Question: Instructions ( 5 marks ) Answer each question on a separate excel sheet in your workbook: Q 1 ; Q 2 ; Q 3 ;

Instructions marks

Answer each question on a separate excel sheet in your workbook: Q; Q; Q; Q

Display two decimal places for all calculations you perform.

Use the specify Currency format as given in each question.

Submit a single Excel Workbook named "AssignstudentnumberMAF on

Moodle before cutoff time!

Moodle cutoff time: Saturday Oct : PM

Question marks

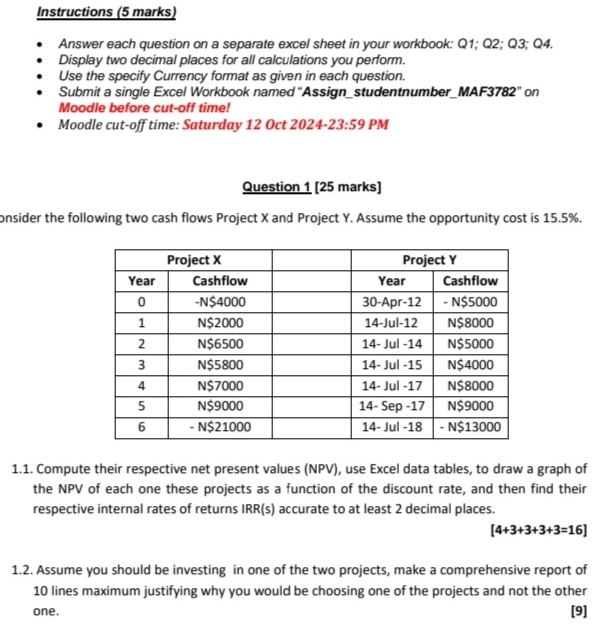

onsider the following two cash flows Project X and Project Y Assume the opportunity cost is

Compute their respective net present values NPV use Excel data tables, to draw a graph of

the NPV of each one these projects as a function of the discount rate, and then find their

respective internal rates of returns IRRs accurate to at least decimal places.

Assume you should be investing in one of the two projects, make a comprehensive report of

lines maximum justifying why you would be choosing one of the projects and not the other

one.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock