Question: KEEP OR DROP A SEGMENT NIKE senior management thinks it should drop the Flash line of sneakers, and keep its other sneaker product lines. Below

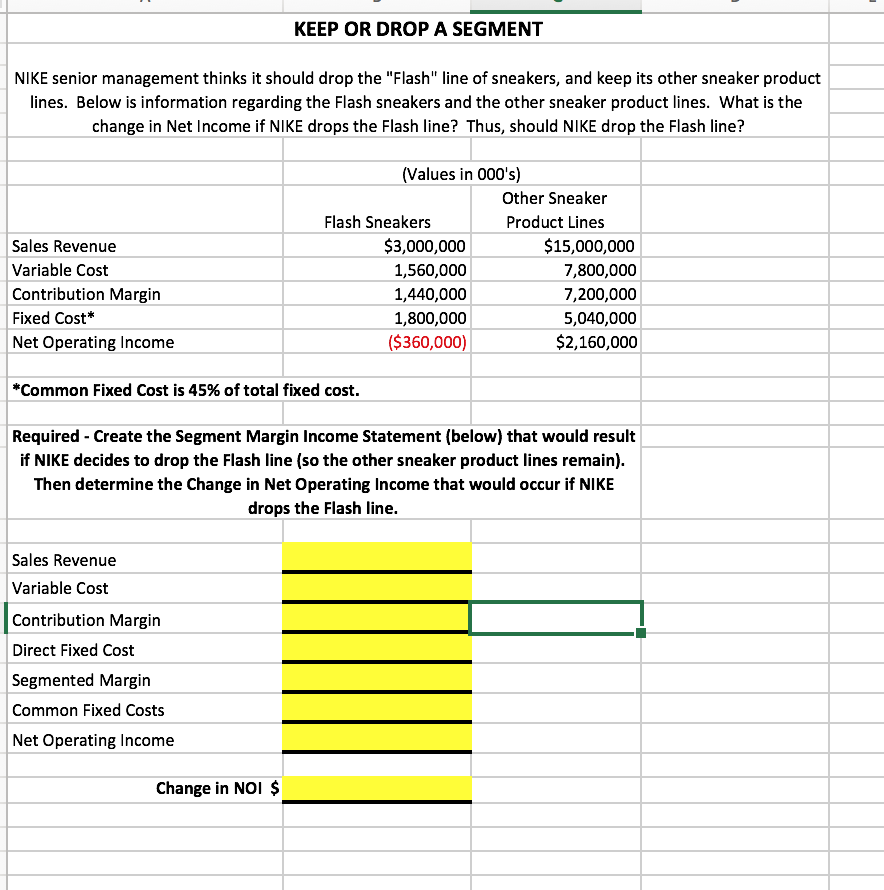

KEEP OR DROP A SEGMENT NIKE senior management thinks it should drop the "Flash" line of sneakers, and keep its other sneaker product lines. Below is information regarding the Flash sneakers and the other sneaker product lines. What is the change in Net Income if NIKE drops the Flash line? Thus, should NIKE drop the Flash line? Values in 000's) Other Sneaker Product Lines Flash Sneakers Sales Revenue Variable Cost Contribution Margin Fixed Cost* Net Operating Income $3,000,000 1,560,000 1,440,000 1,800,000 ($360,000) $15,000,000 7,800,000 7,200,000 5,040,000 $2,160,000 "Common Fixed Cost is 45% of total fixed cost Required - Create the Segment Margin Income Statement (below) that would result if NIKE decides to drop the Flash line (so the other sneaker product lines remain) Then determine the Change in Net Operating Income that would occur if NIKE drops the Flash line. Sales Revenue Variable Cost Contribution Margin Direct Fixed Cost Segmented Margin Common Fixed Costs Net Operating Income Change in NOI $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts