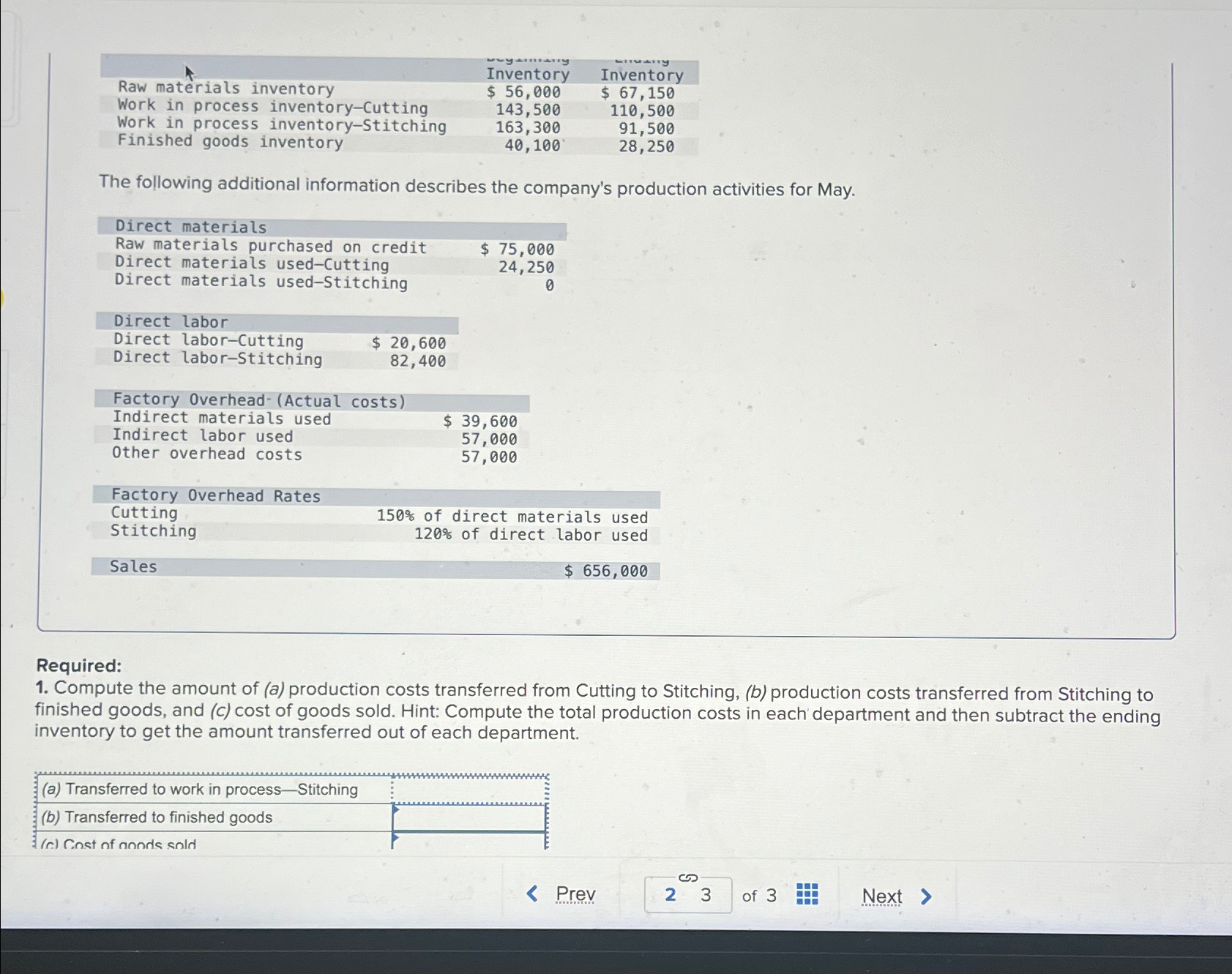

Question: Inventory fi4any Inventory Raw materials inventory Work in process inventory-Cutting Work in process inventory-Stitching Finished goods inventory $ 56,000 143,500 $ 67,150 110,500 163,300

Inventory fi4any Inventory Raw materials inventory Work in process inventory-Cutting Work in process inventory-Stitching Finished goods inventory $ 56,000 143,500 $ 67,150 110,500 163,300 91,500 40,100 28,250 The following additional information describes the company's production activities for May. Direct materials Raw materials purchased on credit Direct materials used-Cutting Direct materials used-Stitching Direct labor Direct labor-Cutting Direct labor-Stitching $ 20,600 82,400 Factory Overhead (Actual costs) Indirect materials used Indirect labor used Other overhead costs $ 75,000 24,250 $ 39,600 57,000 57,000 0 Factory Overhead Rates Cutting Stitching Sales 150% of direct materials used 120% of direct labor used $ 656,000 Required: 1. Compute the amount of (a) production costs transferred from Cutting to Stitching, (b) production costs transferred from Stitching to finished goods, and (c) cost of goods sold. Hint: Compute the total production costs in each department and then subtract the ending inventory to get the amount transferred out of each department. (a) Transferred to work in process-Stitching (b) Transferred to finished goods (c) Cost of goods sold < Prev 2 3 of 3 vext

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts