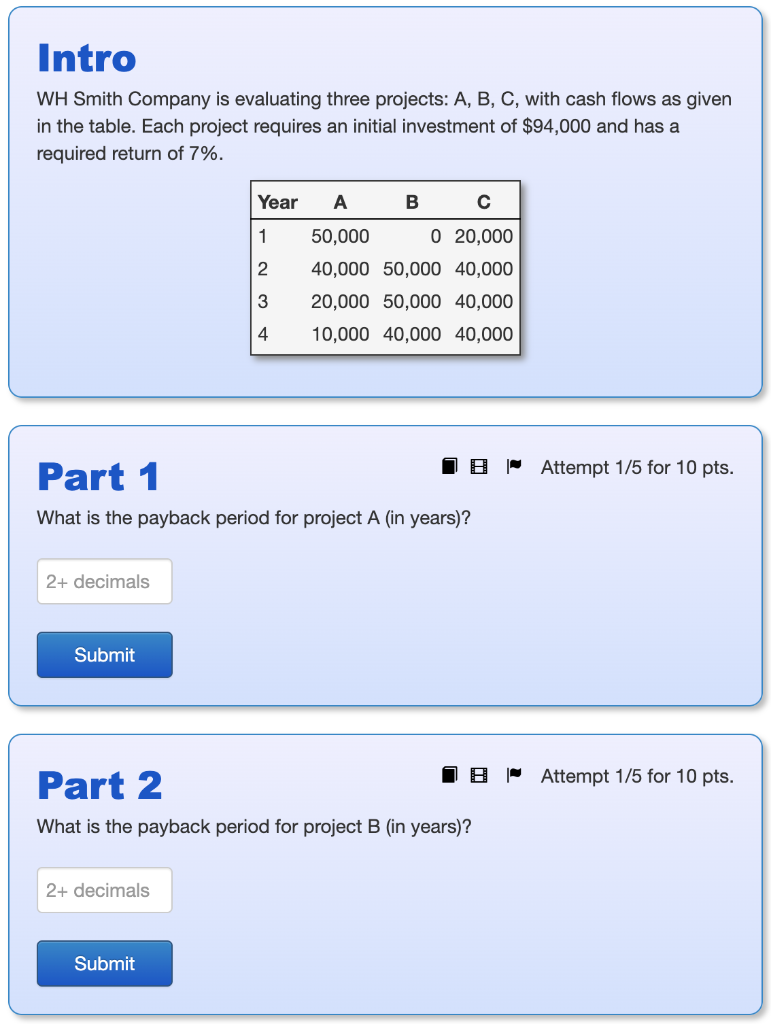

Question: Intro WH Smith Company is evaluating three projects: A, B, C, with cash flows as given in the table. Each project requires an initial investment

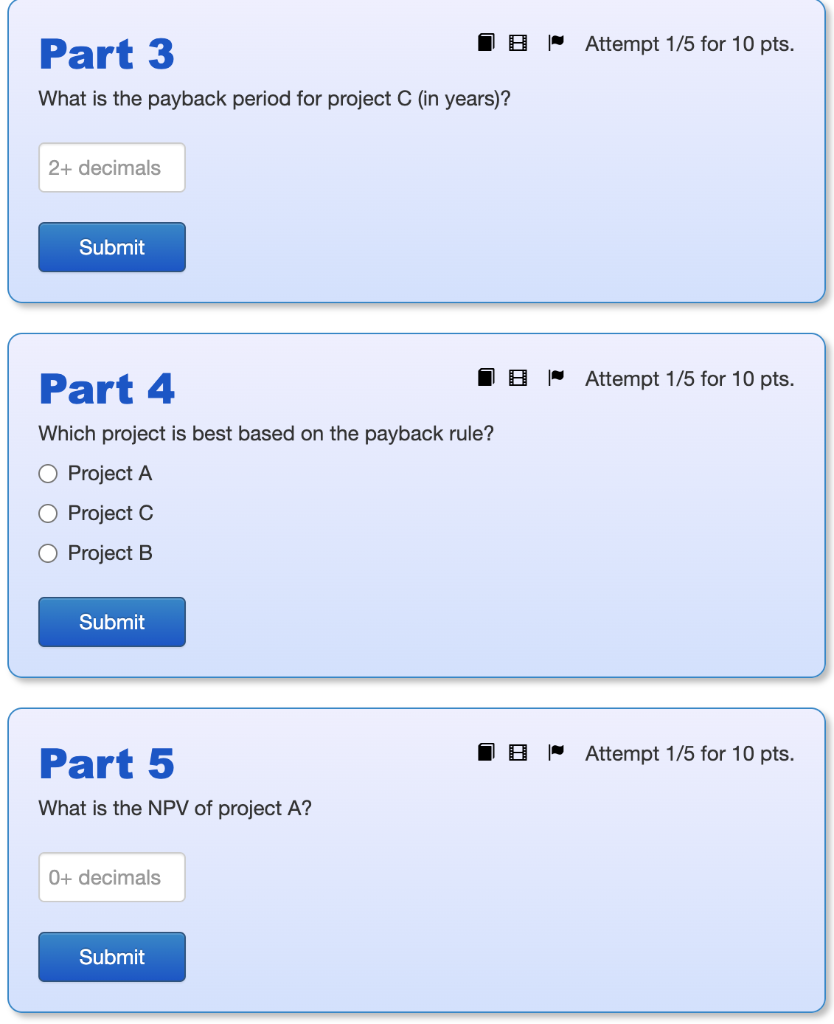

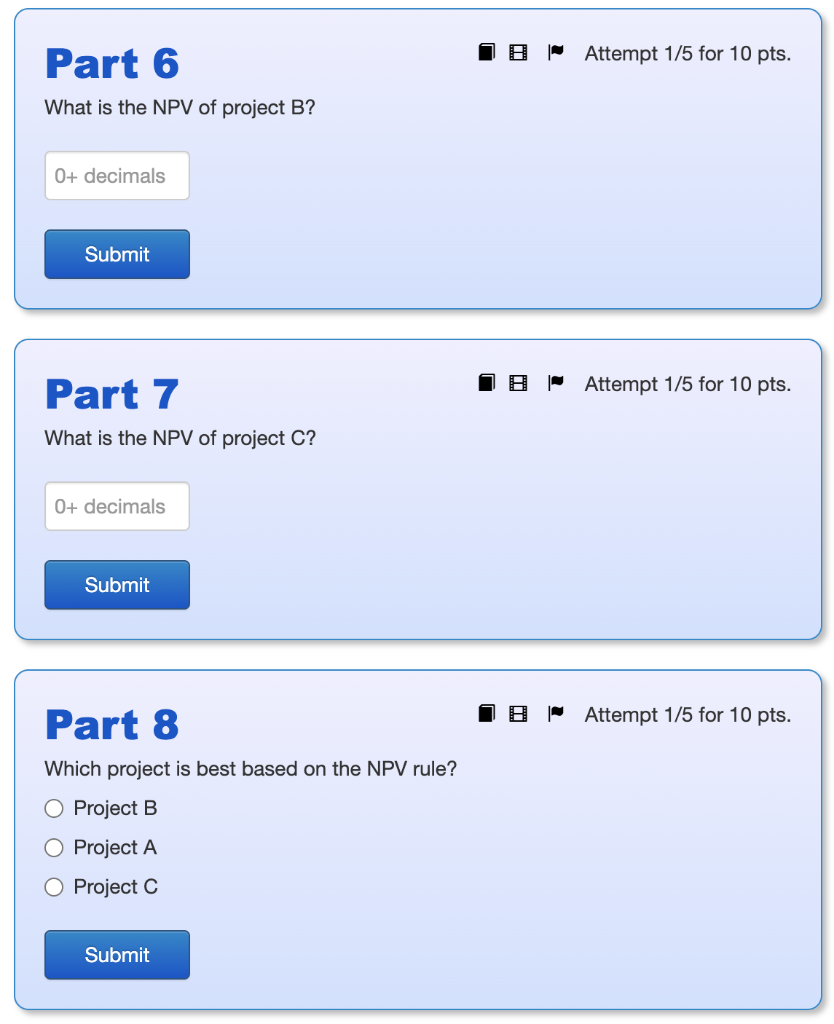

Intro WH Smith Company is evaluating three projects: A, B, C, with cash flows as given in the table. Each project requires an initial investment of $94,000 and has a required return of 7%. Year A B 1 2 50,000 0 20,000 40,000 50,000 40,000 20,000 50,000 40,000 10,000 40,000 40,000 3 4 18 Attempt 1/5 for 10 pts. Part 1 What is the payback period for project A (in years)? 2+ decimals Submit 18 Attempt 1/5 for 10 pts. Part 2 What is the payback period for project B (in years)? 2+ decimals Submit Part 3 8 Attempt 1/5 for 10 pts. What is the payback period for project C (in years)? 2+ decimals Submit 8 | Attempt 1/5 for 10 pts. Part 4 Which project is best based on the payback rule? O Project A O Project C O Project B Submit Part 5 B Attempt 1/5 for 10 pts. What is the NPV of project A? 0+ decimals Submit 18 Attempt 1/5 for 10 pts. Part 6 What is the NPV of project B? 0+ decimals Submit 18 Attempt 1/5 for 10 pts. Part 7 What is the NPV of project C? 0+ decimals Submit 8 Attempt 1/5 for 10 pts. Part 8 Which project is best based on the NPV rule? O Project B O Project A O Project Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts