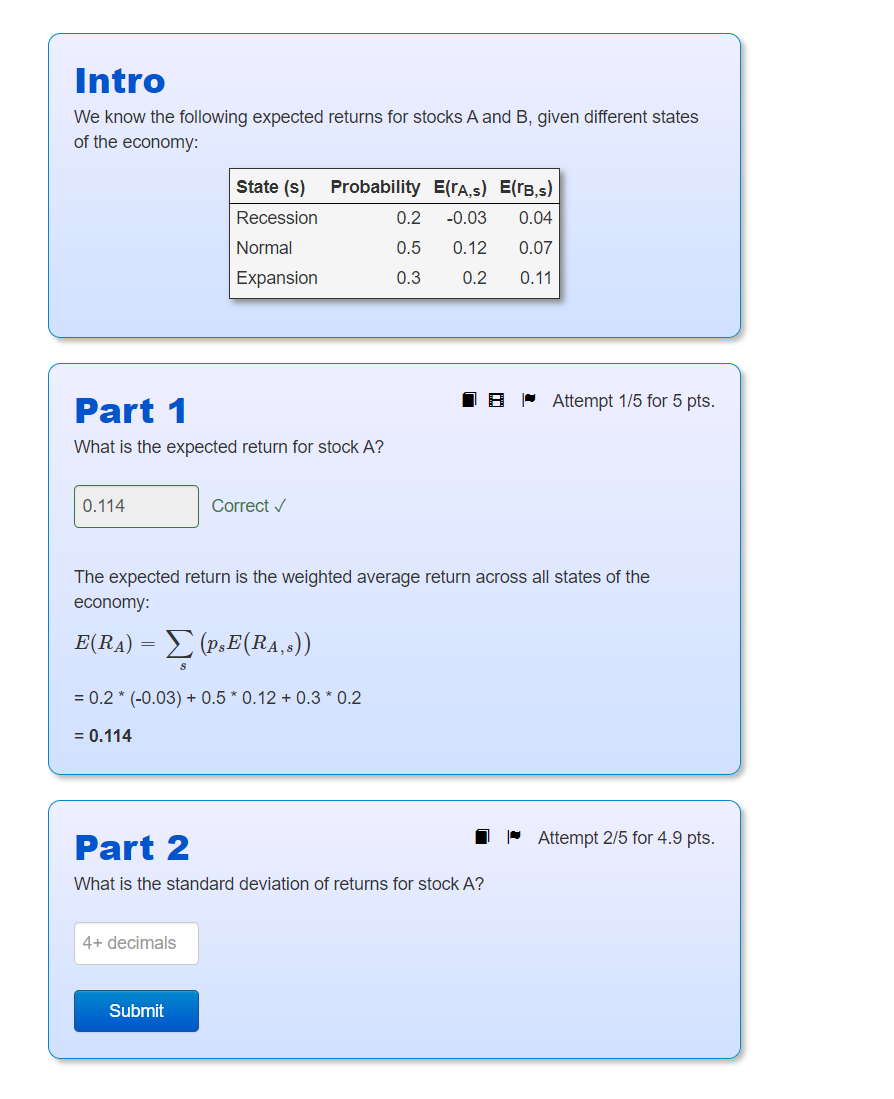

Question: Intro We know the following expected returns for stocks A and B, given different states of the economy: State (s) Recession Probability E(ra,s) E(TB,s) 0.2

Intro We know the following expected returns for stocks A and B, given different states of the economy: State (s) Recession Probability E(ra,s) E(TB,s) 0.2 -0.03 0.04 Normal 0.5 0.12 0.07 Expansion 0.3 0.2 0.11 18 Attempt 1/5 for 5 pts. Part 1 What is the expected return for stock A? 0.114 Correct The expected return is the weighted average return across all states of the economy: E(RA) = \(\$E(R4,3)) = = 0.2* (-0.03) + 0.5 * 0.12 +0.3 * 0.2 = 0.114 | Attempt 2/5 for 4.9 pts. Part 2 What is the standard deviation of returns for stock A? 4+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock