Question: 8. Jane files as a single individual in 2018. She has wage income of $150,000; long-term capital gains of $20,000; short-term capital losses of

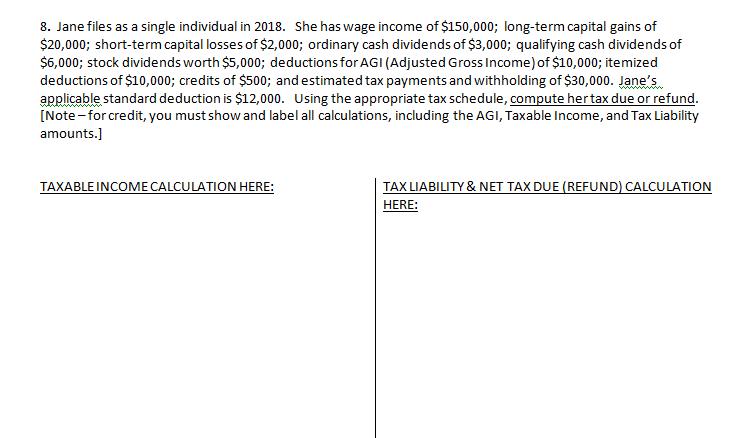

8. Jane files as a single individual in 2018. She has wage income of $150,000; long-term capital gains of $20,000; short-term capital losses of $2,000; ordinary cash dividends of $3,000; qualifying cash dividends of $6,000; stock dividends worth $5,000; deductions for AGI (Adjusted Gross Income) of $10,000; itemized deductions of $10,000; credits of $500; and estimated tax payments and withholding of $30,000. Jane's applicable standard deduction is $12,000. Using the appropriate tax schedule, compute hertax due or refund. [Note- for credit, you must show and label all calculations, including the AGI, Taxable Income, and Tax Liability amounts.] TAXABLE INCOME CALCULATION HERE: TAX LIABILITY & NET TAX DUE (REFUND) CALCULATION HERE:

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Jane is single individual who file Form 1040 for calculation of her federal tax liabilty statement s... View full answer

Get step-by-step solutions from verified subject matter experts