Question: Just complete first student ID # While you were visiting London, you purchased a Tesla Model S for Input1, payable in three months. You have

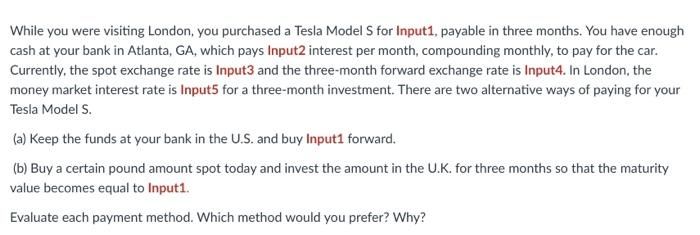

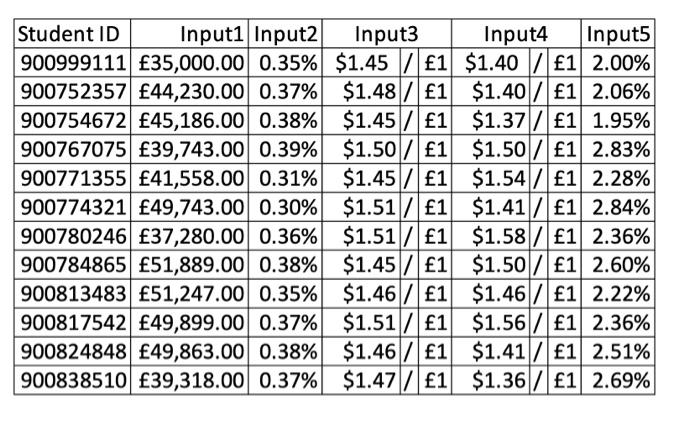

While you were visiting London, you purchased a Tesla Model S for Input1, payable in three months. You have enough cash at your bank in Atlanta, GA, which pays Input2 interest per month, compounding monthly, to pay for the car. Currently, the spot exchange rate is Input3 and the three-month forward exchange rate is Input4. In London, the money market interest rate is Input 5 for a three-month investment. There are two alternative ways of paying for your Tesla Model S. (a) Keep the funds at your bank in the U.S. and buy Input1 forward. (b) Buy a certain pound amount spot today and invest the amount in the U.K. for three months so that the maturity value becomes equal to Input1. Evaluate each payment method. Which method would you prefer? Why? \begin{tabular}{|l|r|r|c|c|c|c|c|c|c|} \hline Student ID & Input1 & Input2 & \multicolumn{2}{|c|}{ Input3 } & \multicolumn{2}{|c|}{ Input4 } & Input5 \\ \hline 900999111 & 35,000.00 & 0.35% & $1.45 & / & 1 & $1.40 & / & 1 & 2.00% \\ \hline 900752357 & 44,230.00 & 0.37% & $1.48 & / & 1 & $1.40 & / & 1 & 2.06% \\ \hline 900754672 & 45,186.00 & 0.38% & $1.45 & / & 1 & $1.37 & / & 1 & 1.95% \\ \hline 900767075 & 39,743.00 & 0.39% & $1.50 & / & 1 & $1.50 & / & 1 & 2.83% \\ \hline 900771355 & 41,558.00 & 0.31% & $1.45 & / & 1 & $1.54 & / & 1 & 2.28% \\ \hline 900774321 & 49,743.00 & 0.30% & $1.51 & / & 1 & $1.41 & / & 1 & 2.84% \\ \hline 900780246 & 37,280.00 & 0.36% & $1.51 & / & 1 & $1.58 & / & 1 & 2.36% \\ \hline 900784865 & 51,889.00 & 0.38% & $1.45 & / & 1 & $1.50 & / & 1 & 2.60% \\ \hline 900813483 & 51,247.00 & 0.35% & $1.46 & / & 1 & $1.46 & / & 1 & 2.22% \\ \hline 900817542 & 49,899.00 & 0.37% & $1.51 & / & 1 & $1.56 & / & 1 & 2.36% \\ \hline 900824848 & 49,863.00 & 0.38% & $1.46 & / & 1 & $1.41 & / & 1 & 2.51% \\ \hline 900838510 & 39,318.00 & 0.37% & $1.47 & / & 1 & $1.36 & / & 1 & 2.69% \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts