Question: In this problem, you will process the sales and purchases transactions for the week of February 8 through February 14 for Vetter Vacuum Center. Answer

In this problem, you will process the sales and purchases transactions for the week of February 8 through February 14 for Vetter Vacuum Center. Answer Audit Questions 4-A on pages 188189 as you complete this problem. Display reports as necessary to answer the questions, and click Info. on the toolbar for helpful check figures to audit your work.

Warning: The inventory valuation (Merchandise Inventory and Cost of Goods Sold accounts) may be affected by the order in which transactions are entered. Therefore, making corrections to earlier transactions or changing the sequence in which transactions are entered may affect the FIFO method of valuation used in this problem. If you must make a correction to a previously entered transaction affecting inventory, it is a good idea to delete all subsequent entries related to the inventory items as well and then reenter the transactions in the order presented.

Step 1: Start Integrated Accounting 8e.

Step 2: Load opening balances file IA8 Problem 04-A.

Step 3: Enter your name in the Your Name text box and click OK.

Step 4: Save the file with a file name of 04-A Your name.

Step 5: Enter the following purchase order and purchase invoice transactions.

Weekly Purchase Order and Purchase Invoice Transactions

Feb 08 Ordered the following merchandise from Handy Manufacturing, Inc., terms 2/10, n/30. Purchase Order No. 277.

| Description | Quantity | Unit Cost |

| Wet&Dry Vacuum | 8 | 199.00 |

11 Received the following merchandise for Purchase Order No. 275 from Handy Manufacturing, Inc., terms 2/10, n/30. Purchase Invoice No. 859.

| Description | Quantity | Unit Cost |

| Allergenci Bag | 32 | 5.35 |

12 Received the following merchandise for Purchase Order No. 276 from Royal Accessories, Inc., terms 2/10, n/30. Purchase Invoice No. 860.

| Description | Quantity | Unit Cost |

| Attachment Kit | 2 | 32.95 |

| Upright Cleaner Bag | 24 | 2.35 |

14 Ordered the following merchandise from Nantz Vacuum Cleaner Co., terms 2/10, n/30. Purchase Order No. 278.

| Description | Quantity | Unit Cost |

| Nantz Canister Vacuum | 4 | 240.00 |

Step 6: Enter the following sales invoice transactions.

Weekly Sales Invoice Transactions

Feb 08 Sold the following merchandise to Fraze Department Stores, terms 2/10. n/30, 7% sales tax. Sales Invoice No. 531 :

| Description | Quantity Sold | Selling Price |

| Attachment Kit | 1 | 49.95 |

| Steam Cleaner | 1 | 219.00 |

| Alpha Upright Vacuum | 1 | 795.95 |

| Upright Cleaner Bag | 12 | 3.95 |

Feb 09 Sold the following merchandise to Jennifer Martens, terms 30 days, 7% sales tax, Sales Invoice No. 532:

| Description | Quantity Sold | Selling Price |

| Rug Machine | 1 | 189.99 |

| Pile Lifter Brush | 1 | 49.00 |

Feb 10 The following merchandise was returned to Vetter Vacuum Center by Wingler Motel, 7% sales tax, Sales Return No. R530:

| Description | Quantity Returned | Price |

| Handy Upright Vacuum | 1 | 485.00 |

Feb 10 Sold the following merchandise to Wingler Motel, terms 2/10, n/ 30, 7% sales tax, Sales Invoice No. 533:

| Description | Quantity Sold | Selling Price |

| Alpha Upright Vacuum | 2 | 795.95 |

| Electric Broom | 3 | 99.99 |

| Shampoo Attachment | 1 | 38.95 |

Feb 11 Sold the following merchandise to Robert Thorson, terms 30 days, 7% sales tax, Sales Invoice No. 534:

| Description | Quantity Sold | Selling Price |

| Car Vac | 1 | 29.95 |

| Battery Powered Vac | 1 | 38.95 |

Feb 12 Sold the following merchandise to Bassett Cleaning, Inc., terms 2/10, n/30, 7% sales tax, Sales Invoice No. 535:

| Description | Quantity Sold | Selling Price |

| Upright Cleaner Bag | 8 | 3.95 |

| Steam Cleaner | 2 | 219.00 |

Feb 13 Sold the following merchandise to Lilly Industries, Inc., terms 2/10, n/30, 7% sales tax, Sales Invoice No. 536:

| Description | Quantity Sold | Selling Price |

| Wet&Dry Vacuum | 2 | 325.00 |

| Allergenci Bag | 12 | 8.95 |

| Attachment Kit | 1 | 49.95 |

| Rug Machine | 1 | 189.99 |

Feb 14 Sold the following merchandise to Matthew Cornish, terms 30 days, 7% sales tax, Sales Invoice No. 537:

| Description | Quantity Sold | Selling Price |

| Wet&Dry Vacuum | 1 | 325.00 |

Step 7: Enter the following cash payments transactions. Weekly Cash Payment Transactions

Feb 13 Paid invoice 859 to Handy Manufacturing, Inc., $171.20, less 2% discount, $3.42. Check No. 3621.

14 Paid invoice 855 to Royal Accessories, Inc., $511.20, no discount. Check No. 3622.

Step 8: Enter the following cash receipt transactions.

Weekly Cash Receipt Transactions

Feb 10 Received cash on account from Lilly Industries, Inc., covering Sales Invoice No. 525 for $828.66, less 2% discount, $16.57.

12 Received cash on account from Bassett Cleaning, Inc., covering Sales Invoice No. 527 for $909.13, less 2% discount, $18.18.

13 Received cash on account from Broderick Company, covering Sales Invoice No. 518 for $7,594.73, no discount.

Step 9: Display the purchase order, purchase invoice, and sales invoice registers for the period February 8 through February 14.

Step 10: Display the general, purchases, cash payments, sales, and cash receipts journals for the period February 8 through February 14.

Step 11: Display a General Ledger report for the Accounts Receivable, Sales, Sales Returns and Allowance, and Sales Discount accounts.

Step 12: Display a Trial Balance report.

Step 13: Display a Schedule of Accounts Receivable and an Accounts Receivable Ledger report for all customers.

Step 14: Display a statement of account for Bassett Cleaning, Inc.

Step 15: Display an Inventory List report.

Step 16: Display the inventory transactions for the period of February 8 through February 14.

Step 17: Display the Yearly Sales report.

Step 18: Display the Top Customers graph.

Step 19: Save your data to disk.

Step 20: Use Check on the toolbar to check your work.

Step 23: End the Integrated Accounting 8e session.

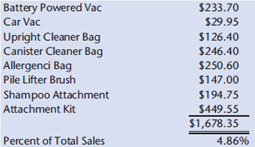

Figure 4.23

Inventory Items with Year-to-Date Sales Less Than $500.00

Step-by-step solution

\begin{tabular}{lr} Battery Powered Vac & $233.70 \\ Car Vac & $29.95 \\ Upright Cleaner Bag & $126.40 \\ Canister Cleaner Bag & $246.40 \\ Allergenci Bag & $250.60 \\ Pile Lifter Brush & $147.00 \\ Shampoo Attachment & $194.75 \\ Attachment Kit & $449.55 \\ \hline Percent of Total Sales & $1,678.35 \\ \hline \hline 4.86% \end{tabular} \begin{tabular}{lr} Battery Powered Vac & $233.70 \\ Car Vac & $29.95 \\ Upright Cleaner Bag & $126.40 \\ Canister Cleaner Bag & $246.40 \\ Allergenci Bag & $250.60 \\ Pile Lifter Brush & $147.00 \\ Shampoo Attachment & $194.75 \\ Attachment Kit & $449.55 \\ \hline Percent of Total Sales & $1,678.35 \\ \hline \hline 4.86% \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts