Question: John needs $1,000,000 to retire in five years. There is a 5-year annual coupon bond that has a YTM of 14.5% and sells at par

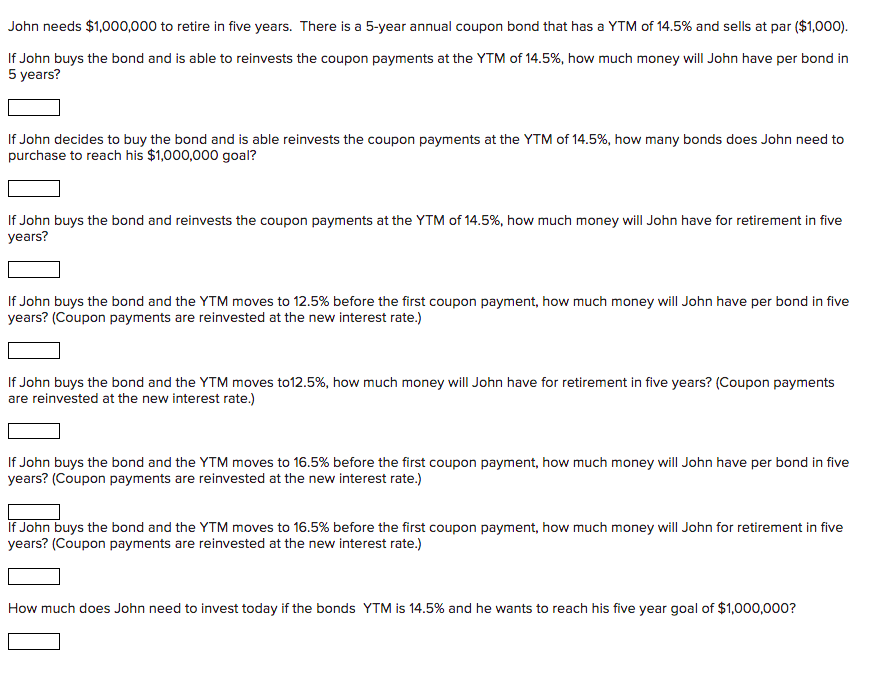

John needs $1,000,000 to retire in five years. There is a 5-year annual coupon bond that has a YTM of 14.5% and sells at par ($1,000). If John buys the bond and is able to reinvests the coupon payments at the YTM of 14.5%, how much money will John have per bond in 5 years? If John decides to buy the bond and is able reinvests the coupon payments at the YTM of 14.5%, how many bonds does John need to purchase to reach his $1,000,000 goal? John buys the bond and reinvests the coupon payments at the YTM of 14.5%, how much money will John have for retirement in five years? If John buys the bond and the YTM moves to 12.5% before the first coupon payment, how much money will John have per bond in five years? (Coupon payments are reinvested at the new interest rate.) If John buys the bond and the YTM moves to 12.5%, how much money will John have for retirement in five years? (Coupon payments are reinvested at the new interest rate.) If John buys the bond and the YTM moves to 16.5% before the first coupon payment, how much money will John have per bond in five years? (Coupon payments are reinvested at the new interest rate.) If John buys the bond and the YTM moves to 16.5% before the first coupon payment, how much money will John for retirement in five years? (Coupon payments are reinvested at the new interest rate.) How much does John need to invest today if the bonds YTM is 14.5% and he wants to reach his five year goal of $1,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts