Question: is there a simple way to fine this answer? A U.S.-based currency dealer has good credit and can borrow $1,000,000 for one year. The one-year

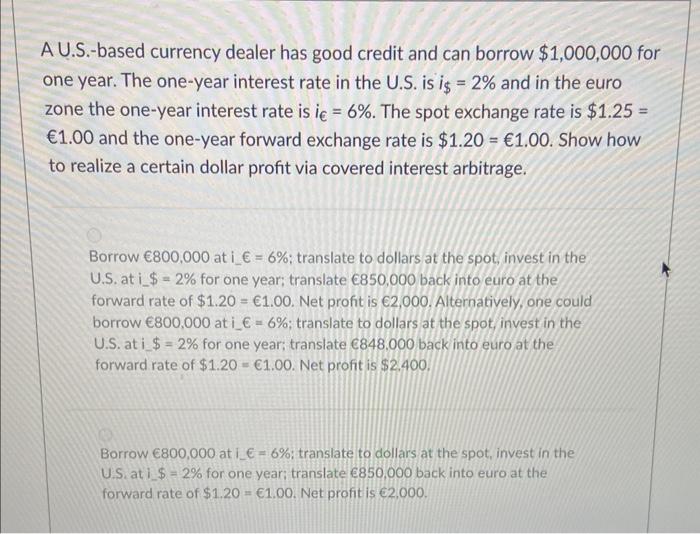

A U.S.-based currency dealer has good credit and can borrow $1,000,000 for one year. The one-year interest rate in the U.S. is i$=2% and in the euro zone the one-year interest rate is i=6%. The spot exchange rate is $1.25= 1.00 and the one-year forward exchange rate is $1.20=1.00. Show how to realize a certain dollar profit via covered interest arbitrage. Borrow 800,000 at i_=6%; translate to dollars at the spot, invest in the U.S. at i_\$ =2% for one year; translate 850,000 back into euro at the forward rate of $1.20=1.00. Net profit is 2,000. Alternatively, one could borrow 800,000 at i_=6%; translate to dollars at the spot, invest in the U.S. at i $=2% for one year; translate 848.000 back into euro at the forward rate of $1.20=61.00. Net profit is $2.400. Borrow 800,000 at i =6%; translate to dollars at the spot, invest in the U.S. at 1_$=2% for one year; translate 850,000 back into euro at the forward rate of $1.20=1.00. Net profit is 2,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts