Question: just question 3 Na Spacing Heading 1 Heading 2 Title QUESTION 1 Selected accounts of Amanda's Rental Service unadjusted trial balance as of 30 June

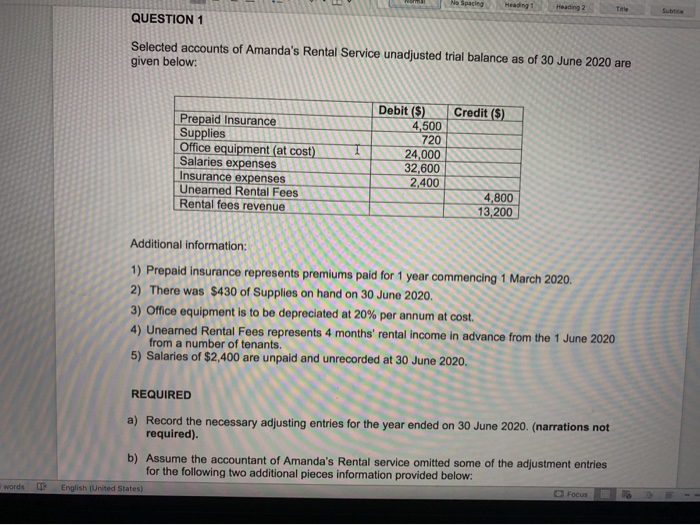

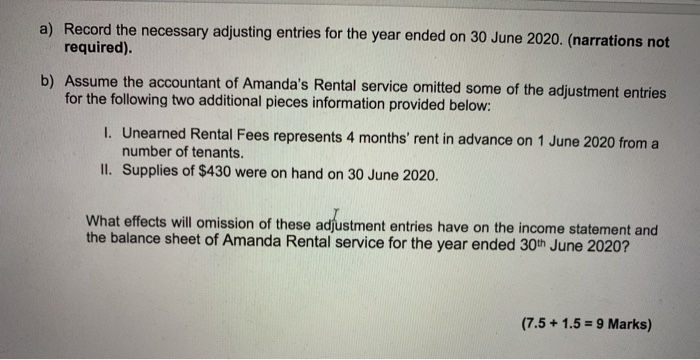

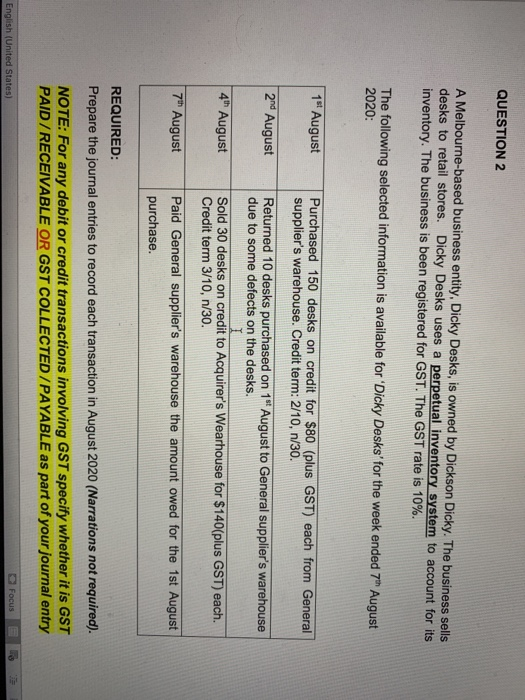

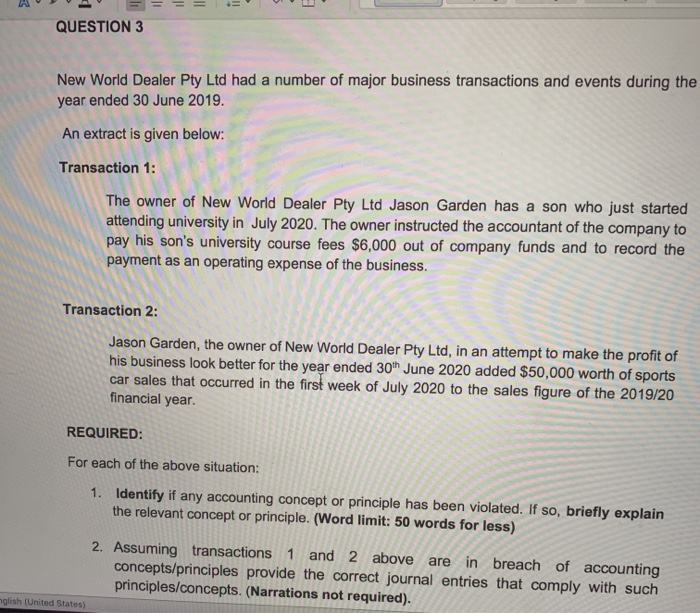

Na Spacing Heading 1 Heading 2 Title QUESTION 1 Selected accounts of Amanda's Rental Service unadjusted trial balance as of 30 June 2020 are given below: Credit ($) Prepaid Insurance Supplies Office equipment (at cost) Salaries expenses Insurance expenses Uneared Rental Fees Rental fees revenue Debit ($) 4,500 720 24,000 32,600 2,400 4,800 13,200 Additional information: 1) Prepaid insurance represents premiums paid for 1 year commencing 1 March 2020. 2) There was $430 of Supplies on hand on 30 June 2020. 3) Office equipment is to be depreciated at 20% per annum at cost. 4) Unearned Rental Fees represents 4 months' rental income in advance from the 1 June 2020 from a number of tenants. 5) Salaries of $2,400 are unpaid and unrecorded at 30 June 2020. REQUIRED a) Record the necessary adjusting entries for the year ended on 30 June 2020. (narrations not required). b) Assume the accountant of Amanda's Rental service omitted some of the adjustment entries for the following two additional pieces information provided below: English (United States) words Focus a) Record the necessary adjusting entries for the year ended on 30 June 2020. (narrations not required). b) Assume the accountant of Amanda's Rental service omitted some of the adjustment entries for the following two additional pieces information provided below: 1. Unearned Rental Fees represents 4 months' rent in advance on 1 June 2020 from a number of tenants. II. Supplies of $430 were on hand on 30 June 2020. What effects will omission of these adjustment entries have on the income statement and the balance sheet of Amanda Rental service for the year ended 30th June 2020? (7.5 +1.5 = 9 Marks) QUESTION 2 A Melbourne-based business entity, Dicky Desks, is owned by Dickson Dicky. The business sells desks to retail stores. Dicky Desks uses a perpetual inventory system to account for its inventory. The business is been registered for GST. The GST rate is 10%. The following selected information is available for 'Dicky Desks' for the week ended 7th August 2020: 1st August Purchased 150 desks on credit for $80 (plus GST) each from General supplier's warehouse. Credit term: 2/10, n/30. 2nd August Returned 10 desks purchased on 1st August to General supplier's warehouse due to some defects on the desks. I Sold 30 desks on credit to Acquirer's Wearhouse for $140(plus GST) each. Credit term 3/10, n/30. 4th August 7h August Paid General supplier's warehouse the amount owed for the 1st August purchase. REQUIRED: Prepare the journal entries to record each transaction in August 2020 (Narrations not required). NOTE: For any debit or credit transactions involving GST specify whether it is GST PAID/RECEIVABLE OR GST COLLECTED/PAYABLE as part of your journal entry English (United States) Focus = += QUESTION 3 New World Dealer Pty Ltd had a number of major business transactions and events during the year ended 30 June 2019. An extract is given below: Transaction 1: The owner of New World Dealer Pty Ltd Jason Garden has a son who just started attending university in July 2020. The owner instructed the accountant of the company to pay his son's university course fees $6,000 out of company funds and to record the payment as an operating expense of the business. Transaction 2: Jason Garden, the owner of New World Dealer Pty Ltd, in an attempt to make the profit of his business look better for the year ended 30th June 2020 added $50,000 worth of sports car sales that occurred in the first week of July 2020 to the sales figure of the 2019/20 financial year. REQUIRED: For each of the above situation: 1. Identify if any accounting concept or principle has been violated. If so, briefly explain the relevant concept or principle. (Word limit: 50 words for less) 2. Assuming transactions 1 and 2 above are in breach of accounting concepts/principles provide the correct journal entries that comply with such principles/concepts. (Narrations not required). nglish (United States)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts