596 and to borrow at 9%. What would the standard deviation of your portfolio be if you wanted to eam a 2% monthly return? D This part is a discussion Question. There is no need to calculate anything here. Suppose you have a client who is able to lend at 1.5% (but has no access to borrowing) and wishes to construct a portfolio with a 29 What would you tell your client about the portfolio they wish to construct? Provide a brief explanation (2-3 sentences). (Point form is acceptable). FOR YOUR SOLUTION, PLEASE USE THE FIRST CELL OF YOUR ANS Date 1/01/2008 1/02/2008 1/03/2008 1/04/2008 1/05/2008 1/06/2008 1/06/2020 1/07/2020 1/08/2020 Stock A Stock B Stock StockD INDEX 0.008400106 -0.2991317 0.03010189 0.0444749 -0.0208146 1.50204E-05 0.00636559 0.0093993 0.3408023 0.0451557 0.062747984 0.08896879 0.02775293 -0.025801 0.0149226 0.054048138 0.02533763 0.00430632 30.062689 0.000285 0.004273676 0.0026705 0.03818454 0.0019279 0.0097875 0.094443909 -0.39022064 0.00254914 30.03113 0.0503671 -0.0074319 -0.0244337 0.00072844 0.0104523 0.0220396 0.014181974 0.01641816 0.0238157 0.0007053 0.0347598 -0.062956048 0.01938401 -0.0048071 -0.0446463 0.0024372 ORP for risk free of 996 | Table 7 - ORP Information ORP for risk free of 1.556 ER ORP 1.596 3.3196 1.0796 SD 2 ORP 796 HE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts