Question: Joshua has electronically filed returns for several clients. He now has a client who needs to file Form 8 2 8 3 for noncash charitable

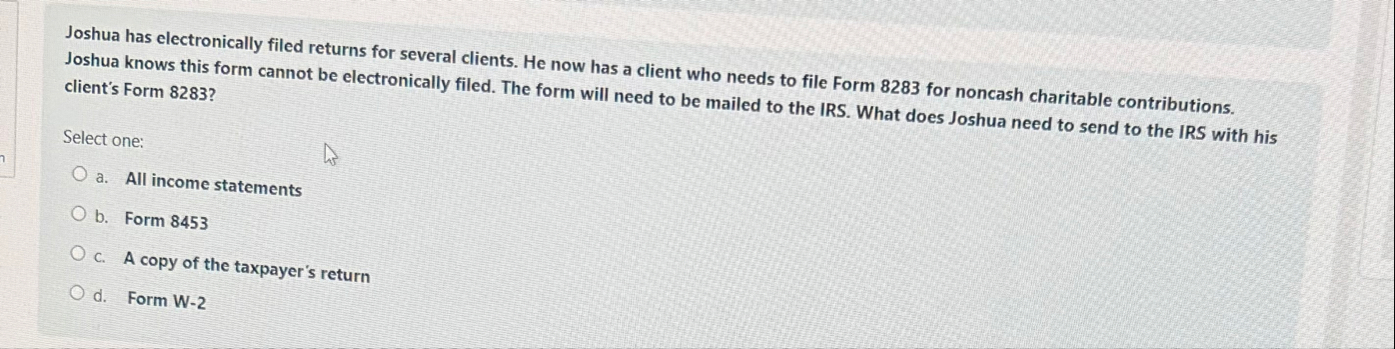

Joshua has electronically filed returns for several clients. He now has a client who needs to file Form for noncash charitable contributions. Joshua knows this form cannot be electronically filed. The form will need to be mailed to the IRS. What does Joshua need to send to the IRS with his client's Form

Select one:

a All income statements

b Form

c A copy of the taxpayer's return

d Form W

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock