Question: Jack Smith, a baker, has been working at his friend's bakery a part time basis for the past 3 years. As of January 1,

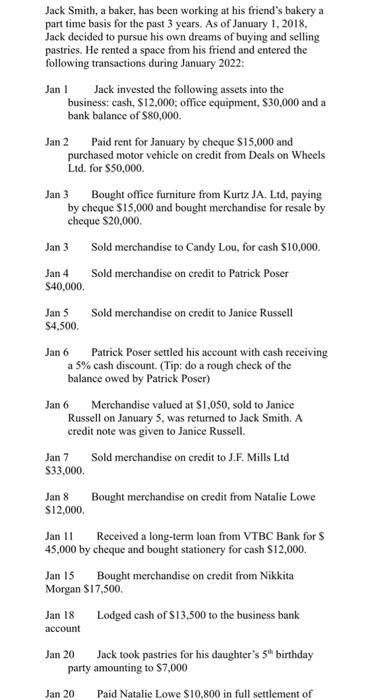

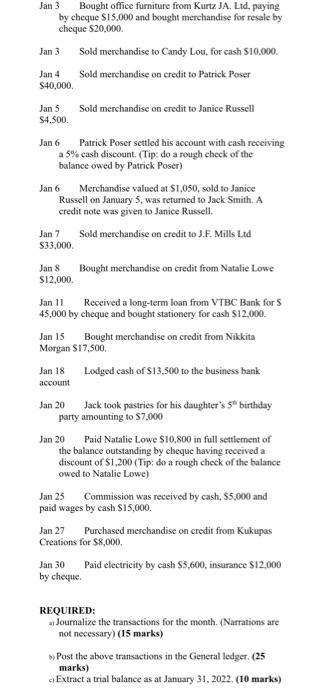

Jack Smith, a baker, has been working at his friend's bakery a part time basis for the past 3 years. As of January 1, 2018, Jack decided to pursue his own dreams of buying and selling pastries. He rented a space from his friend and entered the following transactions during January 2022: Jan 1 Jack invested the following assets into the business: cash, S12,000; office equipment, $30,000 and a bank balance of S80,000. Jan 2 Paid rent for January by cheque S15,000 and purchased motor vehicle on credit from Deals on Wheels Lid. for $50,000. Jan 3 Bought office furniture from Kurtz JA. Ltd, paying by cheque $15,000 and bought merchandise for resale by cheque $20,000. Jan 3 Sold merchandise to Candy Lou, for cash S10,000. Jan 4 Sold merchandise on credit to Patrick Poser $40,000. Jan 5 $4,500. Sold merchandise on credit to Janice Russell Jan 6 Patrick Poser settled his account with cash receiving a 5% cash discount. (Tip: do a rough check of the balance owed by Patrick Poser) Jan 6 Merchandise valued at S1,050, sold to Janice Russell on January 5, was returned to Jack Smith. A credit note was given to Janice Russell. Sold merchandise on credit to J.F. Mills Ltd Jan 7 S33,000. Jan 8 Bought merchandise on credit from Natalie Lowe S12,000. Jan 11 Received a long-term loan from VTBC Bank for $ 45,000 by cheque and bought stationery for cash S12,000. Jan 15 Bought merchandise on credit from Nikkita Morgan S17,500. Lodged cash of $13,500 to the business bank Jan 18 account Jack took pastries for his daughter's 5h birthday party amounting to S7,000 Jan 20 Jan 20 Paid Natalie Lowe S10,800 in full settlement of Jan 3 Bought office furniture from Kurtz JA. Ltd, paying by cheque S15,000 and bought merchandise for resale by cheque $20,000. Jan 3 Sold merchandise to Candy Lou, for cash S10,000. Jan 4 S40,000. Sold merchandise on credit to Patrick Poser Jan 5 $4,500. Sold merchandise on credit to Janice Russell Jan 6 Patrick Poser settled his account with cash receiving a 5% cash discount. (Tip: do a rough check of the balance owed by Patrick Poser) Jan 6 Russell on January 5, was returned to Jack Smith. A credit note was given to Janice Russell. Merchandise valued at S1,050, sold to Janice Jan 7 Sold merchandise on credit to J.F. Mills Ltd S33,000. Jan 8 Bought merchandise on credit from Natalie Lowe S12,000. Received a long-term loan from VTBC Bank for S 45,000 by cheque and bought stationery for cash S12,000. Jan 11 Jan 15 Bought merchandise on credit from Nikkita Morgan S17,500. Jan 18 Lodged cash of S13,500 to the business bank account Jack took pastries for his daughter's 5 birthday party amounting to $7,000 Jan 20 Paid Natalie Lowe S10,800 in full settlement of the balance outstanding by cheque having received a discount of $1,200 (Tip: do a rough check of the balance owed to Natalie Lowe) Jan 20 Jan 25 Commission was received by cash, $5,000 and paid wages by cash S15,000. Jan 27 Purchased merchandise on credit from Kukupas Creations for S8,000, Jan 30 Paid electricity by cash S5,600, insurance S12,000 by cheque. REQUIRED: a Journalize the transactions for the month. (Narrations are not necessary) (15 marks) Post the above transactions in the General ledger. (25 marks) c Extract a trial balance as at January 31, 2022. (10 marks)

Step by Step Solution

3.50 Rating (147 Votes )

There are 3 Steps involved in it

Trial Balance 31st Jan aoa2 ason Dr CAmt Cr CAm Account 1 Capital ... View full answer

Get step-by-step solutions from verified subject matter experts