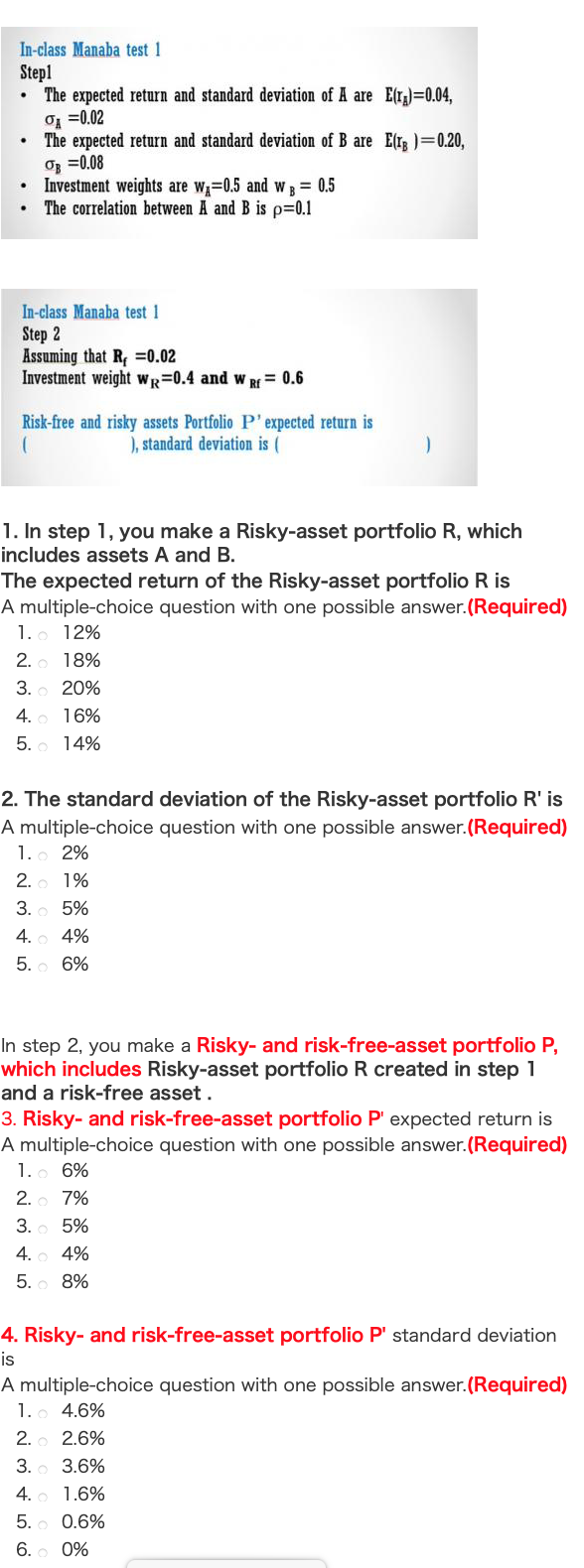

Question: In-class Manaba test 1 Step1 The expected return and standard deviation of A are E(TJ)=0.04, ox=0.02 The expected return and standard deviation of B are

In-class Manaba test 1 Step1 The expected return and standard deviation of A are E(TJ)=0.04, ox=0.02 The expected return and standard deviation of B are E(Ig)=0.20, Op =0.08 Investment weights are Wa=0.5 and w8 = 0.5 B The correlation between A and B is p=0.1 In-class Manaba test 1 Step 2 Assuming that Rp =0.02 Investment weight wr=0.4 and W R = 0.6 Risk-free and risky assets Portfolio P'expected return is ), standard deviation is ) 1. In step 1, you make a Risky-asset portfolio R, which includes assets A and B. The expected return of the Risky-asset portfolio R is A multiple-choice question with one possible answer.(Required) 1. 12% 2.18% 3. 20% 4.16% 5.14% 2. The standard deviation of the Risky-asset portfolio R' is A multiple-choice question with one possible answer.(Required) 1.2% 2.1% 3.5% 4. 4% 5.6% In step 2, you make a Risky- and risk-free-asset portfolio P, which includes Risky-asset portfolio R created in step 1 and a risk-free asset. 3. Risky- and risk-free-asset portfolio P' expected return is A multiple-choice question with one possible answer.(Required) 1.6% 2.7% 3.5% 4. 4% 5.8% 4. Risky- and risk-free-asset portfolio P' standard deviation is A multiple-choice question with one possible answer.(Required) 1.4.6% 2. 2.6% 3.3.6% 4.1.6% 5. 0.6% 6.0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts