Question: Problem 3 (Required, 40 marks) We consider a market with 1 riskfree asset and N risky assets. The following table shows the expected return up

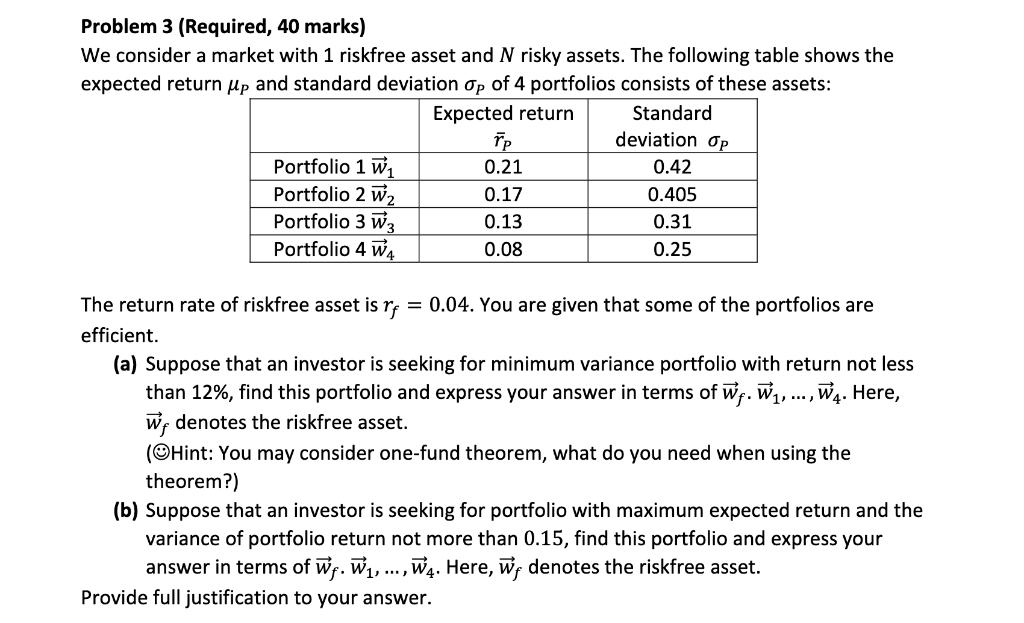

Problem 3 (Required, 40 marks) We consider a market with 1 riskfree asset and N risky assets. The following table shows the expected return up and standard deviation Op of 4 portfolios consists of these assets: Expected return Standard re deviation op Portfolio 1 w1 0.21 0.42 Portfolio 2 w2 0.17 0.405 Portfolio 3 w3 0.13 0.31 Portfolio 4 W4 0.08 0.25 The return rate of riskfree asset is rf = 0.04. You are given that some of the portfolios are efficient. (a) Suppose that an investor is seeking for minimum variance portfolio with return not less than 12%, find this portfolio and express your answer in terms of w. W 1, ... , W 4. Here, Wf denotes the riskfree asset. (Hint: You may consider one-fund theorem, what do you need when using the theorem?) (b) Suppose that an investor is seeking for portfolio with maximum expected return and the variance of portfolio return not more than 0.15, find this portfolio and express your answer in terms of Wf. W 1, ...,W. Here, wf denotes the riskfree asset. Provide full justification to your answer. Problem 3 (Required, 40 marks) We consider a market with 1 riskfree asset and N risky assets. The following table shows the expected return up and standard deviation Op of 4 portfolios consists of these assets: Expected return Standard re deviation op Portfolio 1 w1 0.21 0.42 Portfolio 2 w2 0.17 0.405 Portfolio 3 w3 0.13 0.31 Portfolio 4 W4 0.08 0.25 The return rate of riskfree asset is rf = 0.04. You are given that some of the portfolios are efficient. (a) Suppose that an investor is seeking for minimum variance portfolio with return not less than 12%, find this portfolio and express your answer in terms of w. W 1, ... , W 4. Here, Wf denotes the riskfree asset. (Hint: You may consider one-fund theorem, what do you need when using the theorem?) (b) Suppose that an investor is seeking for portfolio with maximum expected return and the variance of portfolio return not more than 0.15, find this portfolio and express your answer in terms of Wf. W 1, ...,W. Here, wf denotes the riskfree asset. Provide full justification to your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts