Question: I've been trying to do this problem and I got it wrong three times. The formula I was using: $67,000,000x88% = 58,960,000 $1,700,000x34 = 57,800,000

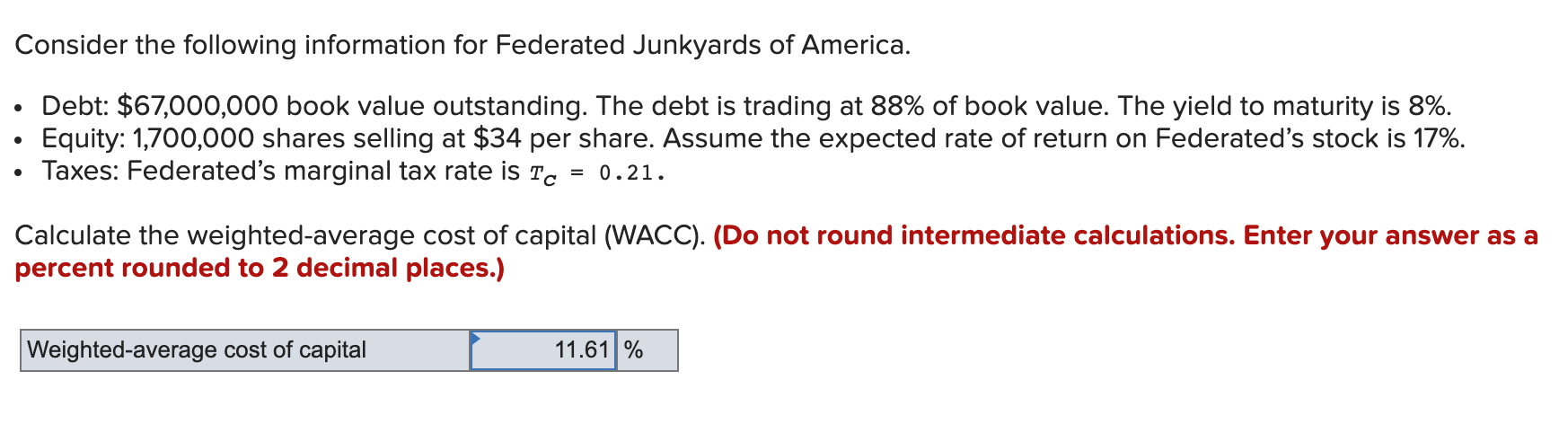

I've been trying to do this problem and I got it wrong three times. The formula I was using: $67,000,000x88% = 58,960,000 $1,700,000x34 = 57,800,000 WACC = (57,800,000/(57,800,000+58,960,000))x17% + (58,960,000/(57,800,000 + 58,960,000)) x 8%(.79) = 11.61%

Consider the following information for Federated Junkyards of America. . . Debt: $67,000,000 book value outstanding. The debt is trading at 88% of book value. The yield to maturity is 8%. Equity: 1,700,000 shares selling at $34 per share. Assume the expected rate of return on Federated's stock is 17%. Taxes: Federated's marginal tax rate is Tc = 0.21. Calculate the weighted average cost of capital (WACC). (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Weighted-average cost of capital 11.61%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts