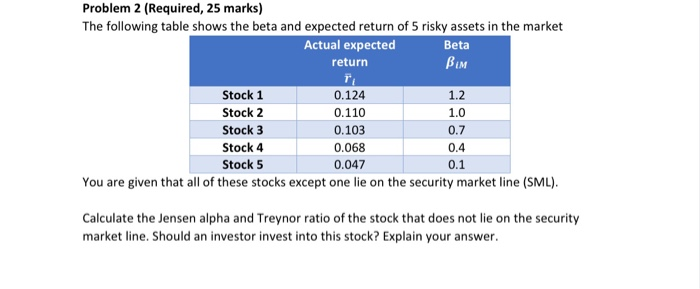

Question: it is RF there is no missing information Problem 2 (Required, 25 marks) The following table shows the beta and expected return of 5 risky

Problem 2 (Required, 25 marks) The following table shows the beta and expected return of 5 risky assets in the market Actual expected Beta return 1 Stock 1 0.124 Stock 2 0.110 1.0 Stock 3 0.103 0.7 Stock 4 0.068 Stock 5 0.047 0.1 You are given that all of these stocks except one lie on the security market line (SML). 1.2 0.4 Calculate the Jensen alpha and Treynor ratio of the stock that does not lie on the security market line. Should an investor invest into this stock? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts