Question: kD(5Chapter 4 Homework (1) la-search in Document ert Design Layout References Mailings Review Vievw Calibri (Body) 11A A a Styles Styles Pane You own a

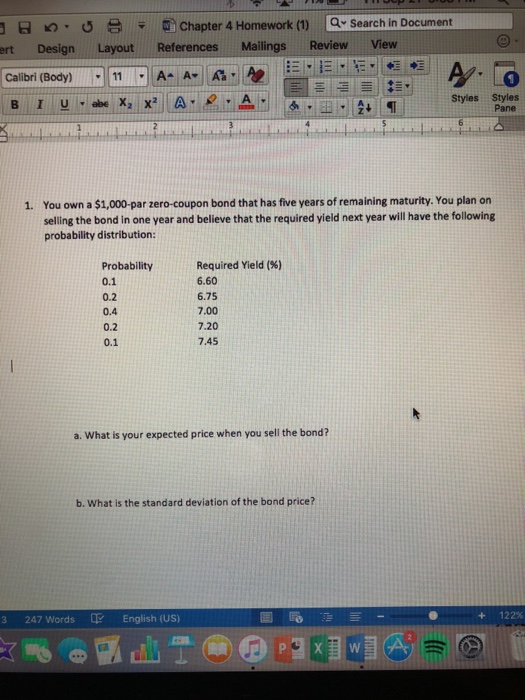

kD"(5Chapter 4 Homework (1) la-search in Document ert Design Layout References Mailings Review Vievw Calibri (Body) 11A A a Styles Styles Pane You own a $1,000-par zero-coupon bond that has five years of remaining maturity. You plan on selling the bond in one year and believe that the required yield next year will have the following probability distribution: 1. Probability 0.1 0.2 0.4 0.2 0.1 Required Yield (%) 6.60 6.75 7.00 7.20 7.45 a. What is your expected price when you sell the bond? b. What is the standard deviation of the bond price? + 122% 3 247 Words English (US)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts