Question: It ' s been four months since you took a position as an assistant financial analyst at Caledonia Products. During that time, you've had a

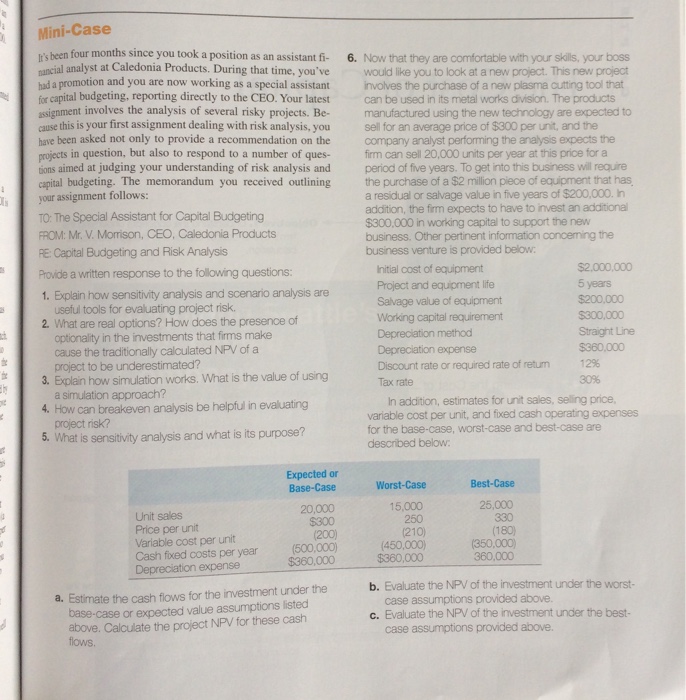

It ' s been four months since you took a position as an assistant financial analyst at Caledonia Products. During that time, you've had a promotion and you are now working as a special assistantincapital budgeting, reporting directly to the CEO. Your latest assignment involves the analysis of several risky projects. Because this is your first assignment dealing with risk analysis, you have been asked not only to provide a recommendation on the projects in question, but also to respond to a number of questionsaimed at judging your understanding of risk analysis and capital budgeting. The memorandum you received outlining your assignment follows: TO: The Special Assistant for Capital Budgeting From:Mr.V. Morrison, CEO, Caledonia Products RE: Capital Budgeting and Risk Analysis Provide a written response to the following questions: Explain how sensitivity analysis and scenario analysis are useful tools for evaluating project risk. What are real options? How does the presence of optionality in the investments that firms make case the traditionally calculated NPV of a projectt to be underestimated? Explain howsimulation woks. What is the valueof usinga simulationapproach? How can breakeven analysis be helpfulin evaluating project risk? What is sensitivity analysis and what is its purpose? Now that they are comfortable with your skills. your boss would like you to look at a new project. This new project involves the purchase of a new plasma cutting tool that can be used in its metal works division. The products manufactured using the new technology are expected to sell for an average price of $303 per unit, and the company analyst performing the analysis expects the firm can sell 20,000 units per year at this price for a period of five years. To get into this business will require the purchase of a$2million piece of equipment that has a residual or salvage valuein five years of $200,000, in addition, the firm expects to have toinvestan additional $300,000 in working capital to support the new business. Other pertinent informationconcerningthebusiness venture is provided below: In addition, estimate for unit sales, selling price varaible cost per unit, and fixed operating expenses for the base-case, worst-case and best-case are describe below: Estimatethe cashflows for the base-case a expected value assumptions listed above. Calculate the project NPV for these cashflows. Evaluate the NPV of the investment under the worst-case assumptions provided above. Evaluate the NPV of the investment under the best-case assumptions provided above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts