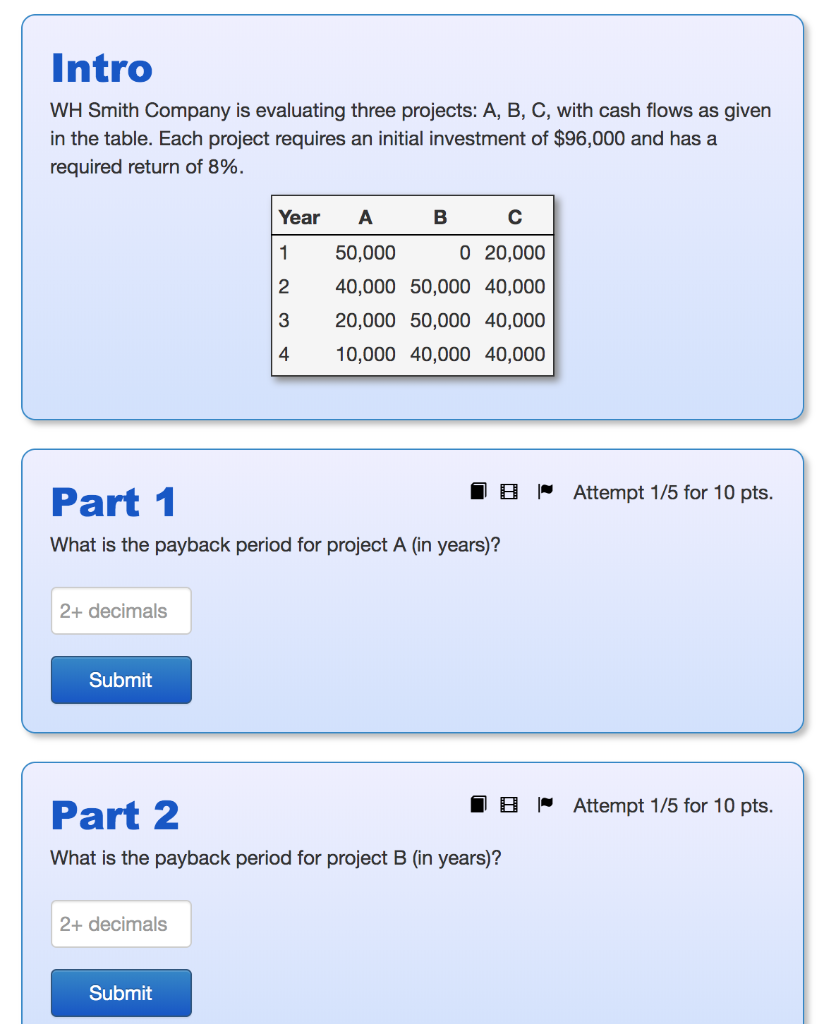

Question: Intro WH Smith Company is evaluating three projects: A, B, C, with cash flows as given in the table. Each project requires an initial investment

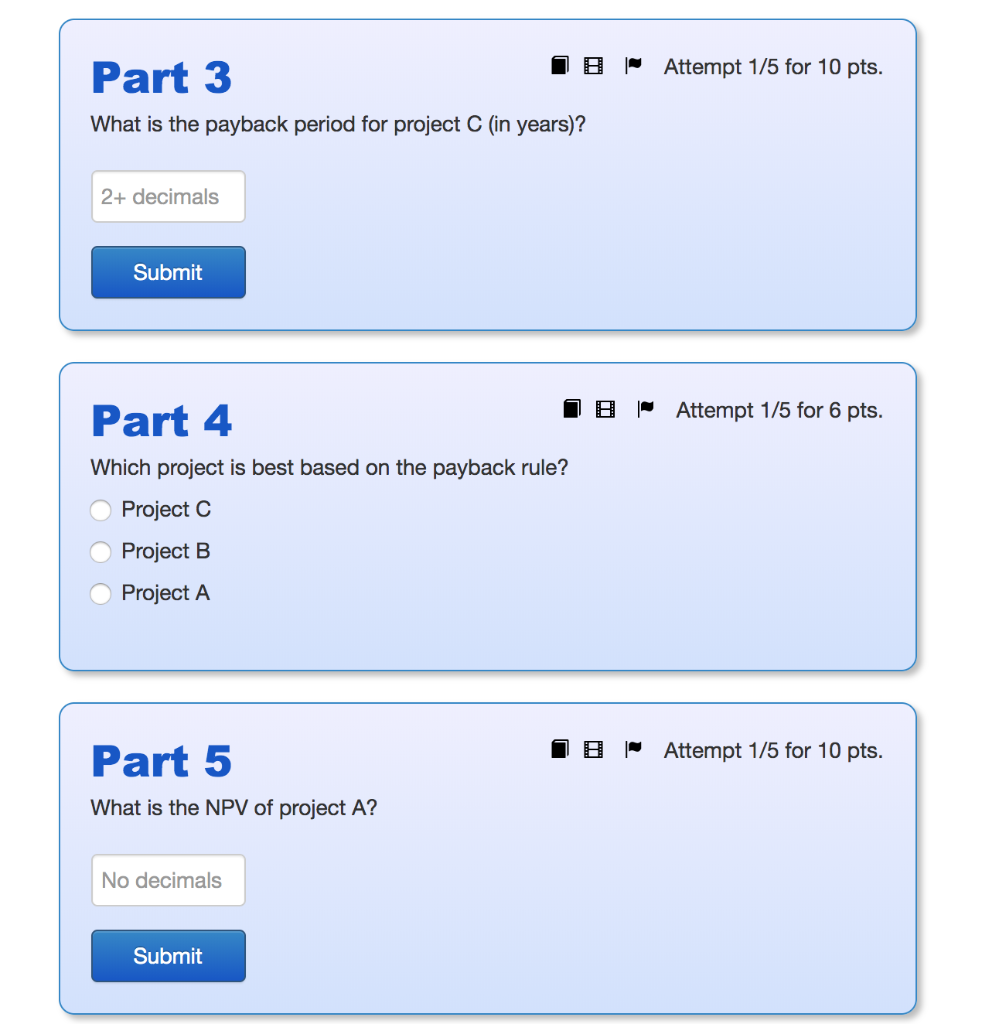

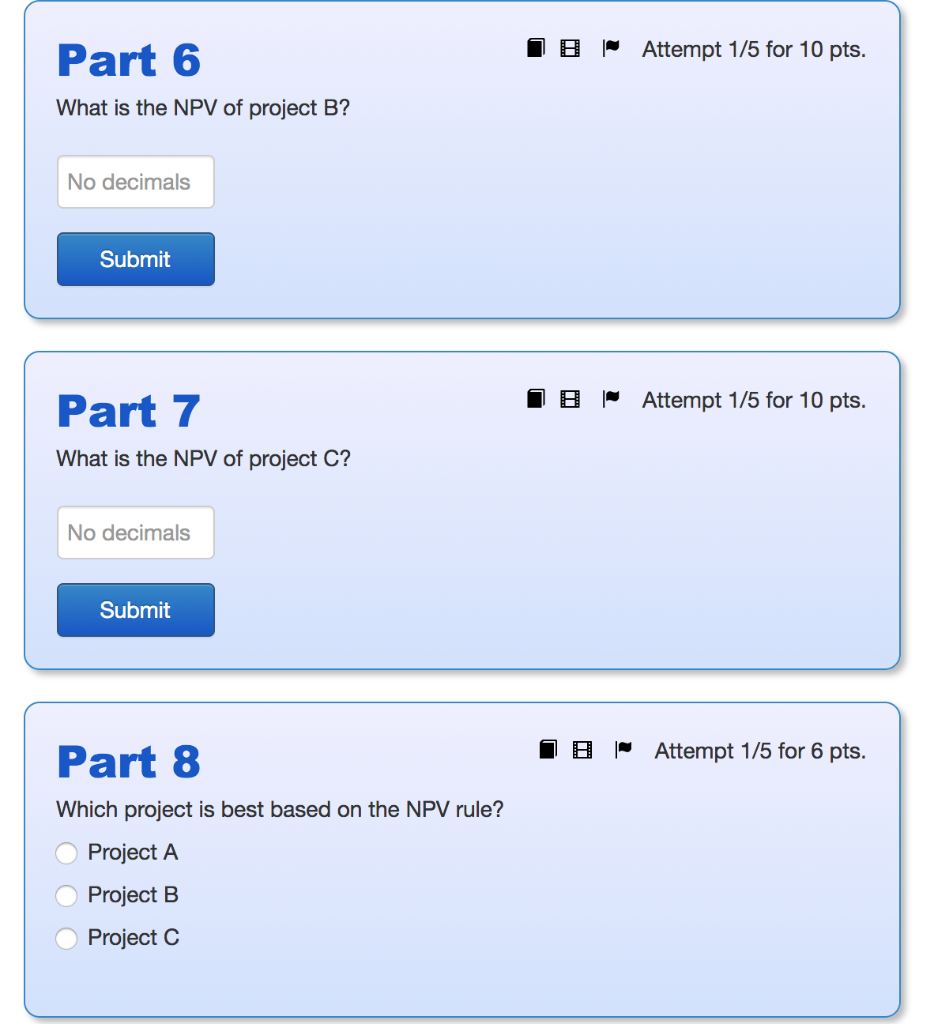

Intro WH Smith Company is evaluating three projects: A, B, C, with cash flows as given in the table. Each project requires an initial investment of $96,000 and has a required return of 8% C Year A 0 20,000 50,000 1 2 40,000 50,000 40,000 20,000 50,000 40,000 4 10,000 40,000 40,000 Attempt 1/5 for 10 pts. Part 1 What is the payback period for project A (in years)? 2+ decimals Submit Attempt 1/5 for 10 pts. Part 2 What is the payback period for project B (in years)? 2+ decimals Submit Attempt 1/5 for 10 pts. Part 3 What is the payback period for project C (in years)? 2+ decimals Submit H Attempt 1/5 for 6 pts. Part 4 Which project is best based on the payback rule? Project C Project B Project A Attempt 1/5 for 10 pts. Part 5 What is the NPV of project A? No decimals Submit Attempt 1/5 for 10 pts Part 6 What is the NPV of project B? No decimals Submit Attempt 1/5 for 10 pts. Part 7 What is the NPV of project C? No decimals Submit Attempt 1/5 for 6 pts Part 8 Which project is best based on the NPV rule? Project A Project B Project C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts