Question: In the answer choices below, there are 5 parameterizations for a lognormal model of stock prices, where: a = Expected return 8 = Continuously compounded

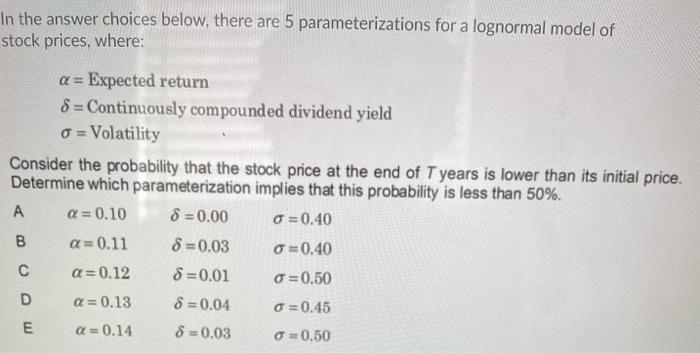

In the answer choices below, there are 5 parameterizations for a lognormal model of stock prices, where: a = Expected return 8 = Continuously compounded dividend yield o = Volatility Consider the probability that the stock price at the end of Tyears is lower than its initial price. Determine which parameterization implies that this probability is less than 50%. A a=0.10 8 =0.00 O=0.40 B a=0.11 8 =0.03 O=0.40 a=0.12 8=0.01 O=0.50 D Q=0.13 8 = 0.04 O=0.45 a = 0.14 8 -0.03 O=0.50 m In the answer choices below, there are 5 parameterizations for a lognormal model of stock prices, where: a = Expected return 8 = Continuously compounded dividend yield o = Volatility Consider the probability that the stock price at the end of Tyears is lower than its initial price. Determine which parameterization implies that this probability is less than 50%. A a=0.10 8 =0.00 O=0.40 B a=0.11 8 =0.03 O=0.40 a=0.12 8=0.01 O=0.50 D Q=0.13 8 = 0.04 O=0.45 a = 0.14 8 -0.03 O=0.50 m

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts