Question: instructions: After studying the educational resources allocated in this module related to the analysis of financial statements through indicators, it solves the following problems. Use

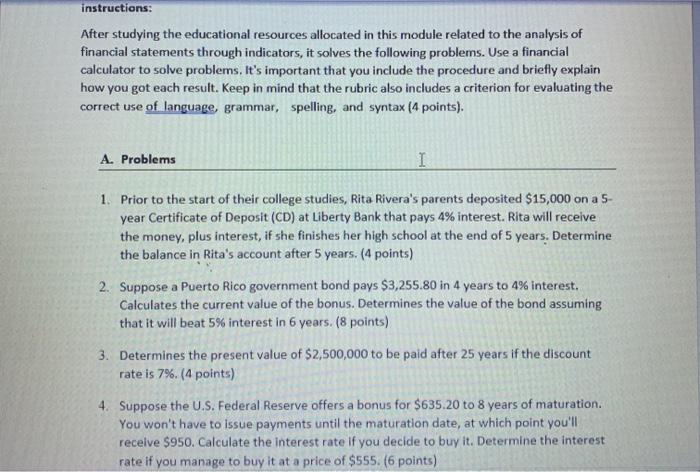

instructions: After studying the educational resources allocated in this module related to the analysis of financial statements through indicators, it solves the following problems. Use a financial calculator to solve problems. It's important that you include the procedure and briefly explain how you got each result. Keep in mind that the rubric also includes a criterion for evaluating the correct use of language, grammar, spelling, and syntax (4 points). A. Problems I 1. Prior to the start of their college studies, Rita Rivera's parents deposited $15,000 on a 5- year Certificate of Deposit (CD) at Liberty Bank that pays 4% interest. Rita will receive the money, plus interest, if she finishes her high school at the end of 5 years. Determine the balance in Rita's account after 5 years. (4 points) 2. Suppose a Puerto Rico government bond pays $3,255.80 in 4 years to 4% interest. Calculates the current value of the bonus. Determines the value of the bond assuming that it will beat 5% interest in 6 years. (8 points) 3. Determines the present value of $2,500,000 to be paid after 25 years if the discount rate is 7%. (4 points) 4. Suppose the U.S. Federal Reserve offers a bonus for $635.20 to 8 years of maturation You won't have to issue payments until the maturation date, at which point you'll receive $950. Calculate the interest rate if you decide to buy it. Determine the interest rate if you manage to buy it at a price of $555. (6 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts