Question: Please provide excel with formulas and values both, upvote will be given CASE 4.1 BLENDING AVIATION GASOLINE AT JANSEN GAS ansen Gas creates three types

Please provide excel with formulas and values both, upvote will be given

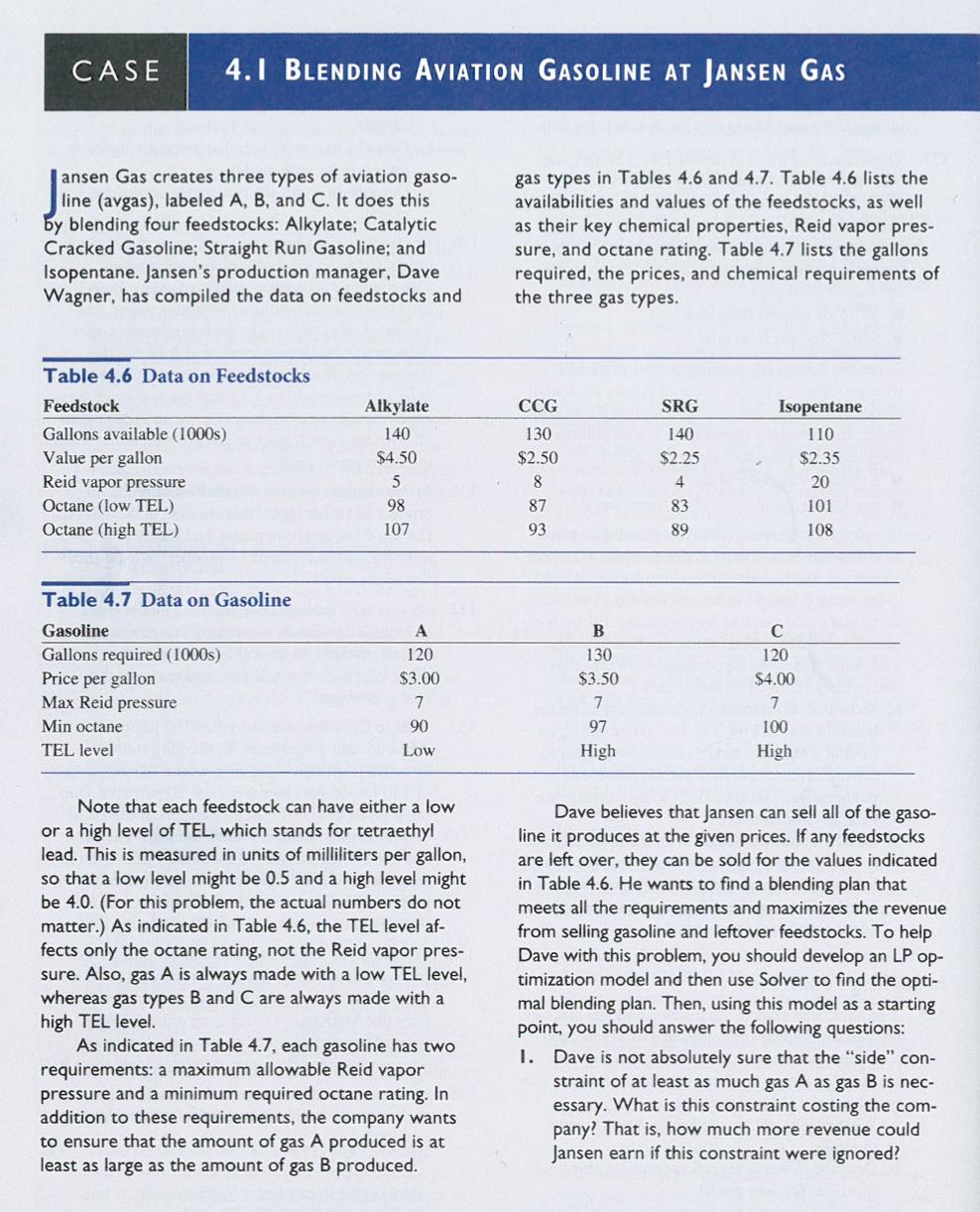

CASE 4.1 BLENDING AVIATION GASOLINE AT JANSEN GAS ansen Gas creates three types of aviation gaso- line (avgas), labeled A, B, and C. It does this by blending four feedstocks: Alkylate; Catalytic Cracked Gasoline; Straight Run Gasoline; and Isopentane. Jansen s production manager, Dave Wagner, has compiled the data on feedstocks and Table 4.6 Data on Feedstocks Feedstock Gallons available (1000s) Value per gallon Reid vapor pressure Octane (low TEL) Octane (high TEL) Table 4.7 Data on Gasoline Gasoline Gallons required (1000s) Price per gallon Max Reid pressure Min octane TEL level Alkylate 140 $4.50 5 98 107 A 120 $3.00 7 90 Low Note that each feedstock can have either a low or a high level of TEL, which stands for tetraethyl lead. This is measured in units of milliliters per gallon, so that a low level might be 0.5 and a high level might be 4.0. (For this problem, the actual numbers do not matter.) As indicated in Table 4.6, the TEL level af- fects only the octane rating, not the Reid vapor pres- sure. Also, gas A is always made with a low TEL level, whereas gas types B and C are always made with a high TEL level. As indicated in Table 4.7, each gasoline has two requirements: a maximum allowable Reid vapor pressure and a minimum required octane rating. In addition to these requirements, the company wants to ensure that the amount of gas A produced is at least as large as the amount of gas B produced. gas types in Tables 4.6 and 4.7. Table 4.6 lists the availabilities and values of the feedstocks, as well as their key chemical properties, Reid vapor pres- sure, and octane rating. Table 4.7 lists the gallons required, the prices, and chemical requirements of the three gas types. CCG 130 $2.50 8 87 93 B 130 $3.50 7 97 High SRG 140 $2.25 4 83 89 Isopentane 110 $2.35 20 101 108 C 120 $4.00 7 100 High Dave believes that Jansen can sell all of the gaso- line it produces at the given prices. If any feedstocks are left over, they can be sold for the values indicated in Table 4.6. He wants to find a blending plan that meets all the requirements and maximizes the revenue from selling gasoline and leftover feedstocks. To help Dave with this problem, you should develop an LP op- timization model and then use Solver to find the opti- mal blending plan. Then, using this model as a starting point, you should answer the following questions: I. Dave is not absolutely sure that the side con- straint of at least as much gas A as gas B is nec- essary. What is this constraint costing the com- pany? That is, how much more revenue could Jansen earn if this constraint were ignored? 2. Dave consults the chemical experts, and they suggest that gas B could be produced with a medium level of TEL. The octane ratings for each feedstock with this medium level would be halfway between their low and high TEL octane ratings. Would this be a better option in terms of its optimal revenue? 3. Suppose that because of air pollution concerns, Jansen might have to lower the Reid vapor pres- sure maximum on each gas type (by the same amount). Use Solver Table to explore how such a change would affect Jansen s optimal revenue. 4. Dave believes the minimum required octane rat- ing for gas A is too low. He would like to know how much this minimum rating could be increased before there would be no feasible solution (still assuming that gas A uses the low TEL level). 5. Dave suspects that only the relative prices mat- ter in the optimal blending plan. Specifically, he believes that if all unit prices of the gas types and all unit values of the feedstocks increase by the same percentage, then the optimal blending plan will remain the same. Is he correct?

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Answer 1 The side constraint of at least as much gas A as gas B is costing the company in terms of revenue By including this constraint the company is not able to maximize the amount of revenue earned ... View full answer

Get step-by-step solutions from verified subject matter experts