Question: just answer e and f 6. Calculate the below ratios for 2021/2020 of the company. (DSO) e. Accounts Payable Turnover and Days Payable Outstanding (DPO)

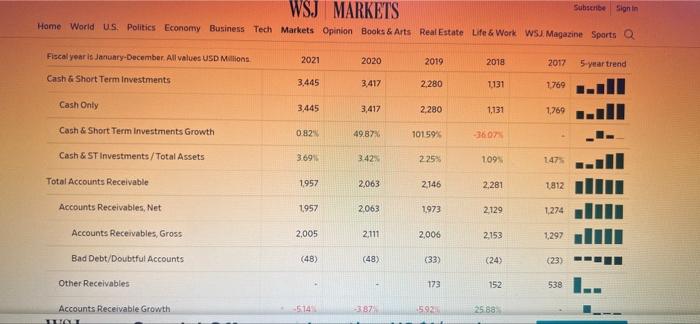

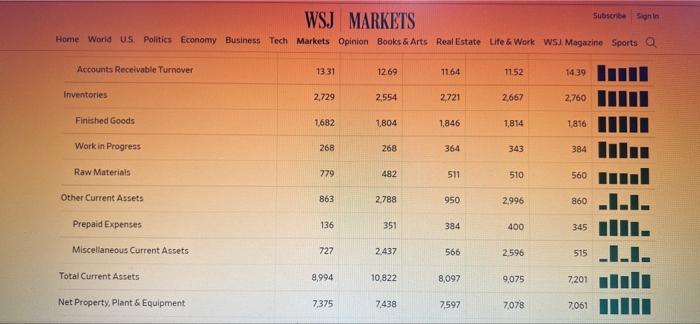

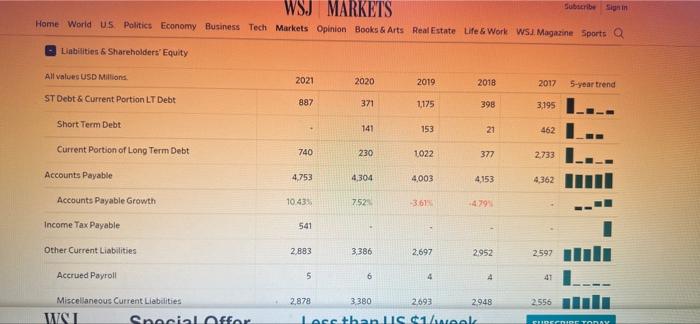

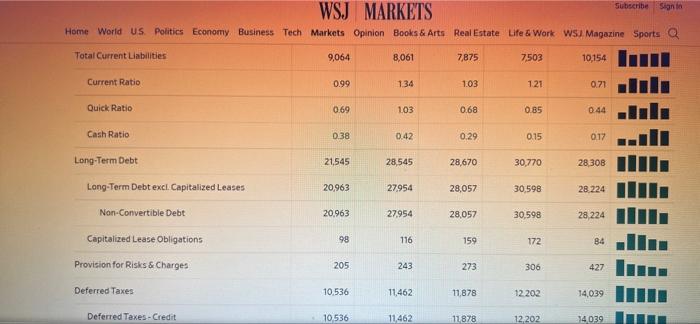

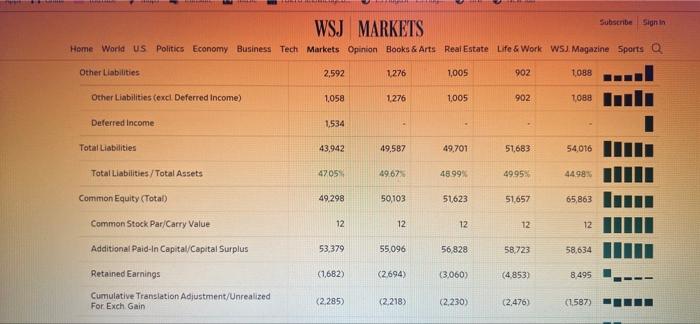

6. Calculate the below ratios for 2021/2020 of the company. (DSO) e. Accounts Payable Turnover and Days Payable Outstanding (DPO) f. Debt Ratio WSJ MARKETS Subscribe Sign In Home World U.S. Politics Economy Business Tech Markets Opinion Books & Arts Real Estate Life & Work WSJ Magazine Sports Q Fiscal year is January-December. All values USD Millions 2021 2020 2019 2018 2017 5-year trend Cash & Short Term Investments 3,445 3,417 1,131 1,769 Cash Only 3,445 3,417 1,131 1,769 Cash & Short Term Investments Growth 0.82% 49.87% -36.07% Cash & ST Investments/Total Assets 3.69% 3.42% 1.09% 147% Total Accounts Receivable 1,957 2,063 2,281 1812 1,957 2,063 2,129 1,274 2,005 2,111 2,153 1,297 (48) (48) (24) (23) 152 538 Accounts Receivables, Net Accounts Receivables, Gross Bad Debt/Doubtful Accounts Other Receivables Accounts Receivable Growth THOI -514 -3.87 2,280 2,280 101.59% 2:25% 2,146 1,973 2,006 (33) 173 5.92 25.88 Subscribe Sign In WSJ MARKETS Home World U.S. Politics Economy Business Tech Markets Opinion Books & Arts Real Estate Life & Work WSJ Magazine Sports Q Accounts Receivable Turnover 13.31 12.69 11.64 11.52 14.39 2,729 2,554 2,721 2,667 2,760 Finished Goods 1,682 1,804 1,814 1,816 Work in Progress 268 268 343 Raw Materials 779 482 510 Other Current Assets 863 2,788 2,996 Prepaid Expenses 136 351 400 Miscellaneous Current Assets 2,437 2.596 Total Current Assets 10,822 9,075 Net Property, Plant & Equipment 7,438 7,078 Inventories 727 8,994 7,375 1,846 364 511 950 384 566 8,097 7,597 384 560 860 345 515 7,201 7,061 1100 STRESAGARRIAK Home World U.S. Politics Economy Business Tech Markets Opinion Books & Arts Real Estate Life & Work WSJ. Magazine Sports Property, Plant & Equipment - Gross 11,243 11,001 10,784 9,662 9,150 Buildings 2,508 2,514 2,447 2,375 2,232 Land & Improvements 207 210 218 250 Construction in Progress 1,002 792 1,033 1,165 1,345 Other Property, Plant & Equipment 6,957 6,914 6,552 5,904 5,323 Accumulated Depreciation 3,868 3,563 3,187 2,584 2,089 Total Investments and Advances 182 300 201 144 363 Other Long-Term Investments 182 300 201 144 363 74,838 79,756 84,198 85,971 104,257 31,296 33,089 35,546 36,503 44,825 Intangible Assets Net Goodwill Subscribe Sign in WSJ MARKETS Home World U.S. Politics Economy Business Tech Markets Opinion Books & Arts Real Estate Life & Work WSJ Magazine Sports Q Liabilities & Shareholders' Equity All values USD Millions 2021 2020 2019 2018 2017 5-year trend ST Debt & Current Portion LT Debt 887 371 1,175 398 3,195 Short Term Debt 141 153 21 462 Current Portion of Long Term Debt 740 230 1022 377 2,733 Accounts Payable 4,753 4,304 4,003 4,153 4,362 Accounts Payable Growth 10.43% 7.52% -3.61% -4.79% 541 2,883 3,386 2,697 2.952 2,597 5 6 4 41 2,878 3:380 2693 2948 2.556 Less than US $1/week SURGERIDE TODAY Income Tax Payable Other Current Liabilities Accrued Payroll Miscellaneous Current Liabilities WSI Special Offer Subscribe Sign in WSJ MARKETS Home World U.S. Politics Economy Business Tech Markets Opinion Books & Arts Real Estate Life & Work WSJ Magazine Sports Q Total Current Liabilities 9,064 8,061 7,875 7,503 10.154 Current Ratio 0.99 1.34 1.03 1.21 0.71 Quick Ratio 0.69 1.03 0.68 0.85 0.44 Cash Ratio 0.38 0.42 0.29 0.15 0.17 Long-Term Debt 21,545 28,545 28,670 30,770 28,308 Long-Term Debt excl. Capitalized Leases 20,963 27,954 28,057 30,598 28,224 Non-Convertible Debt 20,963 27,954 28,057 30,598 28,224 Capitalized Lease Obligations 98 116 159 172 84 205 243 273 306 427 10,536 11,462 11,878 12.202 14,039 10,536 11,462 11878 12,202 14,039 Provision for Risks & Charges Deferred Taxes Deferred Taxes-Credit [*** AMMAN Subscribe Sign In WSJ MARKETS Home World US Politics Economy Business Tech Markets Opinion Books & Arts Real Estate Life & Work WSJ. Magazine Sports Q Other Liabilities 2,592 1,276 1,005 902 1,088 Other Liabilities (excl. Deferred Income) 1,058 1,276 1,005 902 1,088 Deferred Income 1,534 43,942 49,587 49,701 51,683 54,016 Total Liabilities/Total Assets 4705% 49.67% 45.99% 49.95% 44.98% Common Equity (Total) 49,298 50,103 51,623 51,657 65,863 Common Stock Par/Carry Value 12 12 12 12 12 Additional Paid-In Capital/Capital Surplus 53,379 55,096 56,828 58,723 58,634 Retained Earnings (1,682) (2.694) (3,060) (4,853) 8,495 Cumulative Translation Adjustment/Unrealized (2,285) (2,218) (2,230) (2,476) For Exch Gain (1,587) Total Liabilities 6. Calculate the below ratios for 2021/2020 of the company. (DSO) e. Accounts Payable Turnover and Days Payable Outstanding (DPO) f. Debt Ratio WSJ MARKETS Subscribe Sign In Home World U.S. Politics Economy Business Tech Markets Opinion Books & Arts Real Estate Life & Work WSJ Magazine Sports Q Fiscal year is January-December. All values USD Millions 2021 2020 2019 2018 2017 5-year trend Cash & Short Term Investments 3,445 3,417 1,131 1,769 Cash Only 3,445 3,417 1,131 1,769 Cash & Short Term Investments Growth 0.82% 49.87% -36.07% Cash & ST Investments/Total Assets 3.69% 3.42% 1.09% 147% Total Accounts Receivable 1,957 2,063 2,281 1812 1,957 2,063 2,129 1,274 2,005 2,111 2,153 1,297 (48) (48) (24) (23) 152 538 Accounts Receivables, Net Accounts Receivables, Gross Bad Debt/Doubtful Accounts Other Receivables Accounts Receivable Growth THOI -514 -3.87 2,280 2,280 101.59% 2:25% 2,146 1,973 2,006 (33) 173 5.92 25.88 Subscribe Sign In WSJ MARKETS Home World U.S. Politics Economy Business Tech Markets Opinion Books & Arts Real Estate Life & Work WSJ Magazine Sports Q Accounts Receivable Turnover 13.31 12.69 11.64 11.52 14.39 2,729 2,554 2,721 2,667 2,760 Finished Goods 1,682 1,804 1,814 1,816 Work in Progress 268 268 343 Raw Materials 779 482 510 Other Current Assets 863 2,788 2,996 Prepaid Expenses 136 351 400 Miscellaneous Current Assets 2,437 2.596 Total Current Assets 10,822 9,075 Net Property, Plant & Equipment 7,438 7,078 Inventories 727 8,994 7,375 1,846 364 511 950 384 566 8,097 7,597 384 560 860 345 515 7,201 7,061 1100 STRESAGARRIAK Home World U.S. Politics Economy Business Tech Markets Opinion Books & Arts Real Estate Life & Work WSJ. Magazine Sports Property, Plant & Equipment - Gross 11,243 11,001 10,784 9,662 9,150 Buildings 2,508 2,514 2,447 2,375 2,232 Land & Improvements 207 210 218 250 Construction in Progress 1,002 792 1,033 1,165 1,345 Other Property, Plant & Equipment 6,957 6,914 6,552 5,904 5,323 Accumulated Depreciation 3,868 3,563 3,187 2,584 2,089 Total Investments and Advances 182 300 201 144 363 Other Long-Term Investments 182 300 201 144 363 74,838 79,756 84,198 85,971 104,257 31,296 33,089 35,546 36,503 44,825 Intangible Assets Net Goodwill Subscribe Sign in WSJ MARKETS Home World U.S. Politics Economy Business Tech Markets Opinion Books & Arts Real Estate Life & Work WSJ Magazine Sports Q Liabilities & Shareholders' Equity All values USD Millions 2021 2020 2019 2018 2017 5-year trend ST Debt & Current Portion LT Debt 887 371 1,175 398 3,195 Short Term Debt 141 153 21 462 Current Portion of Long Term Debt 740 230 1022 377 2,733 Accounts Payable 4,753 4,304 4,003 4,153 4,362 Accounts Payable Growth 10.43% 7.52% -3.61% -4.79% 541 2,883 3,386 2,697 2.952 2,597 5 6 4 41 2,878 3:380 2693 2948 2.556 Less than US $1/week SURGERIDE TODAY Income Tax Payable Other Current Liabilities Accrued Payroll Miscellaneous Current Liabilities WSI Special Offer Subscribe Sign in WSJ MARKETS Home World U.S. Politics Economy Business Tech Markets Opinion Books & Arts Real Estate Life & Work WSJ Magazine Sports Q Total Current Liabilities 9,064 8,061 7,875 7,503 10.154 Current Ratio 0.99 1.34 1.03 1.21 0.71 Quick Ratio 0.69 1.03 0.68 0.85 0.44 Cash Ratio 0.38 0.42 0.29 0.15 0.17 Long-Term Debt 21,545 28,545 28,670 30,770 28,308 Long-Term Debt excl. Capitalized Leases 20,963 27,954 28,057 30,598 28,224 Non-Convertible Debt 20,963 27,954 28,057 30,598 28,224 Capitalized Lease Obligations 98 116 159 172 84 205 243 273 306 427 10,536 11,462 11,878 12.202 14,039 10,536 11,462 11878 12,202 14,039 Provision for Risks & Charges Deferred Taxes Deferred Taxes-Credit [*** AMMAN Subscribe Sign In WSJ MARKETS Home World US Politics Economy Business Tech Markets Opinion Books & Arts Real Estate Life & Work WSJ. Magazine Sports Q Other Liabilities 2,592 1,276 1,005 902 1,088 Other Liabilities (excl. Deferred Income) 1,058 1,276 1,005 902 1,088 Deferred Income 1,534 43,942 49,587 49,701 51,683 54,016 Total Liabilities/Total Assets 4705% 49.67% 45.99% 49.95% 44.98% Common Equity (Total) 49,298 50,103 51,623 51,657 65,863 Common Stock Par/Carry Value 12 12 12 12 12 Additional Paid-In Capital/Capital Surplus 53,379 55,096 56,828 58,723 58,634 Retained Earnings (1,682) (2.694) (3,060) (4,853) 8,495 Cumulative Translation Adjustment/Unrealized (2,285) (2,218) (2,230) (2,476) For Exch Gain (1,587) Total Liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts