Question: Kd=5.4% Kp=15% Ke=18.6% Please explain the answer step by steps. Thank you! Using the balance sheet provided for Universal Exports, determine the weighted- average cost

Kd=5.4% Kp=15% Ke=18.6%

Please explain the answer step by steps. Thank you!

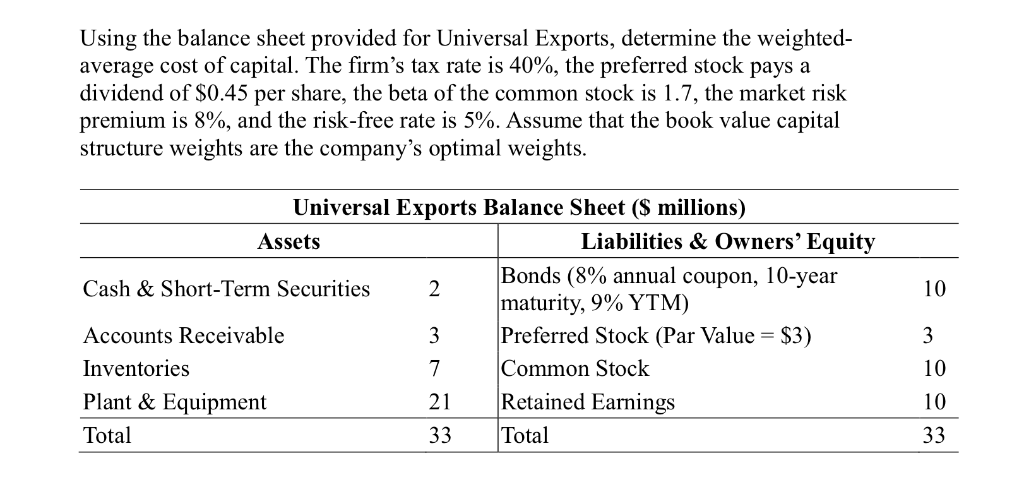

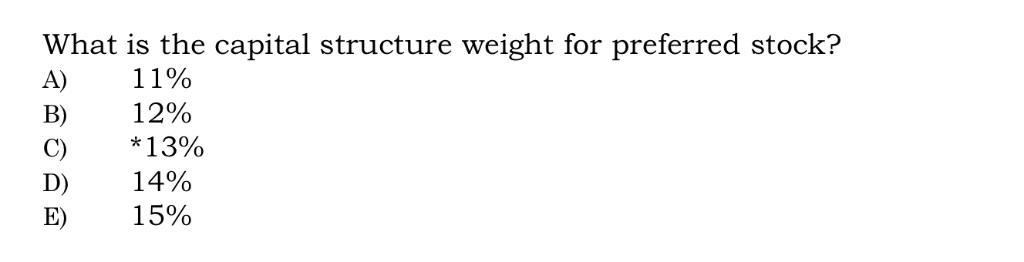

Using the balance sheet provided for Universal Exports, determine the weighted- average cost of capital. The firm's tax rate is 40%, the preferred stock pays a dividend of S0.45 per share, the beta of the common stock is 1.7, the market risk premium is 8%, and the risk-free rate is 5%. Assume that the book value capital structure weights are the company's optimal weights. Universal Exports Assets Balance Sheet (S millions) Liabilities & Owners' Equity Cash & Short-Term Securities 2 Accounts Receivable Inventories Plant & Equipment Total Bonds (8% annual coupon, 10-year maturity, 9% YTM) 3 Preferred Stock (Par Value $3) Common Stock 10 10 10 21 Retained Earnings 33 Total What is the capital structure weight for preferred stock? A) 11% B) 12% C) *13% D) 14% E) 15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts