Question: In this lab , we will compare 3 different loan options . Suppose that you are buying a house for $205 , 000 . The

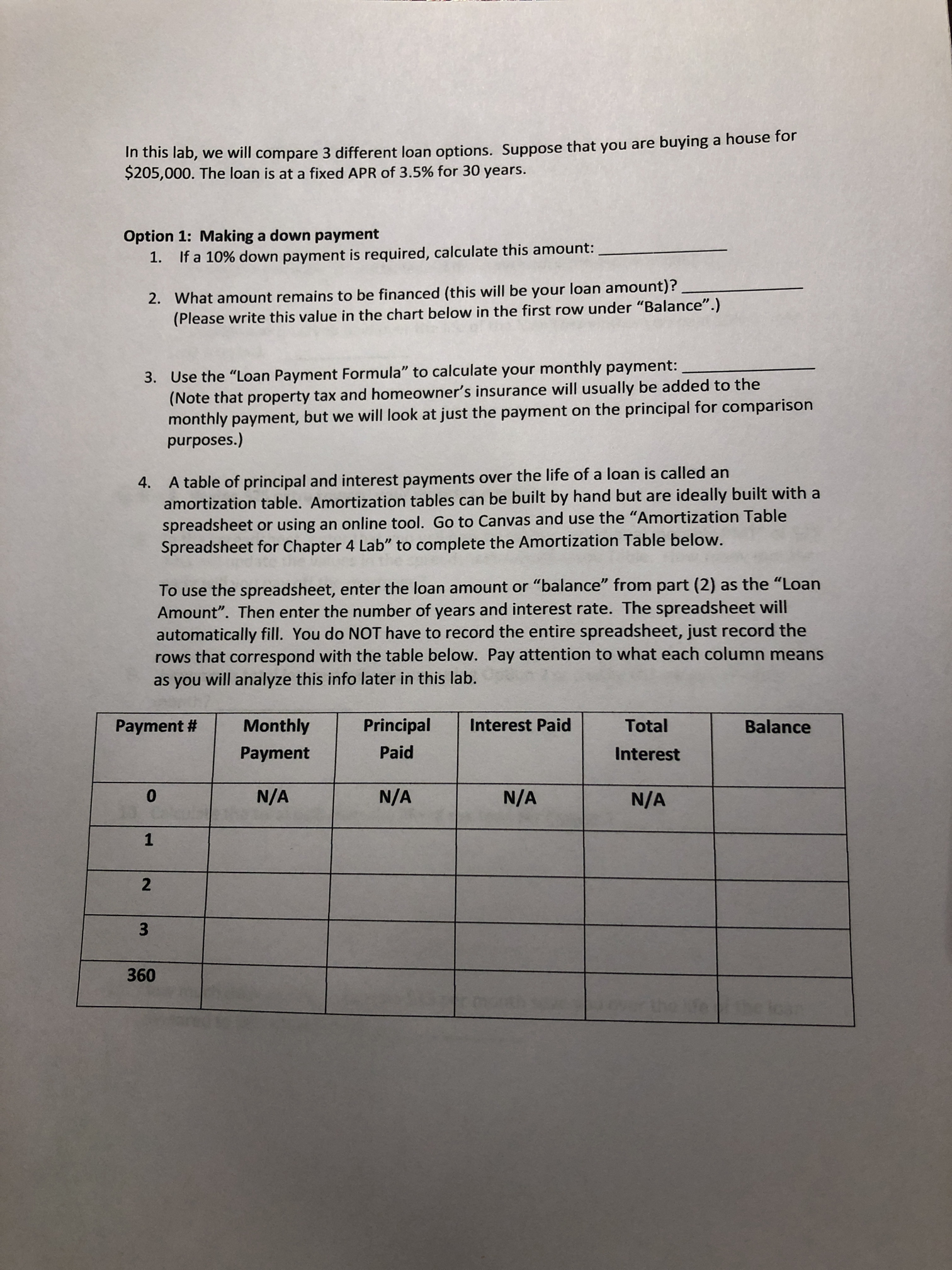

In this lab , we will compare 3 different loan options . Suppose that you are buying a house for $205 , 000 . The loan is at a fixed APR of 3. 5% for 30 years . Option 1 : Making a down payment 1 . If a 10% down payment is required , calculate this amount : 2 . What amount remains to be financed ( this will be your loan amount ) ?" ( Please write this value in the chart below in the first row under " Balance " ! ) 3 . Use the " Loan Payment Formula" to calculate your monthly payment :" ( Note that property tax and homeowner's insurance will usually be added to the monthly payment , but we will look at just the payment on the principal for comparison purposes . ) 4 . A table of principal and interest payments over the life of a loan is called an amortization table . Amortization tables can be built by hand but are ideally built with a spreadsheet or using an online tool . Go to Canvas and use the " Amortization Table Spreadsheet for Chapter 4 Lab" to complete the Amortization Table below . To use the spreadsheet , enter the loan amount or " balance " from part ( 2 ) as the " Loan Amount " . Then enter the number of years and interest rate . The spreadsheet will automatically fill . You do NOT have to record the entire spreadsheet , just record the rows that correspond with the table below . Pay attention to what each column means as you will analyze this info later in this lab . Payment $ Monthly Principal Interest Paid Total Balance Payment Paid Interest O N / A N / A N / A N / A 1 2 360

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts