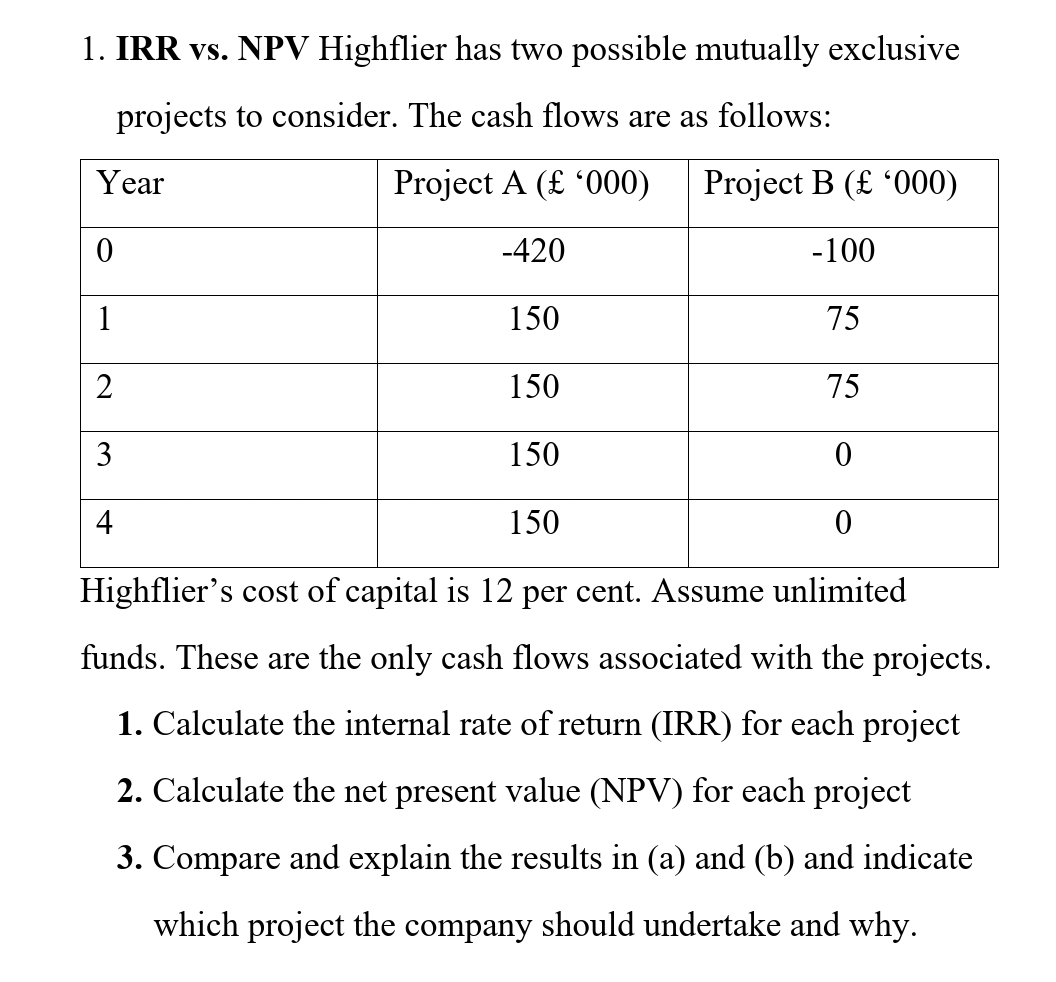

Question: IRR vs . NPV Highflier has two possible mutually exclusive projects to consider. The cash flows are as follows: table [ [ Year ,

IRR vs NPV Highflier has two possible mutually exclusive projects to consider. The cash flows are as follows:

tableYearProject A Project B

Highflier's cost of capital is per cent. Assume unlimited funds. These are the only cash flows associated with the projects.

Calculate the internal rate of return IRR for each project

Calculate the net present value NPV for each project

Compare and explain the results in a and b and indicate which project the company should undertake and why.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock