Question: ? Internal Rate of Return Analysis White Mountain Mining, LLC is considering the purchase of a new piece of machinery. The initial cost of the

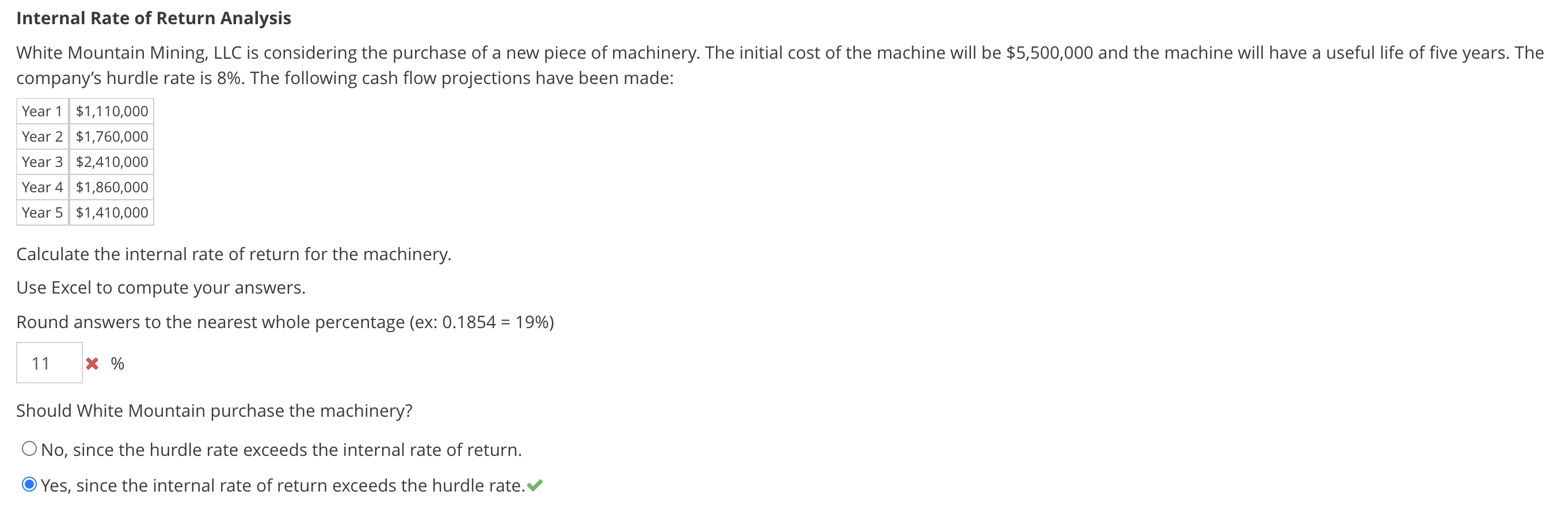

Internal Rate of Return Analysis White Mountain Mining, LLC is considering the purchase of a new piece of machinery. The initial cost of the machine will be $5,500,000 and the machine will have a useful life of five years. The company's hurdle rate is 8%. The following cash flow projections have been made: Year 1 $1,110,000 Year 2 $1,760,000 Year 3 $2,410,000 Year 4 $1,860,000 Year 5 $1,410,000 Calculate the internal rate of return for the machinery. Use Excel to compute your answers. Round answers to the nearest whole percentage (ex: 0.1854 = 19%) 11 % Should White Mountain purchase the machinery? O No, since the hurdle rate exceeds the internal rate of return. Yes, since the internal rate of return exceeds the hurdle rate.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts