Question: In this lab, we will compare 3 different loan options. Suppose that you are buying a house for $205,000. The loan is at a fixed

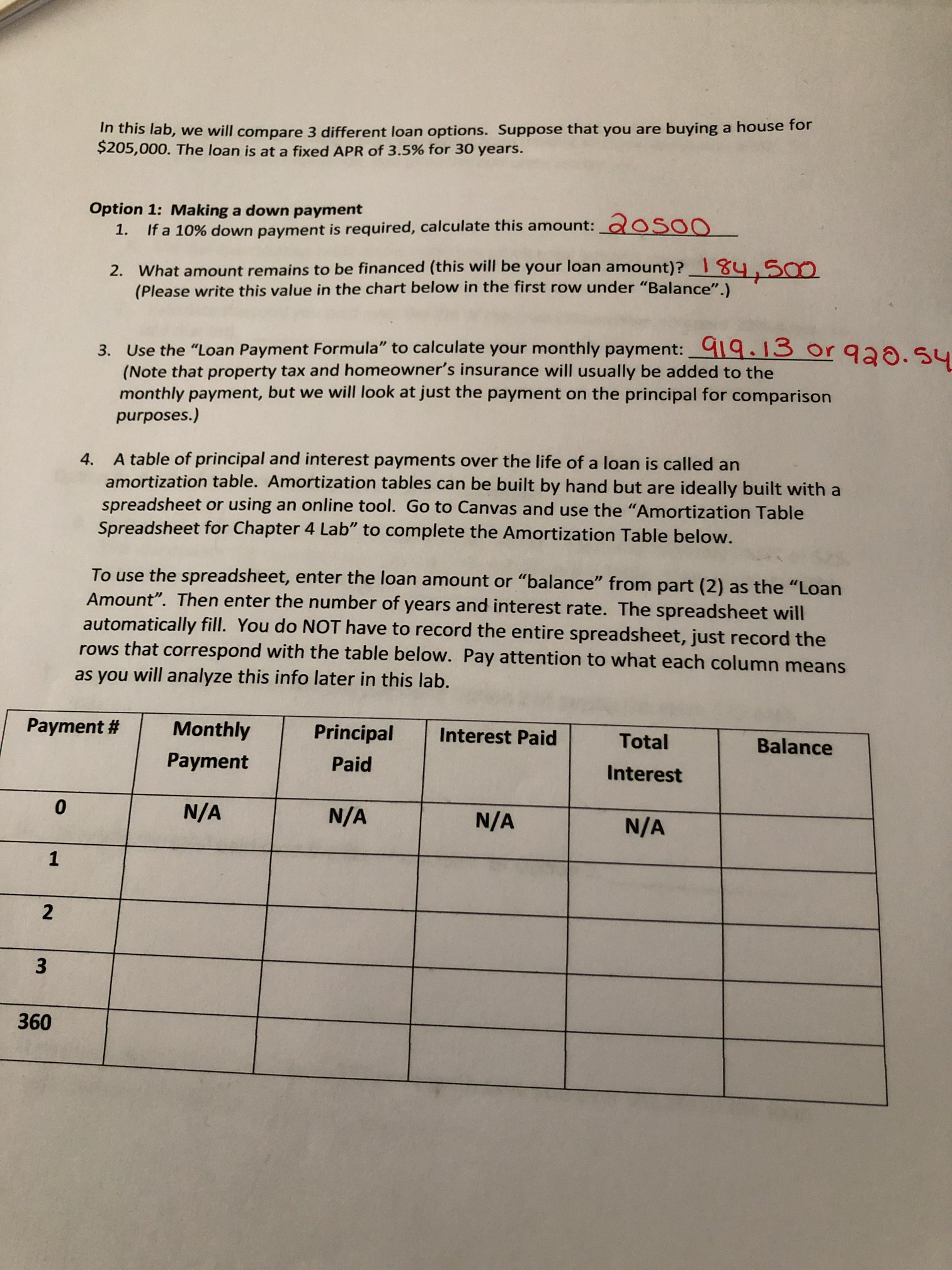

In this lab, we will compare 3 different loan options. Suppose that you are buying a house for $205,000. The loan is at a fixed APR of 3.5% for 30 years. Option 1: Making a down payment 1. If a 10% down payment is required, calculate this amount: aosoo 2. What amount remains to be financed (this will be your loan amount)? _1 84_, 500 ( Please write this value in the chart below in the first row under "Balance".) 3. Use the "Loan Payment Formula" to calculate your monthly payment: 419. 13 or q28. $4 ( Note that property tax and homeowner's insurance will usually be added to the monthly payment, but we will look at just the payment on the principal for comparison purposes.) 4. A table of principal and interest payments over the life of a loan is called an amortization table. Amortization tables can be built by hand but are ideally built with a spreadsheet or using an online tool. Go to Canvas and use the "Amortization Table Spreadsheet for Chapter 4 Lab" to complete the Amortization Table below. To use the spreadsheet, enter the loan amount or "balance" from part (2) as the "Loan Amount". Then enter the number of years and interest rate. The spreadsheet will automatically fill. You do NOT have to record the entire spreadsheet, just record the rows that correspond with the table below. Pay attention to what each column means as you will analyze this info later in this lab. Payment # Monthly Principal Interest Paid Total Payment Paid Balance Interest 0 N/A N/A N/A N/A 1 2 3 360

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts