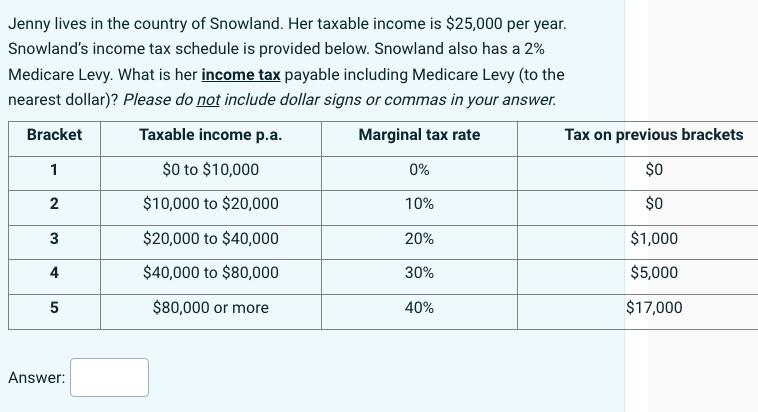

Jenny lives in the country of Snowland. Her taxable income is $25,000 per year. Snowland's income...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

Jenny lives in the country of Snowland. Her taxable income is $25,000 per year. Snowland's income tax schedule is provided below. Snowland also has a 2% Medicare Levy. What is her income tax payable including Medicare Levy (to the nearest dollar)? Please do not include dollar signs or commas in your answer. Marginal tax rate Bracket 1 2 3 4 5 Answer: Taxable income p.a. $0 to $10,000 $10,000 to $20,000 $20,000 to $40,000 $40,000 to $80,000 $80,000 or more 0% 10% 20% 30% 40% Tax on previous brackets $0 $0 $1,000 $5,000 $17,000 Jenny lives in the country of Snowland. Her taxable income is $25,000 per year. Snowland's income tax schedule is provided below. Snowland also has a 2% Medicare Levy. What is her income tax payable including Medicare Levy (to the nearest dollar)? Please do not include dollar signs or commas in your answer. Marginal tax rate Bracket 1 2 3 4 5 Answer: Taxable income p.a. $0 to $10,000 $10,000 to $20,000 $20,000 to $40,000 $40,000 to $80,000 $80,000 or more 0% 10% 20% 30% 40% Tax on previous brackets $0 $0 $1,000 $5,000 $17,000

Expert Answer:

Answer rating: 100% (QA)

First we need to determine which tax bracket Jenny falls into based on her taxable incom... View the full answer

Related Book For

Income Tax Fundamentals 2013

ISBN: 9781285586618

31st Edition

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

Posted Date:

Students also viewed these finance questions

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-6. On December 12, Irene purchased the building where her store is located. She paid...

-

Carol Harris, Ph.D, CPA, is a single taxpayer and she lives at 674 Yankee Street, Durham, NC 27409. Her Social Security number is 793-52-4335. Carol is an Associate Professor of Accounting at a local...

-

In Exercises 1126, determine whether each equation defines y as a function of x. 4x = y 2

-

An opaque surface, 2 m by 2 m, is maintained at 400 K and is simultaneously exposed to solar irradiation with G = 1200 W/m2 . The surface is diffuse and its spectral absorptivity is = 0, 0.8, 0, and...

-

Jessicas office building is destroyed by fire on November 15, 2021. The adjusted basis of the building is $410,000. She receives insurance proceeds of $550,000 on December 12, 2021. a. Calculate her...

-

Go to the library (either in person or online) and find a copy of a journal article in your own discipline. Then, go through the article and highlight the section (usually the "Results" section)...

-

Ford 10-K, Toyota 20-F a. What are the key acquisition and inventory cycle accounts for Ford? What are the critical accounting policies for these accounts? Ford 10-K, Toyota 20-F b. Compare Ford and...

-

Write a chemical equationfor H2SO4( a q ) showing how it is an acidor a base according to the Arrhenius definition. Write a chemical equationfor HBr( a q ) showing how it is an acidor a base...

-

At the beginning of the year, Carla Vista Company had total assets of $763,000 and total liabilities of $296,000. Answer the following questions. (a) If total assets increased $134,000 during the...

-

The purchasing manager of Tembo Tamu Limited, a wine retailer store holds a regular stock of among other things, Jayden a bottle of wine. Over the past year, he has sold, on average, 25 bottles of...

-

When it comes to costume design, why is it important to focus on the silhouette of a costume? Explain.

-

Checker Restaurant Inc. has two divisions, Canadian and European. The European division had assets of $32,000,000. Checker has a cost of capital of 9.0% overall. During the most recent year, revenues...

-

On September 1, Global Tech Inc. purchased merchandise for resale for $20,800 on credit terms 2/15, n/60 using the gross method and a perpetual inventory system. Global Tech incurred a shipping...

-

Assume that your advertising agency is compensated based on markup percentage charges. If the cost of the advertising is $850,000, and the agency includes 15% markup, how much will the client be...

-

Calculate the accounting impact on Google if it implemented a new stock grant plan with the following characteristics: Grant of 1000 shares. The shares vest in equal proportions over a 3-year period...

-

65% of Americans want the US to take a major role in world affairs. Suppose that a random sample of 1500 Pennsylvania residents is taken and 963 say that they want the US to take a major role in...

-

Sportique Boutique reported the following financial data for 2012 and 2011. Instructions(a) Calculate the current ratio for Sportique Boutique for 2012 and 2011.(b) Suppose that at the end of 2012,...

-

Jason and Mary are married taxpayers in 2012. They are both under age 65 and in good health. For this tax year, they have a total of $41,000 in wages and $500 in interest income. Jason and Mary's...

-

William sold Section 1245 property for $25,000 in 2012. The property cost $35,000 when it was purchased 5 years ago. The depreciation claimed on the property was $16,000. a. Calculate the adjusted...

-

Dr. George E. Beeper is a single taxpayer. He lives at 45 Mountain View Dr., Apt. 321, Spokane, WA 99210. Dr. Beeper's Social Security number is 775-88-9531. Dr. Beeper works for the Pine Medical...

-

Use Rayleigh's method to solve Problem 2.13. Data From Problem 2.13:- Find the natural frequency of the pulley system shown in Fig. 2.56 by neglecting the friction and the masses of the pulleys. 0000...

-

Use Rayleigh's method to solve Problem 2.7. Data From Problem 2.7:- Three springs and a mass are attached to a rigid, weightless bar \(P Q\) as shown in Fig. 2.51. Find the natural frequency of...

-

Determine the effect of self weight on the natural frequency of vibration of the pinned-pinned beam shown in Fig. 2.110. 1 2 M + Uniform beam flexural stiffness = El total weight-mg FIGURE 2.110...

Study smarter with the SolutionInn App