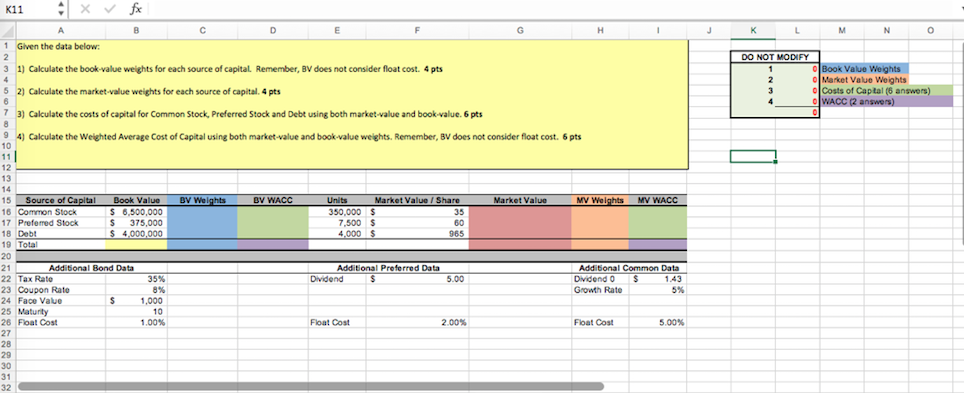

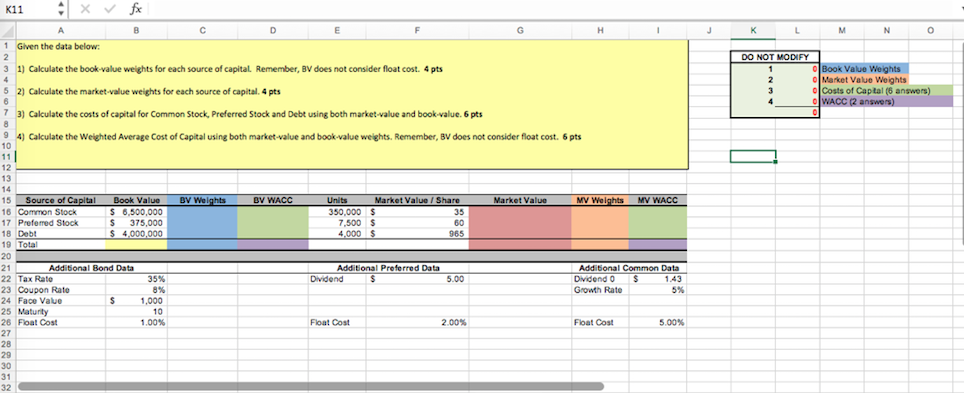

Question: J K L M N o DO NOT MODIFY 1 Book Value Weights 2 Market Value Weights 3 o Costs of Captal (6 answers) 4

J K L M N o DO NOT MODIFY 1 Book Value Weights 2 Market Value Weights 3 o Costs of Captal (6 answers) 4 O WACC (2 answers) 10 K11 A X fx B D E G H 1 1 Given the data below: 2 1) Calculate the book-value weights for each source of capital. Remember, BV does not consider float cost. 4 pts $ 2) Calculate the market-value weights for each source of capital. 4 pts 6 3) Calculate the costs of capital for Common Stock. Preferred Stock and Debt using both market value and book-value. 6 pts 8 9 4) Calculate the weighted Average Cost of Capital using both market value and book-value weights. Remember, BV does not consider float cost. 6 pts . , 6 11 12 13 14 15 Source of Capital Book Value BV Weights BV WACC Units Market Value / Share Market Value MV Weights MV WACC 16 Common Stock $ 6,500,000 350,000 $ 35 17 Preferred Stock s 375,000 7,500 $ 60 18 Debt $ 4,000,000 4,000 $ 965 19 Total 20 21 Additional Bond Data Additional Preferred Data Additonal Common Data 22 Tax Rate 35% Dividend 5.00 Dividendo $ 1.43 23 Coupon Rate 8% Growth Rate 5% 24 Face Value $ 1.000 25 Maturity 10 26 Float Cost 1.00% Float Cost 2.00% Float Cost 5.00% 27 28 29 30 31 32 J K L M N o DO NOT MODIFY 1 Book Value Weights 2 Market Value Weights 3 o Costs of Captal (6 answers) 4 O WACC (2 answers) 10 K11 A X fx B D E G H 1 1 Given the data below: 2 1) Calculate the book-value weights for each source of capital. Remember, BV does not consider float cost. 4 pts $ 2) Calculate the market-value weights for each source of capital. 4 pts 6 3) Calculate the costs of capital for Common Stock. Preferred Stock and Debt using both market value and book-value. 6 pts 8 9 4) Calculate the weighted Average Cost of Capital using both market value and book-value weights. Remember, BV does not consider float cost. 6 pts . , 6 11 12 13 14 15 Source of Capital Book Value BV Weights BV WACC Units Market Value / Share Market Value MV Weights MV WACC 16 Common Stock $ 6,500,000 350,000 $ 35 17 Preferred Stock s 375,000 7,500 $ 60 18 Debt $ 4,000,000 4,000 $ 965 19 Total 20 21 Additional Bond Data Additional Preferred Data Additonal Common Data 22 Tax Rate 35% Dividend 5.00 Dividendo $ 1.43 23 Coupon Rate 8% Growth Rate 5% 24 Face Value $ 1.000 25 Maturity 10 26 Float Cost 1.00% Float Cost 2.00% Float Cost 5.00% 27 28 29 30 31 32