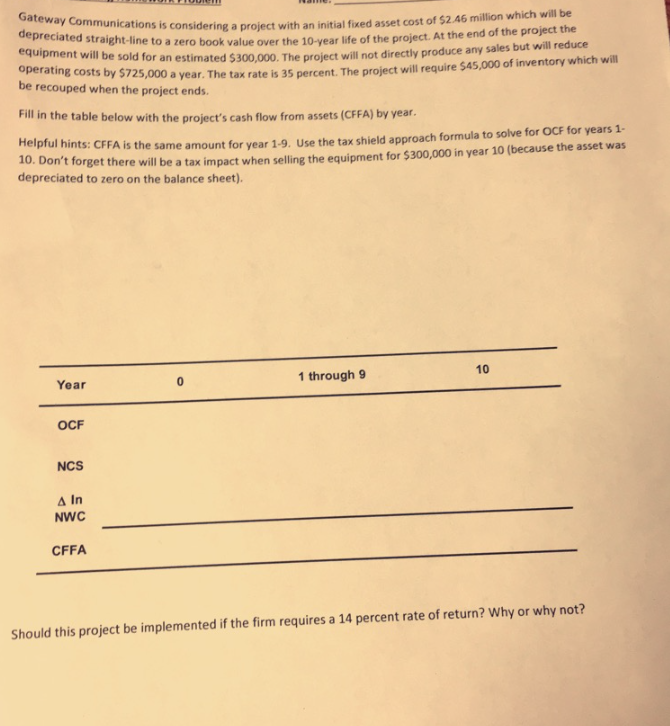

Question: is considering a project with an initial fixed asset cost of $2.46 million which will be depreciated straight-line to a zero equipment will be sold

is considering a project with an initial fixed asset cost of $2.46 million which will be depreciated straight-line to a zero equipment will be sold for an estimated $300,000. The project will not directly produce any book value over the 10-year life of the project. At the end of the project the sales but will reduce a year. The tax rate is 35 percent. The project will require $45,000 of inventory which will be recouped when the project ends Fill in the table below with the project's cash flow from assets (CFFA) by year Helpful hints: CFFA is the same amount for year 1 10. Don't f depreciated to zero on the balance sheet). -9. Use the tax shield approach formula to solve for OCF for years 1- orget there will be a tax impact when selling the equipment for $300,000 in year 10 (because the asset was 10 0 1 through Year OCF NCS A In NWC CFFA Should this project be implemented if the firm requires a 14 percent rate of return? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts