Question: In this case study, you will evaluate the financial performance of three major commercial banks: Bank A , Bank B , and Bank C .

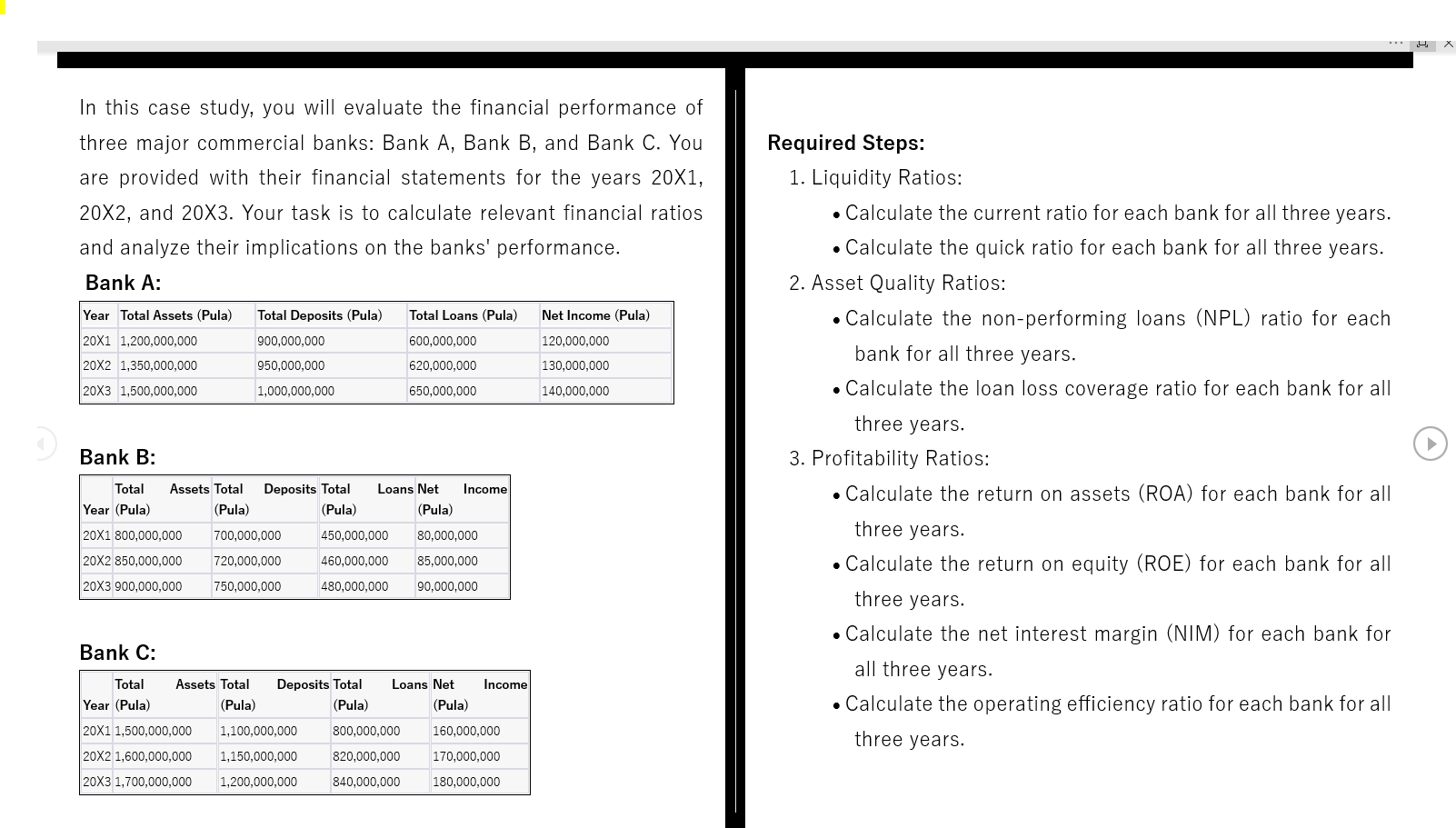

In this case study, you will evaluate the financial performance of

three major commercial banks: Bank A Bank B and Bank C You

are provided with their financial statements for the years X

X and X Your task is to calculate relevant financial ratios

and analyze their implications on the banks' performance.

Bank A:

Bank B:

Bank C:

Required Steps:

Liquidity Ratios:

Calculate the current ratio for each bank for all three years.

Calculate the quick ratio for each bank for all three years.

Asset Quality Ratios:

Calculate the nonperforming loans NPL ratio for each

bank for all three years.

Calculate the loan loss coverage ratio for each bank for all

three years.

Profitability Ratios:

Calculate the return on assets ROA for each bank for all

three years.

Calculate the return on equity ROE for each bank for all

three years.

Calculate the net interest margin NIM for each bank for

all three years.

Calculate the operating efficiency ratio for each bank for all

three years.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock