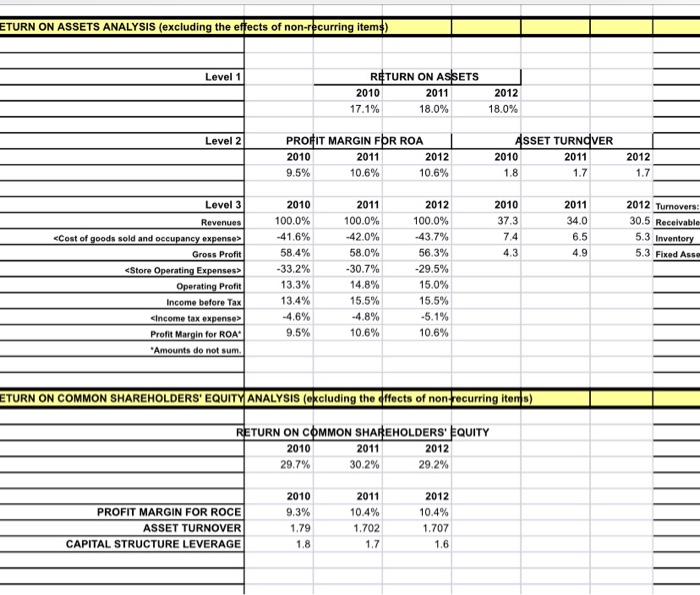

Question: interpret the changes in Starbucks return on assets ratio is during the three-year period, indicating areas of concern. interpret the changes in Starbucks return on

ETURN ON ASSETS ANALYSIS (excluding the effects of non-recurring items) RETURN ON ASSETS Level 1 2010 2011 2012 17.1% 18.0% 18.0% ASSET TURNOVER PROFIT MARGIN FOR ROA Level 2 2011 2010 2011 2012 2010 2012 9.5% 10.6% 10.6% 1.7 1.7 1.8 2012 Turnovers: Level 3 2010 2011 2012 2010 2011 100.0% 100.0% 100.0% 34.0 30.5 Receivable- 37.3 Revenues -41.6% -42.0 % 43.7% 7.4 6.5 5.3 Inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts