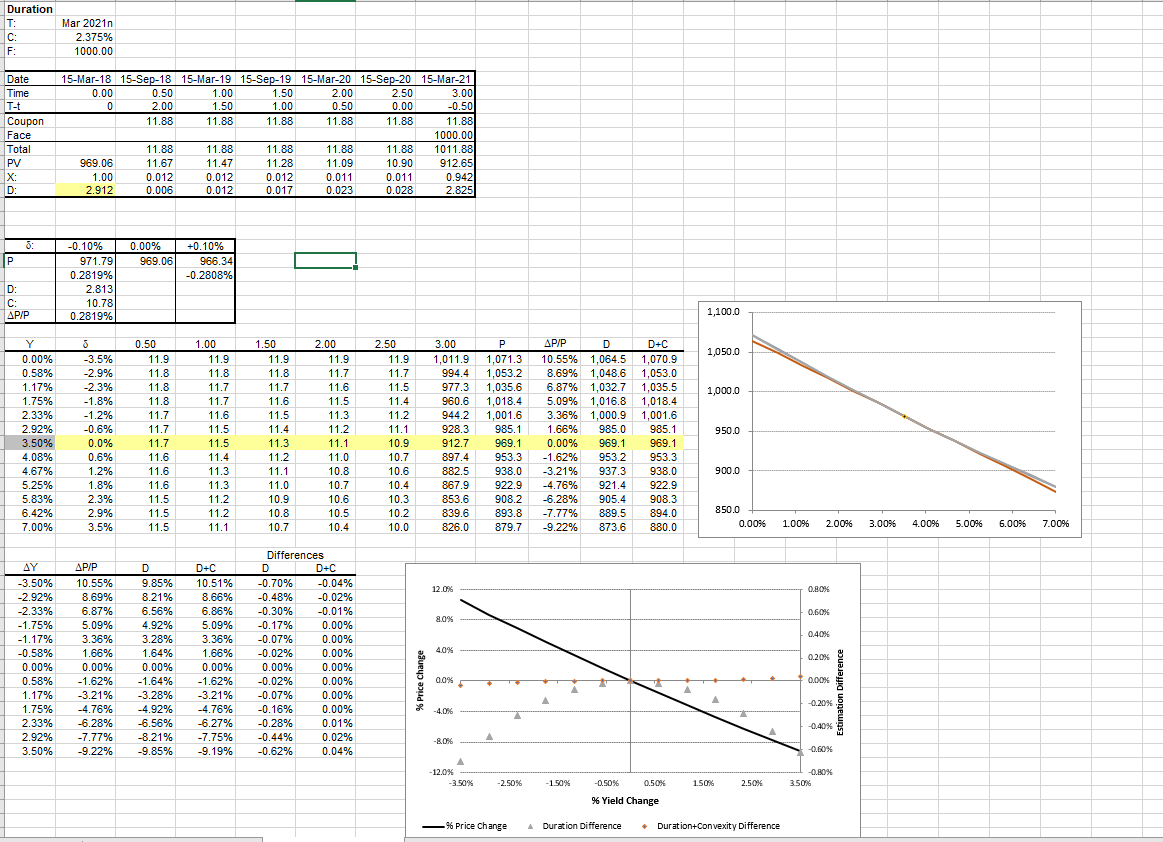

Question: Using the Excel template, set the term structure to be flat at 4%. On the Duration-Complete tab, set the coupon to be 3.5% Calculate and

Using the Excel template, set the term structure to be flat at 4%.

On the Duration-Complete tab, set the coupon to be 3.5%

Calculate and fill in the values for cells $B19:$D19. The 0.1% up and down moves are shifts of the whole term structure.

What's the duration for this bond in this market environment?

Duration T: C: F: Mar 2021n 2.375% 1000.00 Date Time T-t Coupon Face Total PV X: D: : 15-Mar-18 15-Sep-18 15-Mar-19 15-Sep-19 15-Mar-2015-Sep-20 15-Mar-21 0.00 0.50 1.00 1.50 2.00 2.50 3.00 0 2.00 1.50 1.00 0.50 0.00 -0.50 11.88 11.88 11.88 11.88 11.88 11.88 1000.00 11.88 11.88 11.88 11.88 11.88 1011.88 969.06 11.67 11.47 11.28 11.09 10.90 912.65 1.00 0.012 0.012 0.012 0.011 0.011 0.942 2.912 0.006 0.012 0.017 0.023 0.028 2.825 3: 0.00% 969.06 +0.10% 966.34 -0.2808% D: : C: c AP/P -0.10% 971.79 0.2819% 2.813 10.78 0.2819% 1,100.0 Y 1,050.0 1,000.0 950.0 0.00% 0.58% 1.17% 1.75% 2.33% 2.92% 3.50% 4.08% 4.67% 5.25% 5.83% 6.42% 7.00% 0 -3.5% -2.9% -2.3% -1.8% -1.2% -0.6% 0.0% 0.6% 1.2% 1.8% 2.3% 2.9% 3.5% 0.50 11.9 11.8 11.8 11.8 11.7 11.7 11.7 11.6 11.6 11.6 11.5 11.5 11.5 1.00 11.9 11.8 11.7 11.7 11.6 11.5 11.5 11.4 11.3 11.3 11.2 11.2 11.1 1.50 11.9 11.8 11.7 11.6 11.5 11.4 11.3 11.2 11.1 11.0 10.9 10.8 10.7 2.00 11.9 11.7 11.6 11.5 11.3 11.2 11.1 11.0 10.8 10.7 10.6 10.5 10.4 2.50 11.9 11.7 11.5 11.4 11.2 11.1 10.9 10.7 10.6 10.4 10.3 10.2 10.0 3.00 1,011.9 994.4 977.3 960.6 944.2 928.3 912.7 897.4 882.5 867.9 853.6 839.6 826.0 P 1,071.3 1,053.2 1,035.6 1,018.4 1,001.6 985.1 969.1 953.3 938.0 922.9 908.2 893.8 879.7 AP/P D D+C D+ 10.55% 1,064.5 1,070.9 8.69% 1,048.6 1,053.0 6.87% 1,032.7 1,035.5 5.09% 1,016.8 1,018.4 3.36% 1,000.9 1,001.6 1.66% 985.0 985.1 0.00% 969.1 969.1 -1.62% 953.2 953.3 -3.21% 937.3 938.0 -4.76% 921.4 922.9 -6.28% 905.4 908.3 -7.77% 889.5 894.0 -9.22% 873.6 880.0 900.0 850.0 0.0096 1.0096 2.00% 3.0096 4.0096 5.0096 6.0096 7.00% 12.0% 0.80% 0.60% 8.0% 0.40% AY -3.50% -2.92% -2.33% -1.75% - 1.17% -0.58% 0.00% 0.58% 1.17% 1.75% 2.33% 2.92% 3.50% 4.0% AP/P 10.55% 8.69% 6.87% 5.09% 3.36% 1.66% 0.00% -1.62% -3.21% -4.76% -6.28% -7.77% -9.22% D 9.85% 8.21% 6.56% 4.92% 3.28% 1.64% 0.00% -1.64% -3.28% -4.92% -6.56% -8.21% -9.85% Differences D D+C -0.70% -0.04% -0.48% -0.02% -0.30% -0.01% -0.17% 0.00% -0.07% 0.00% -0.02% 0.00% 0.00% 0.00% -0.02% 0.00% -0.07% 0.00% -0.16% 0.00% -0.28% 0.01% -0.44% 0.02% -0.62% 0.04% D+C 10.51% 8.66% 6.86% 5.09% 3.36% 1.66% 0.00% -1.62% -3.21% -4.76% -6.27% -7.75% -9.19% 0.20% 0.0% 0.00% Estimation Difference -0.20% -40% -0.40% -8.0% -0.60% A -12.0% -3.50% -0.80% 3.50% -2.50% -1.50% -0.50% 0.50% 150% 2.50% % Yield Change % Price Change A Duration Difference - Duration+Convexity Difference Duration T: C: F: Mar 2021n 2.375% 1000.00 Date Time T-t Coupon Face Total PV X: D: : 15-Mar-18 15-Sep-18 15-Mar-19 15-Sep-19 15-Mar-2015-Sep-20 15-Mar-21 0.00 0.50 1.00 1.50 2.00 2.50 3.00 0 2.00 1.50 1.00 0.50 0.00 -0.50 11.88 11.88 11.88 11.88 11.88 11.88 1000.00 11.88 11.88 11.88 11.88 11.88 1011.88 969.06 11.67 11.47 11.28 11.09 10.90 912.65 1.00 0.012 0.012 0.012 0.011 0.011 0.942 2.912 0.006 0.012 0.017 0.023 0.028 2.825 3: 0.00% 969.06 +0.10% 966.34 -0.2808% D: : C: c AP/P -0.10% 971.79 0.2819% 2.813 10.78 0.2819% 1,100.0 Y 1,050.0 1,000.0 950.0 0.00% 0.58% 1.17% 1.75% 2.33% 2.92% 3.50% 4.08% 4.67% 5.25% 5.83% 6.42% 7.00% 0 -3.5% -2.9% -2.3% -1.8% -1.2% -0.6% 0.0% 0.6% 1.2% 1.8% 2.3% 2.9% 3.5% 0.50 11.9 11.8 11.8 11.8 11.7 11.7 11.7 11.6 11.6 11.6 11.5 11.5 11.5 1.00 11.9 11.8 11.7 11.7 11.6 11.5 11.5 11.4 11.3 11.3 11.2 11.2 11.1 1.50 11.9 11.8 11.7 11.6 11.5 11.4 11.3 11.2 11.1 11.0 10.9 10.8 10.7 2.00 11.9 11.7 11.6 11.5 11.3 11.2 11.1 11.0 10.8 10.7 10.6 10.5 10.4 2.50 11.9 11.7 11.5 11.4 11.2 11.1 10.9 10.7 10.6 10.4 10.3 10.2 10.0 3.00 1,011.9 994.4 977.3 960.6 944.2 928.3 912.7 897.4 882.5 867.9 853.6 839.6 826.0 P 1,071.3 1,053.2 1,035.6 1,018.4 1,001.6 985.1 969.1 953.3 938.0 922.9 908.2 893.8 879.7 AP/P D D+C D+ 10.55% 1,064.5 1,070.9 8.69% 1,048.6 1,053.0 6.87% 1,032.7 1,035.5 5.09% 1,016.8 1,018.4 3.36% 1,000.9 1,001.6 1.66% 985.0 985.1 0.00% 969.1 969.1 -1.62% 953.2 953.3 -3.21% 937.3 938.0 -4.76% 921.4 922.9 -6.28% 905.4 908.3 -7.77% 889.5 894.0 -9.22% 873.6 880.0 900.0 850.0 0.0096 1.0096 2.00% 3.0096 4.0096 5.0096 6.0096 7.00% 12.0% 0.80% 0.60% 8.0% 0.40% AY -3.50% -2.92% -2.33% -1.75% - 1.17% -0.58% 0.00% 0.58% 1.17% 1.75% 2.33% 2.92% 3.50% 4.0% AP/P 10.55% 8.69% 6.87% 5.09% 3.36% 1.66% 0.00% -1.62% -3.21% -4.76% -6.28% -7.77% -9.22% D 9.85% 8.21% 6.56% 4.92% 3.28% 1.64% 0.00% -1.64% -3.28% -4.92% -6.56% -8.21% -9.85% Differences D D+C -0.70% -0.04% -0.48% -0.02% -0.30% -0.01% -0.17% 0.00% -0.07% 0.00% -0.02% 0.00% 0.00% 0.00% -0.02% 0.00% -0.07% 0.00% -0.16% 0.00% -0.28% 0.01% -0.44% 0.02% -0.62% 0.04% D+C 10.51% 8.66% 6.86% 5.09% 3.36% 1.66% 0.00% -1.62% -3.21% -4.76% -6.27% -7.75% -9.19% 0.20% 0.0% 0.00% Estimation Difference -0.20% -40% -0.40% -8.0% -0.60% A -12.0% -3.50% -0.80% 3.50% -2.50% -1.50% -0.50% 0.50% 150% 2.50% % Yield Change % Price Change A Duration Difference - Duration+Convexity Difference

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts