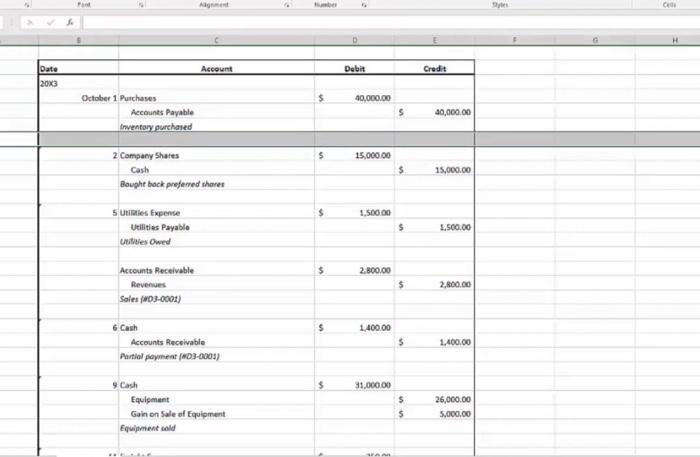

Question: it should be a general journal. and notify if ts debit or credit as well. Could you please make a general jounral should look like

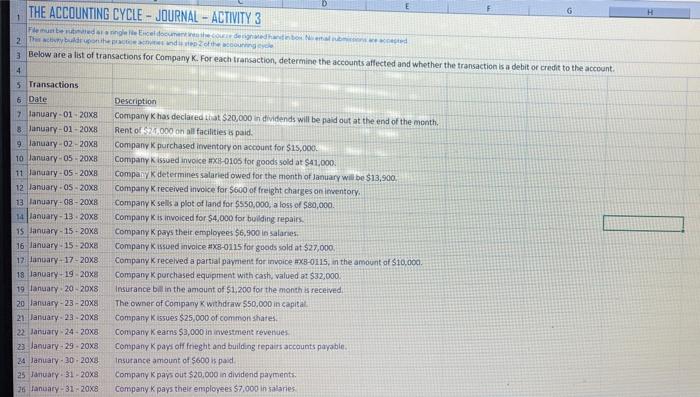

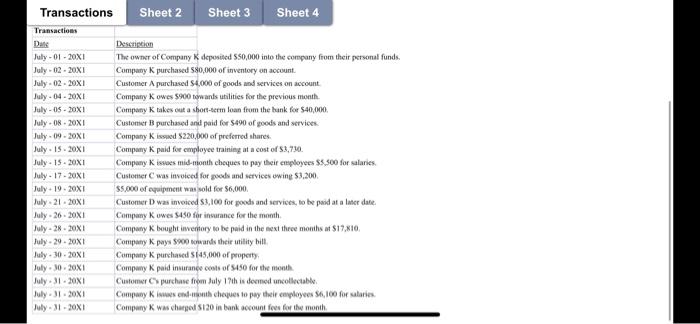

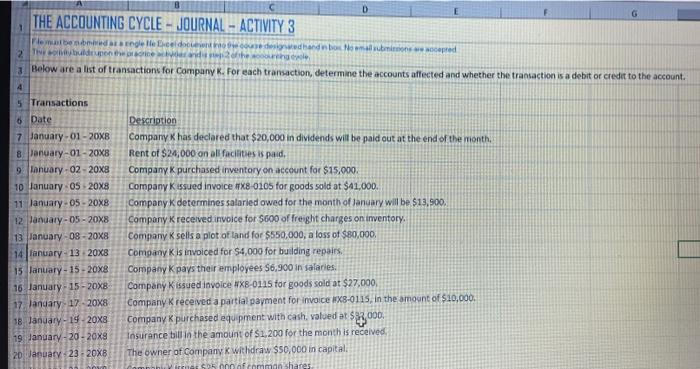

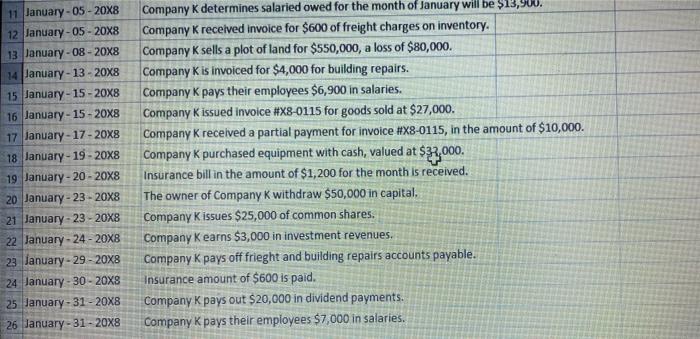

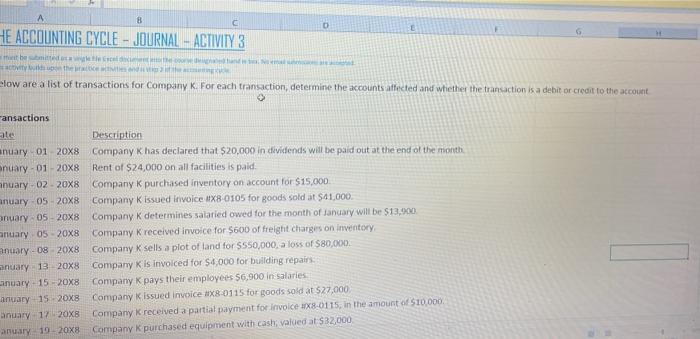

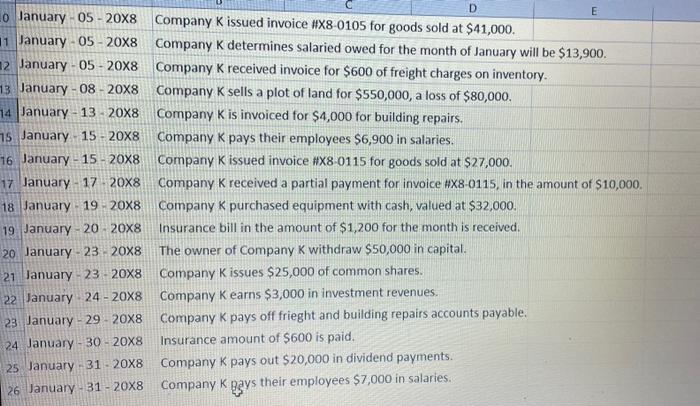

Transactions Sheet2 THE ACCOUNTING CYCLE-OURNAL ACTIVITY . Ram . . - 1. www.com nom y come www - - Compen - Cape 1 THE ACCOUNTING CYCLE - JOURNAL - ACTIVITY 3 Femutbedringlich 2 cupon de bouge 3 Below are a list of transactions for Company K. For each transaction, determine the accounts affected and whether the transaction is a debitor credit to the account. 4 5 Transactions 6 Date 7 lanuary-01-20x8 8. January-01-20X8 9 January 02-20x8 10 January-05 - 20x8 11 January-05 - 20XA 12 January-05-20x8 13 January-08-20x8 14 Ianuary - 13 20x8 January - 15 - 20x8 16 January 15 - 20x8 12 January 17-20x8 18 Ianuary 19 20x8 19 Ianuary 20 20x8 20 January-23-2008 21 January-23-20x8 22 January 24 20x8 23 January-23-20x8 24 January 30 20x8 25 January 31 - 20x8 76 Ianuary-31-20x8 Description Company has declared that $20,000 in dividends will be paid out at the end of the month. Rent of $20,000 on all facilities is paid. Company k purchased Inventory on account for $15,000 Company issued invoke X-0105 for goods sold at $41,000 Company determines salaried owed for the month of January will be $13,900 Company received invoice for $600 of freight charges on inventory Company sells a plot of land for $550,000, a loss of $80,000 Company is invoiced for $4,000 for building repairs. Company k pays their employees $6.900 in salaries Company issued invoice X8-0115 for goods sold at $27,000 Company received a partial payment for invoice X3-0115, in the amount of $10,000 Company K porchased equipment with cash, valued at $32,000 Insurance bill in the amount of $1.200 for the month received The owner of Company withdraw 550.000 in capital Company issues $25,000 of common shares Company Kearns $3,000 in investment revenues Company K pays off frieght and building repairs accounts payable Insurance amount of $600 is paid Company K pays out $20,000 in dividend payments. Company k pays their employees $7.000 in salaries Transactions Sheet 2 Sheet 3 Sheet 4 Transactions De July-01-20X1 July 02 - 20X1 July. 02. 20X1 July .04.20X1 July - 05.20X1 July. 08. 20XI July 0920X1 July - 15. 20X1 July - 15. 20X1 July 17. 20X1 July-1920X1 July.21. 20X1 July - 26. 20X1 July.28. 20X1 July - 29. 20X1 July 30 20X1 July 10. 20X1 July 3120X1 July 31 20X1 July 31 - 20X1 Description The owner of Company K deposited 50,000 into the company from their personal funds. Company purchased 580,000 of inventory on account Customer A purchased $4,000 of goods and services on account Company Kowes $900 towards utilities for the previous month Company K takes out a short-term loan from the bank for $40,000 Customer purchased and paid for $490 of goods and services Company Kied S220,000 of preferred shares Company K paid for employee training at a cost of $1,790 Company Kisses mid-month cheques to pay their employees $5,500 for salaries. Customer was involved for goods and services owing 83.200. $5,000 of equipment was sold for $6.000. Customer D) was invoiced $3,100 for goods and services, to be paid at a later date Company Kuwes S450 for insurance for the month Company bought twentory to be paid in the next three months of $17.10 Company Kpays 200 towards their willy Will Company purchased 145,000 of property Company k paid insurance costs of $450 for the month Customer Cs purchase from July 17this dormed uncollectable Company Kenth cheques to pay their employees 56,100 for salaries Company was charged 5130 in bank account fees for the month D THE ACCOUNTING CYCLE - JOURNAL - ACTIVITY 3 Flema beberangellecedores de bandbox Nombor pred 2 ha 3. Below are a list of transactions for Company K. For each transaction, determine the accounts affected and whether the transaction is a debitor credit to the account 5 Transactions 6 Date 7 January-01-20XB 8 January-01-20X8 9 ianuary-02-20x8 10 January 05 20x8 11 January-05-20x8 12 January-05-20X8 13 January -08 - 20x8 14 january - 13 20x8 15 January - 15-20x8 16 January - 15 - 20XB 17 January 17-20x8 18 January - 1920x8 19 January-20 - 20x8 20 January23-20XB Description Company has declared that $20,000 in dividends will be paid out at the end of the month, Rent of $24,000 on all facilities is paid, Company purchased inventory on account for $15.000 Company issued invoice X8 0105 for goods sold at $41,000. Company K determines salaried owed for the month of January will be $13,900. Company received invoice for $600 of freight charges on inventory Company sells a plot of land for $550,000, a loss of $80,000, Company is invoiced for $4,000 for building repairs Company K pays their employees S6,900 in salaries Company issued invoice #XB-0115 for goods sold at $27.000 Company received a partial payment for invoice X8-0115, in the amount of $10,000, Company purchased equipment with cash valued at $8,000 Insurance till in the amount of $1.200 for the month is received The owner of Company withdraw $50,000 in capital 000 Comman Shares 11 January - 05 - 20x8 12 January-05-20x8 13 January -08 - 20x8 14 January - 13 - 20x8 15 January - 15 - 20x8 16 January - 15 - 20x8 17 January - 17 - 20x8 18 January - 19 - 20x8 19 January - 20 - 20x8 20 January-23-20x8 21 January-23-20x8 22 January - 24 - 20x8 23 January-29-20x8 24 January -30 - 20x8 25 January - 31 - 20x8 26 January - 31 - 20x8 Company K determines salaried owed for the month of January will be $13,900. Company K received invoice for $600 of freight charges on inventory. Company K sells a plot of land for $550,000, a loss of $80,000. Company K is invoiced for $4,000 for building repairs. Company K pays their employees $6,900 in salaries. Company K issued invoice #X8-0115 for goods sold at $27,000. Company K received a partial payment for invoice #X8-0115, in the amount of $10,000. Company K purchased equipment with cash, valued at $3,000. Insurance bill in the amount of $1,200 for the month is received. The owner of Company K withdraw $50,000 in capital. Company issues $25,000 of common shares. Company Kearns $3,000 in investment revenues. Company k pays off frieght and building repairs accounts payable. Insurance amount of $600 is paid. Company K pays out $20,000 in dividend payments. Company K pays their employees $7,000 in salaries. 8 C C HE ACCOUNTING CYCLE - JOURNAL - ACTIVITY 3 the batte the elow are a list of transactions for Company K. For each transaction, determine the accounts affected and whether the transaction is a debitor credit to the account ansactions ale Description anuary 01 20x8 Company Khas declared that $20,000 in dividends will be paid out at the end of the month anuary - 01 - 20x8 Rent of $24,000 on all facilities is paid. anuary 02. 20x8 Company k purchased inventory on account for $15.000 anuary 05 20X8 Company issued invoice X8-0105 for goods sold at $41,000. anuary 05 - 20X8 Company k determines salaried owed for the month of January will be $13.900 anuary 05 20x8 Company received invoice for $600 of freight charges on inventory anuary-08 20x8 Company K sells a plot of land for $550,000, a loss of $80,000 anuary 13 20x8 Company K is invoiced for $4,000 for building repairs aanuary - 15 - 20x8 Company K pays their employees 56,900 in salaries anuary 15 20X8 Company issued invoice #X8-0115 for goods sold at 527,000 anuary 17 20x8 Company received a partial payment for Invoice X8-0115 in the amount of $10.000 anuary 19 20x8 Company k purchased equipment with cash valued at $32,000 E 0 January-05 - 20x8 11 January - 05 - 20x8 12 January - 05 - 20x8 13 January - 08 - 20x8 14 January - 13 20x8 15 January 15 - 20x8 16 January - 15 - 20x8 17 January - 17 20X8 18 January 19 - 20X8 19 January - 20 20x8 20. January - 23 20x8 21 January - 23 20x8 22 January 24 - 20X8 23 January - 2920X8 24 January - 30 - 20x8 25 January -31 - 20x8 26 January - 31 - 20X8 D Company K issued invoice #X8-0105 for goods sold at $41,000. Company K determines salaried owed for the month of January will be $13,900. Company K received invoice for $600 of freight charges on inventory. Company K sells a plot of land for $550,000, a loss of $80,000. Company K is invoiced for $4,000 for building repairs. Company k pays their employees $6,900 in salaries. Company Kissued invoice #X8-0115 for goods sold at $27,000. Company K received a partial payment for invoice #X8-0115, in the amount of $10,000. Company k purchased equipment with cash, valued at $32,000. Insurance bill in the amount of $1,200 for the month is received. The owner of Company K withdraw $50,000 in capital. Company K issues $25,000 of common shares. Company Kearns $3,000 in investment revenues. Company k pays off frieght and building repairs accounts payable, Insurance amount of $600 is paid. Company K pays out $20,000 in dividend payments. Company k gays their employees $7,000 in salaries. Fand Account Debit Credit Date 20x3 40,000.00 October 1 Purchases Accounts Payable Inventory purchased 5 10,000.00 15,000.00 2 Company Shares Cash Bought back preferred there! $ 15,000.00 $ 1.500.00 5 Utilities Expense Utilities Payable Us Owed $ 3.500.00 $ 2,800.00 Accounts Receivable Revenues Sales (03-0001 $ 2,800.00 $ 1.400.00 6 Cash Accounts Receivable Partial payment (D3-2003) $ 1.400.00 $ 35,000.00 9 Cash Equipment Gain on sale el Equipment Equipment cold 5 $ 26,000.00 5,000.00 Transactions Sheet2 THE ACCOUNTING CYCLE-OURNAL ACTIVITY . Ram . . - 1. www.com nom y come www - - Compen - Cape 1 THE ACCOUNTING CYCLE - JOURNAL - ACTIVITY 3 Femutbedringlich 2 cupon de bouge 3 Below are a list of transactions for Company K. For each transaction, determine the accounts affected and whether the transaction is a debitor credit to the account. 4 5 Transactions 6 Date 7 lanuary-01-20x8 8. January-01-20X8 9 January 02-20x8 10 January-05 - 20x8 11 January-05 - 20XA 12 January-05-20x8 13 January-08-20x8 14 Ianuary - 13 20x8 January - 15 - 20x8 16 January 15 - 20x8 12 January 17-20x8 18 Ianuary 19 20x8 19 Ianuary 20 20x8 20 January-23-2008 21 January-23-20x8 22 January 24 20x8 23 January-23-20x8 24 January 30 20x8 25 January 31 - 20x8 76 Ianuary-31-20x8 Description Company has declared that $20,000 in dividends will be paid out at the end of the month. Rent of $20,000 on all facilities is paid. Company k purchased Inventory on account for $15,000 Company issued invoke X-0105 for goods sold at $41,000 Company determines salaried owed for the month of January will be $13,900 Company received invoice for $600 of freight charges on inventory Company sells a plot of land for $550,000, a loss of $80,000 Company is invoiced for $4,000 for building repairs. Company k pays their employees $6.900 in salaries Company issued invoice X8-0115 for goods sold at $27,000 Company received a partial payment for invoice X3-0115, in the amount of $10,000 Company K porchased equipment with cash, valued at $32,000 Insurance bill in the amount of $1.200 for the month received The owner of Company withdraw 550.000 in capital Company issues $25,000 of common shares Company Kearns $3,000 in investment revenues Company K pays off frieght and building repairs accounts payable Insurance amount of $600 is paid Company K pays out $20,000 in dividend payments. Company k pays their employees $7.000 in salaries Transactions Sheet 2 Sheet 3 Sheet 4 Transactions De July-01-20X1 July 02 - 20X1 July. 02. 20X1 July .04.20X1 July - 05.20X1 July. 08. 20XI July 0920X1 July - 15. 20X1 July - 15. 20X1 July 17. 20X1 July-1920X1 July.21. 20X1 July - 26. 20X1 July.28. 20X1 July - 29. 20X1 July 30 20X1 July 10. 20X1 July 3120X1 July 31 20X1 July 31 - 20X1 Description The owner of Company K deposited 50,000 into the company from their personal funds. Company purchased 580,000 of inventory on account Customer A purchased $4,000 of goods and services on account Company Kowes $900 towards utilities for the previous month Company K takes out a short-term loan from the bank for $40,000 Customer purchased and paid for $490 of goods and services Company Kied S220,000 of preferred shares Company K paid for employee training at a cost of $1,790 Company Kisses mid-month cheques to pay their employees $5,500 for salaries. Customer was involved for goods and services owing 83.200. $5,000 of equipment was sold for $6.000. Customer D) was invoiced $3,100 for goods and services, to be paid at a later date Company Kuwes S450 for insurance for the month Company bought twentory to be paid in the next three months of $17.10 Company Kpays 200 towards their willy Will Company purchased 145,000 of property Company k paid insurance costs of $450 for the month Customer Cs purchase from July 17this dormed uncollectable Company Kenth cheques to pay their employees 56,100 for salaries Company was charged 5130 in bank account fees for the month D THE ACCOUNTING CYCLE - JOURNAL - ACTIVITY 3 Flema beberangellecedores de bandbox Nombor pred 2 ha 3. Below are a list of transactions for Company K. For each transaction, determine the accounts affected and whether the transaction is a debitor credit to the account 5 Transactions 6 Date 7 January-01-20XB 8 January-01-20X8 9 ianuary-02-20x8 10 January 05 20x8 11 January-05-20x8 12 January-05-20X8 13 January -08 - 20x8 14 january - 13 20x8 15 January - 15-20x8 16 January - 15 - 20XB 17 January 17-20x8 18 January - 1920x8 19 January-20 - 20x8 20 January23-20XB Description Company has declared that $20,000 in dividends will be paid out at the end of the month, Rent of $24,000 on all facilities is paid, Company purchased inventory on account for $15.000 Company issued invoice X8 0105 for goods sold at $41,000. Company K determines salaried owed for the month of January will be $13,900. Company received invoice for $600 of freight charges on inventory Company sells a plot of land for $550,000, a loss of $80,000, Company is invoiced for $4,000 for building repairs Company K pays their employees S6,900 in salaries Company issued invoice #XB-0115 for goods sold at $27.000 Company received a partial payment for invoice X8-0115, in the amount of $10,000, Company purchased equipment with cash valued at $8,000 Insurance till in the amount of $1.200 for the month is received The owner of Company withdraw $50,000 in capital 000 Comman Shares 11 January - 05 - 20x8 12 January-05-20x8 13 January -08 - 20x8 14 January - 13 - 20x8 15 January - 15 - 20x8 16 January - 15 - 20x8 17 January - 17 - 20x8 18 January - 19 - 20x8 19 January - 20 - 20x8 20 January-23-20x8 21 January-23-20x8 22 January - 24 - 20x8 23 January-29-20x8 24 January -30 - 20x8 25 January - 31 - 20x8 26 January - 31 - 20x8 Company K determines salaried owed for the month of January will be $13,900. Company K received invoice for $600 of freight charges on inventory. Company K sells a plot of land for $550,000, a loss of $80,000. Company K is invoiced for $4,000 for building repairs. Company K pays their employees $6,900 in salaries. Company K issued invoice #X8-0115 for goods sold at $27,000. Company K received a partial payment for invoice #X8-0115, in the amount of $10,000. Company K purchased equipment with cash, valued at $3,000. Insurance bill in the amount of $1,200 for the month is received. The owner of Company K withdraw $50,000 in capital. Company issues $25,000 of common shares. Company Kearns $3,000 in investment revenues. Company k pays off frieght and building repairs accounts payable. Insurance amount of $600 is paid. Company K pays out $20,000 in dividend payments. Company K pays their employees $7,000 in salaries. 8 C C HE ACCOUNTING CYCLE - JOURNAL - ACTIVITY 3 the batte the elow are a list of transactions for Company K. For each transaction, determine the accounts affected and whether the transaction is a debitor credit to the account ansactions ale Description anuary 01 20x8 Company Khas declared that $20,000 in dividends will be paid out at the end of the month anuary - 01 - 20x8 Rent of $24,000 on all facilities is paid. anuary 02. 20x8 Company k purchased inventory on account for $15.000 anuary 05 20X8 Company issued invoice X8-0105 for goods sold at $41,000. anuary 05 - 20X8 Company k determines salaried owed for the month of January will be $13.900 anuary 05 20x8 Company received invoice for $600 of freight charges on inventory anuary-08 20x8 Company K sells a plot of land for $550,000, a loss of $80,000 anuary 13 20x8 Company K is invoiced for $4,000 for building repairs aanuary - 15 - 20x8 Company K pays their employees 56,900 in salaries anuary 15 20X8 Company issued invoice #X8-0115 for goods sold at 527,000 anuary 17 20x8 Company received a partial payment for Invoice X8-0115 in the amount of $10.000 anuary 19 20x8 Company k purchased equipment with cash valued at $32,000 E 0 January-05 - 20x8 11 January - 05 - 20x8 12 January - 05 - 20x8 13 January - 08 - 20x8 14 January - 13 20x8 15 January 15 - 20x8 16 January - 15 - 20x8 17 January - 17 20X8 18 January 19 - 20X8 19 January - 20 20x8 20. January - 23 20x8 21 January - 23 20x8 22 January 24 - 20X8 23 January - 2920X8 24 January - 30 - 20x8 25 January -31 - 20x8 26 January - 31 - 20X8 D Company K issued invoice #X8-0105 for goods sold at $41,000. Company K determines salaried owed for the month of January will be $13,900. Company K received invoice for $600 of freight charges on inventory. Company K sells a plot of land for $550,000, a loss of $80,000. Company K is invoiced for $4,000 for building repairs. Company k pays their employees $6,900 in salaries. Company Kissued invoice #X8-0115 for goods sold at $27,000. Company K received a partial payment for invoice #X8-0115, in the amount of $10,000. Company k purchased equipment with cash, valued at $32,000. Insurance bill in the amount of $1,200 for the month is received. The owner of Company K withdraw $50,000 in capital. Company K issues $25,000 of common shares. Company Kearns $3,000 in investment revenues. Company k pays off frieght and building repairs accounts payable, Insurance amount of $600 is paid. Company K pays out $20,000 in dividend payments. Company k gays their employees $7,000 in salaries. Fand Account Debit Credit Date 20x3 40,000.00 October 1 Purchases Accounts Payable Inventory purchased 5 10,000.00 15,000.00 2 Company Shares Cash Bought back preferred there! $ 15,000.00 $ 1.500.00 5 Utilities Expense Utilities Payable Us Owed $ 3.500.00 $ 2,800.00 Accounts Receivable Revenues Sales (03-0001 $ 2,800.00 $ 1.400.00 6 Cash Accounts Receivable Partial payment (D3-2003) $ 1.400.00 $ 35,000.00 9 Cash Equipment Gain on sale el Equipment Equipment cold 5 $ 26,000.00 5,000.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts