Question: Jane Co. has the following data for the year: Net income 62,000,000 Outstanding shares, Ianuary 1 100,000 Employee share options during the year: Option shares

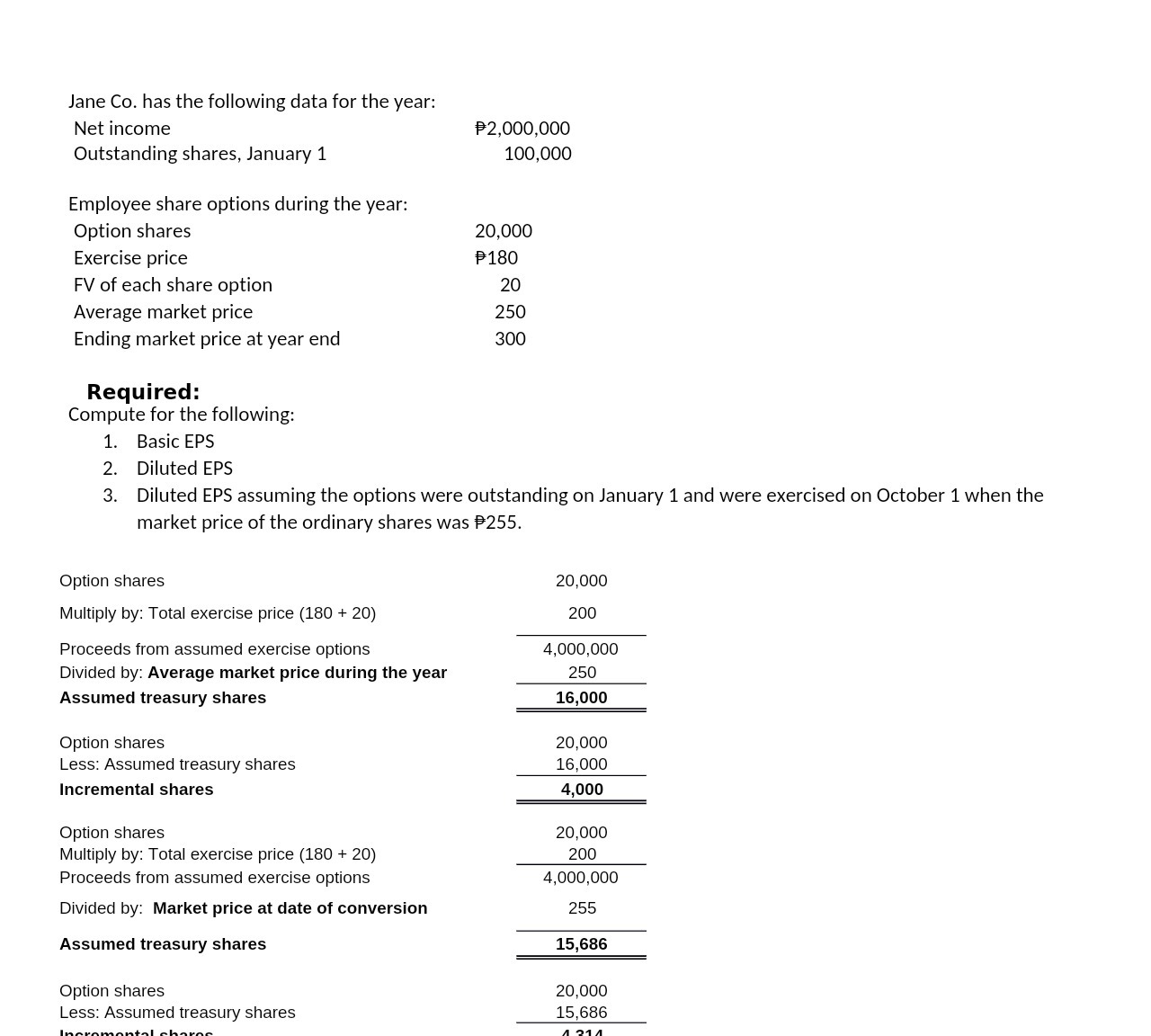

Jane Co. has the following data for the year: Net income 62,000,000 Outstanding shares, Ianuary 1 100,000 Employee share options during the year: Option shares 20,000 Exercise price 6180 FV of each share option 20 Average market price 250 Ending market price at year end 300 Required: Compute for the following: 1. Basic EPS 2. Diluted EPS 3. Diluted EPS assuming the options were outstanding on January 1 and were exercised on October 1 when the market price of the ordinary shares was $255. Option shares 20,000 Multiply by: Total exercise price (180 + 20) 200 Proceeds from assumed exercise options 4,000,000 Divided by: Average market price during the year 250 Assumed treasury shares 16,000 Option shares 20,000 Less: Assumed treasury shares 16,000 Incremental shares 4,000 Option shares 20,000 Multiply by: Total exercise price (180 + 20) 200 Proceeds from assumed exercise options 4,000,000 Divided by: Market price at date of conversion 255 Assumed treasury shares 15,686 Option shares 20,000 Less: Assumed treasury shares 15,686 Innrnmnnl-nl l-Ih-Irnr- A '31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts