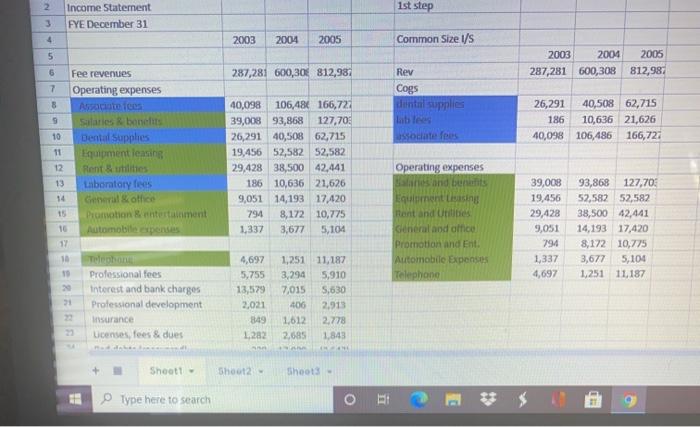

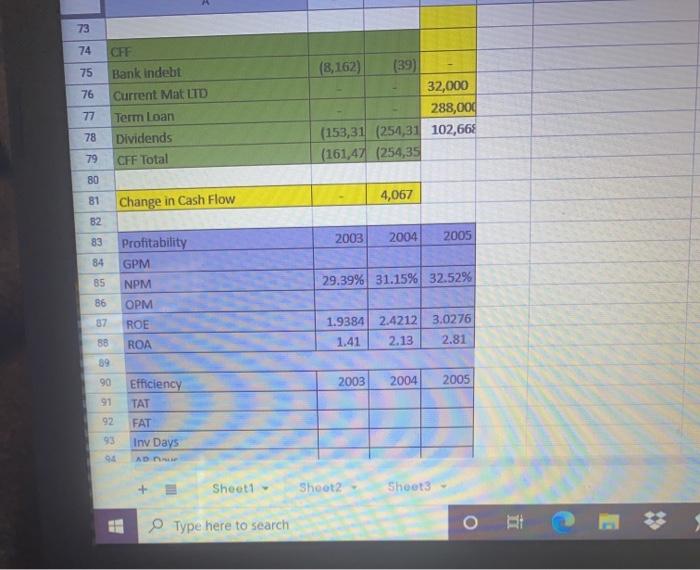

Question: just need analysis completedd 2 1st step Income Statement FYE December 31 3 4 2003 2004 2005 Common Size I/S 2003 2004 2005 287,281 600,308

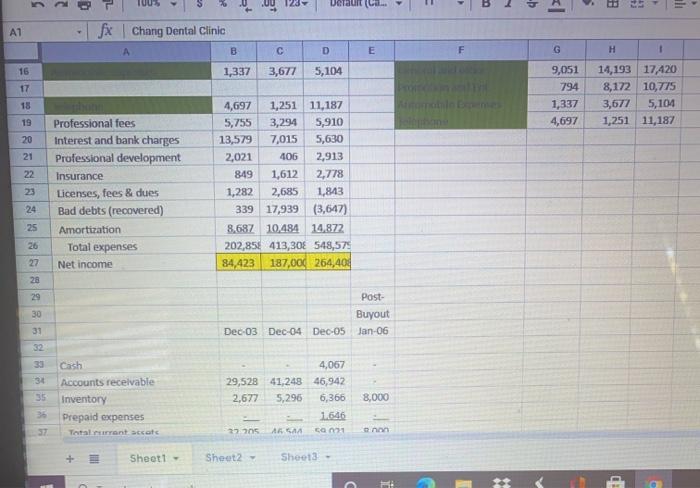

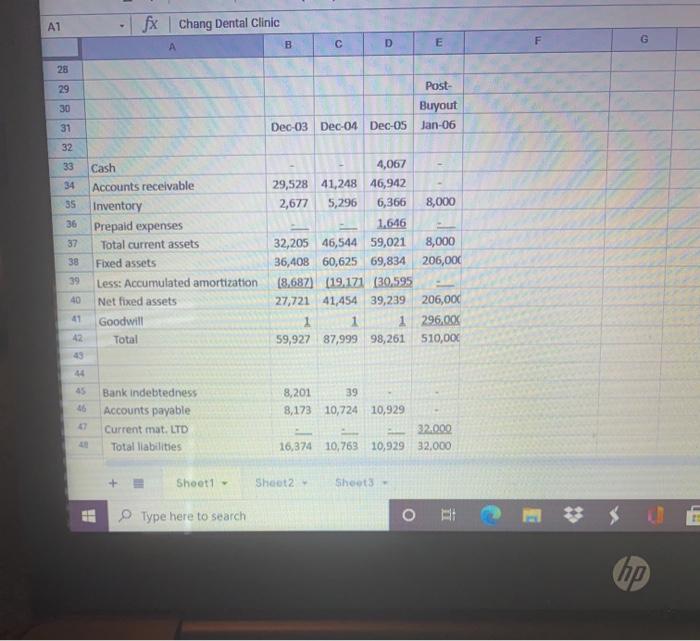

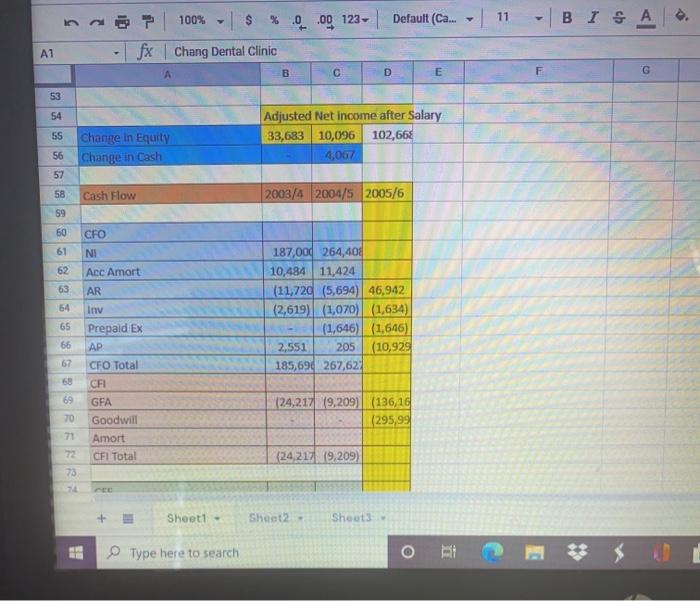

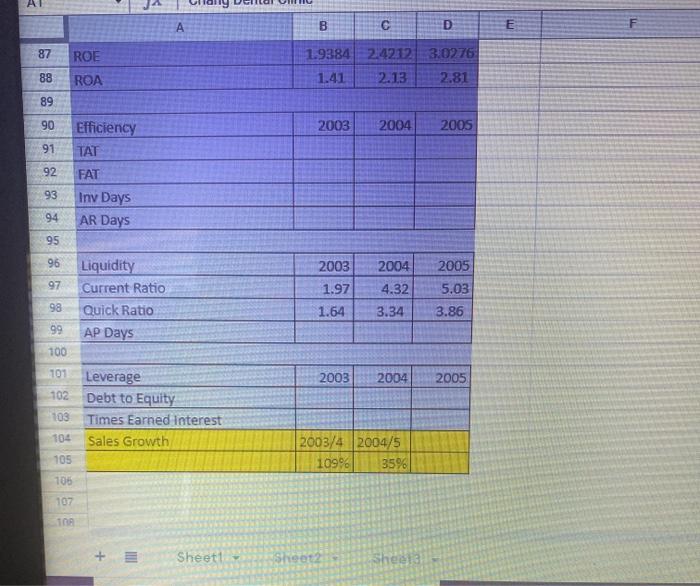

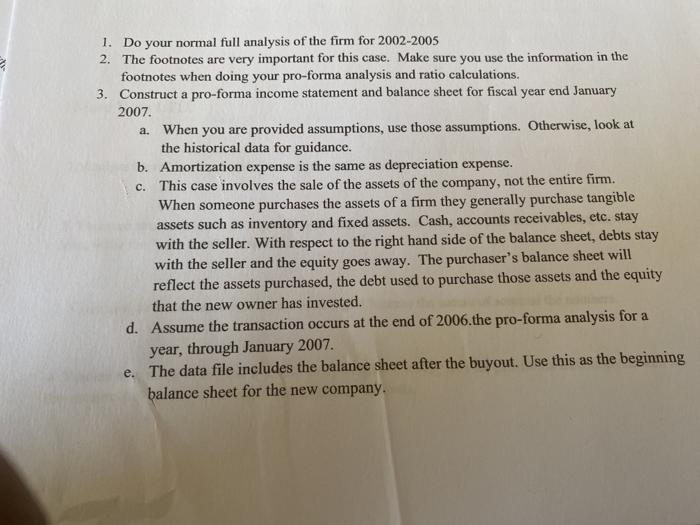

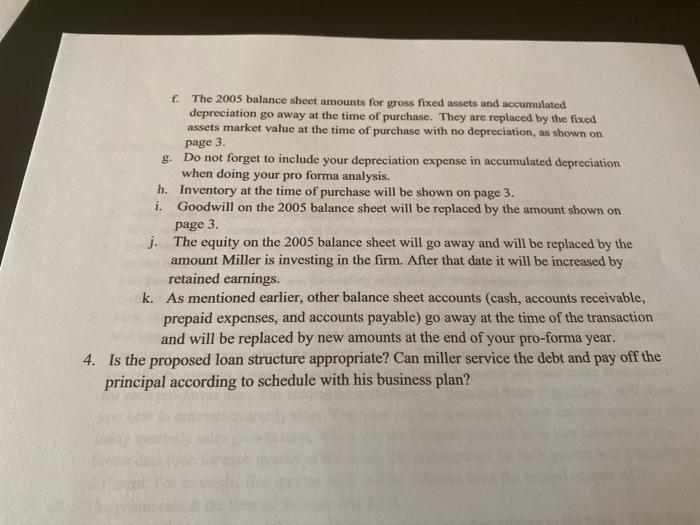

2 1st step Income Statement FYE December 31 3 4 2003 2004 2005 Common Size I/S 2003 2004 2005 287,281 600,308 812,987 287,281 600,30 812,987 Rev Cogs dental supplies 26,291 40,508 62,715 186 10,636 21,626 40,098 106,486 166,727 associate fees 5 6 Fee revenues 7 Operating expenses 8 Associates 9 Salaries benefits 10 Dental Supplies 11 Equipment leasing 12 Rent & utilities 13 Laboratory fees 14 General other 15 Promotion entertainment Automobile penses 17 10 Telephone Professional fees Interest and bank charges 21 Professional development insurance Licenses, fees & dues 40,098 106,48 166,722 39,008 93,868 127,70 26,291 40,508 62,715 19,456 52,582 52,582 29.428 38,500 42,441 186 10,636 21,626 9,051 14,193 17,420 794 8,172 10,775 1,337 3,677 5,104 Operating expenses and bent Equipment tising ment and Utilities General and office Promotion and Ent Automobile Expenses Telephone 39,008 19,456 29,428 9,051 794 1,337 4,697 93,868 127.70 52,582 52,582 38,500 42,441 14,193 17,420 8,172 10,775 3,677 5,104 1,251 11.187 4,697 5,755 13,579 2 1,251 11,187 3,294 5,910 7,015 5,630 400 2,913 1,612 2,778 2.685 1,843 2,021 849 1282 Shooti Shoot2 Shoot Type here to search o HE = 0 2 Ueraut -- A1 fx Chang Dental Clinic B D E G H 1 16 1,337 3,677 5,104 17 9,051 794 1,337 4,697 14,193 17,420 8,172 10,775 3,677 5,104 1,251 11,187 18 19 20 21 Professional fees Interest and bank charges Professional development Insurance Licenses, fees & dues Bad debts (recovered) Amortization Total expenses Net income NR 9 4,697 1,251 11,187 5,755 3,294 5,910 13,579 7,015 5,630 2,021 406 2,913 849 1,612 2,778 1,282 2,685 1,843 339 17,939 (3,647) 8,687 10,484 14.872 202,854 413,30 548,575 84,423 187,000 264,404 24 25 26 27 29 30 31 Post- Buyout Dec 03 Dec 04 Dec 05 Jan-06 32 34 35 Cash Accounts receivable Inventory Prepaid expenses Totalent accots 4,067 29,528 41,248 46,942 2,677 5,296 6,366 8,000 1.646 ca 22205 AR SAA Sheet1 - Sheet2 - Shoot d A1 Chang Dental Clinic A B G D E 28 29 Post- 30 31 Buyout Dec 03 Dec 04 Dec 05 Jan-06 32 33 34 35 36 37 Cash Accounts receivable Inventory Prepaid expenses Total current assets Fixed assets Less: Accumulated amortization Net fixed assets Goodwill Total 4,067 29,528 41,248 46,942 2,677 5,296 6,366 8,000 1.646 32,205 46,544 59,021 8,000 36,408 60,625 69,834 206,000 (8.687) (19.171 (30.595 27,721 41,454 39,239 206,000 1 296,000 59,927 87,999 98,261 510,000 38 39 40 41 42 49 45 46 Bank indebtedness Accounts payable Current mat. LTD Total liabilities 8,201 39 8,173 10,724 10,929 32.000 16,374 10,763 10,929 32.000 Sheet1 Shoot2 Sheet3 - Type here to search mo 100% -B IS AS $ % 0 .00 123- | Default (Ca... - 11 Chang Dental Clinic A1 fx B D E 53 54 55 change in Equity Change in Cash Adjusted Net Income after Salary 33,683 10,096 102,668 4,067 56 57 58 Cash Flow 2003/4 2004/5 2005/6 59 60 61 62 63 64 187,000 264,408 10,484 11,424 (11,720 (5,694) 46,942 (2,619) (1,070) (1,634) (1,646) (1.646) 2,551 205 (10,929 185,69 267,62 65 CFO NI Acc Amort AR Inv Prepaid Ex AP CFO Total CFI GFA Goodwill Amort CFI Total 66 67 68 69 70 (24,217 19,209) (136,16 (295,99 71 72 73 (2421719,209) Shoot - Sheet2 Shout Type here to search 73 74 75 76 CFF Bank indebt Current Mat LTD Term Loan Dividends CFF Total 77 (8,162) (39) 32,000 288,000 (153,31 (254,31 102,66% (161,47 (254,35 78 79 80 81 4,067 Change in Cash Flow 82 83 2003 2004 2005 84 Profitability GPM NPM OPM 85 29.39% 31.15% 32.52% 86 37 ROE 1.93841 2.4212 1.41 2.13 3.0276 2.81 88 ROA 89 90 2003 2004 2005 Efficiency TAT 91 92 FAT 93 04 Inv Days Aprise Sheet1 Shoot2 Shoot3 Type here to search o A B D E 87 ROE ROA 1.938424212 3.0276 1.41 2.13 2.81 88 89 90 2003 2004 2005 91 92 Efficiency TAT FAT Iny Days AR Days 93 94 95 96 97 Liquidity Current Ratio Quick Ratio AP Days 2003 1.97 1.64 2004 4.32 3.34 2005 5.03 3.86 98 99 100 2003 2004 2005 101 Leverage 102 Debt to Equity 103 Times Earned Interest 104 Sales Growth 105 2003/4 2004/5 10996 3596 105 107 TOA Sheett Sheet Sheet 1. Do your normal full analysis of the firm for 2002-2005 2. The footnotes are very important for this case. Make sure you use the information in the footnotes when doing your pro-forma analysis and ratio calculations. 3. Construct a pro-forma income statement and balance sheet for fiscal year end January 2007. a. When you are provided assumptions, use those assumptions. Otherwise, look at the historical data for guidance. b. Amortization expense is the same as depreciation expense. c. This case involves the sale of the assets of the company, not the entire firm. When someone purchases the assets of a firm they generally purchase tangible assets such as inventory and fixed assets. Cash, accounts receivables, etc. stay with the seller. With respect to the right hand side of the balance sheet, debts stay with the seller and the equity goes away. The purchaser's balance sheet will reflect the assets purchased, the debt used to purchase those assets and the equity that the new owner has invested. d. Assume the transaction occurs at the end of 2006 the pro-forma analysis for a year, through January 2007. e. The data file includes the balance sheet after the buyout. Use this as the beginning balance sheet for the new company. f. The 2005 balance sheet amounts for gross fixed assets and accumulated depreciation go away at the time of purchase. They are replaced by the fixed assets market value at the time of purchase with no depreciation, as shown on page 3 g. Do not forget to include your depreciation expense in accumulated depreciation when doing your pro forma analysis. h. Inventory at the time of purchase will be shown on page 3. i. Goodwill on the 2005 balance sheet will be replaced by the amount shown on page 3 j. The equity on the 2005 balance sheet will go away and will be replaced by the amount Miller is investing in the firm. After that date it will be increased by retained earnings. k. As mentioned earlier, other balance sheet accounts (cash, accounts receivable, prepaid expenses, and accounts payable) go away at the time of the transaction and will be replaced by new amounts at the end of your pro-forma year. 4. Is the proposed loan structure appropriate? Can miller service the debt and pay off the principal according to schedule with his business plan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts