Question: In this problem we examine two stochastic processes for a stock price: PROCESS A: Driftless geometric Brownian motion (GBM). Driftless means no dt term. So

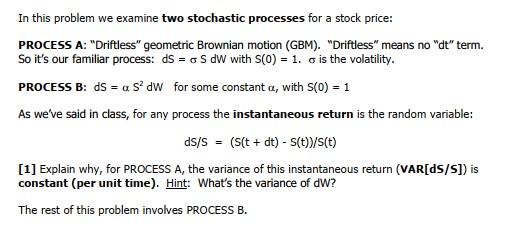

In this problem we examine two stochastic processes for a stock price: PROCESS A: "Driftless" geometric Brownian motion (GBM). "Driftless" means no "dt" term. So it's our familiar process: ds = o S dw with S(0) = 1. o is the volatility. PROCESS B: ds = a sd for some constant a, with S(0) = 1 As we've said in class, for any process the instantaneous return is the random variable: ds/S= (s(t + dt) - S(t)}/s(t) [1] Explain why, for PROCESS A, the variance of this instantaneous return (VAR[ds/s]) is constant (per unit time). Hint: What's the variance of dW? The rest of this problem involves PROCESS B. In this problem we examine two stochastic processes for a stock price: PROCESS A: "Driftless" geometric Brownian motion (GBM). "Driftless" means no "dt" term. So it's our familiar process: ds = o S dw with S(0) = 1. o is the volatility. PROCESS B: ds = a sd for some constant a, with S(0) = 1 As we've said in class, for any process the instantaneous return is the random variable: ds/S= (s(t + dt) - S(t)}/s(t) [1] Explain why, for PROCESS A, the variance of this instantaneous return (VAR[ds/s]) is constant (per unit time). Hint: What's the variance of dW? The rest of this problem involves PROCESS B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts