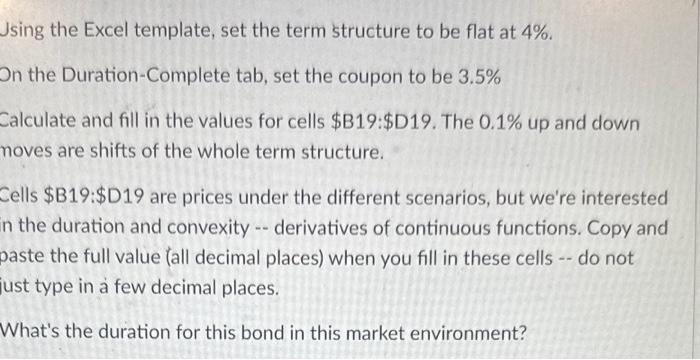

Question: Jsing the Excel template, set the term structure to be flat at 4%. On the Duration-Complete tab, set the coupon to be 3.5% Calculate and

Jsing the Excel template, set the term structure to be flat at 4%. On the Duration-Complete tab, set the coupon to be 3.5% Calculate and fill in the values for cells \$B19:\$D19. The 0.1\% up and down noves are shifts of the whole term structure. Cells \$B19:\$D19 are prices under the different scenarios, but we're interested n the duration and convexity - derivatives of continuous functions. Copy and jaste the full value (all decimal places) when you fill in these cells -. do not ust type in a few decimal places. What's the duration for this bond in this market environment? Jsing the Excel template, set the term structure to be flat at 4%. On the Duration-Complete tab, set the coupon to be 3.5% Calculate and fill in the values for cells \$B19:\$D19. The 0.1\% up and down noves are shifts of the whole term structure. Cells \$B19:\$D19 are prices under the different scenarios, but we're interested n the duration and convexity - derivatives of continuous functions. Copy and jaste the full value (all decimal places) when you fill in these cells -. do not ust type in a few decimal places. What's the duration for this bond in this market environment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts