Question: Just the final answer ASAP please Use the data below for Questions 18, 19 and 20: Five alteratives (A, B, C, D and E) are

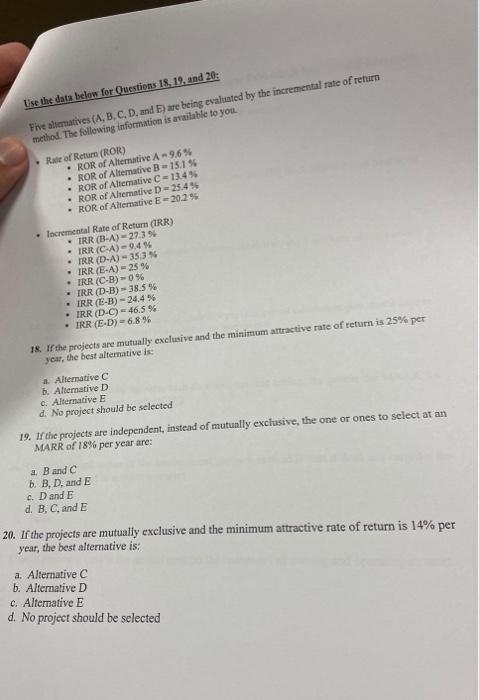

Use the data below for Questions 18, 19 and 20: Five alteratives (A, B, C, D and E) are being evaluated by the incremental rate of return method. The following information is available to you Rate of Return (ROR) ROR of Alternative A-9,6% ROR of Alternative B-15.15 . ROR of Alterative C-13.4% ROR of Alternative De 25.4 ROR of Alternative E-20.2% Incremental Rate of Return (IRR) - TRR (B-A)-27.3 % IRR (CA) 9.4% IRR (D-A) - 353 % IRR (E-A) -25% IRR (C-B)=0% IRR (D-B) - 38.5% IRR (E-B) - 24.4% IRR (D-C) = 46.5 96 IRR (E-D) -6.896 18. If the projects are mutually exclusive and the minimum attractive rate of return is 25% per year, the best alternative is a Alternative C b. Alternative D c. Alternative E No project should be selected 19. If the projects are independent, instead of mutually exclusive, the one or ones to select at an MARR of 18% per year are: a. Bandc b. B, D, and E c. D and E d. B, C and E 20. If the projects are mutually exclusive and the minimum attractive rate of return is 14% per year, the best alternative is: a. Alternative C b. Alternative D c. Alternative E d. No project should be selected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts