Question: key performance indicators and corporate governance PR8: Key Performance Indicators (KPIs) and Corporate Governance SCENARIO You have received the following email from your supervisor, Chris

key performance indicators and corporate governance

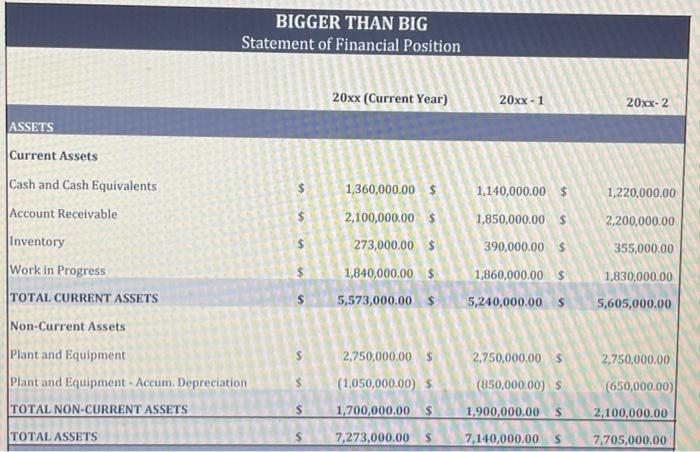

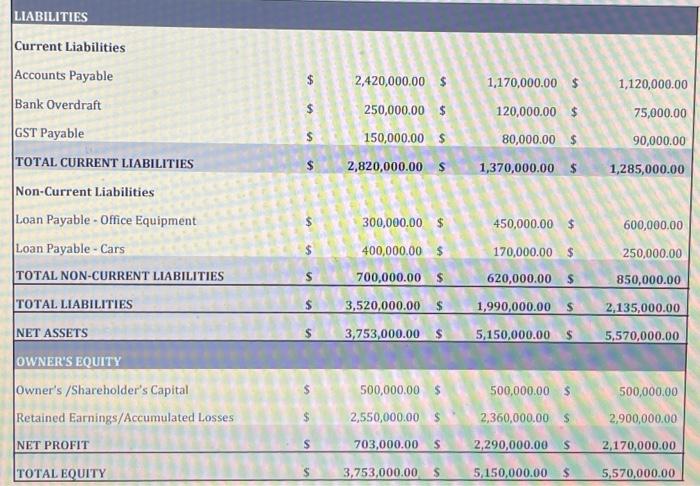

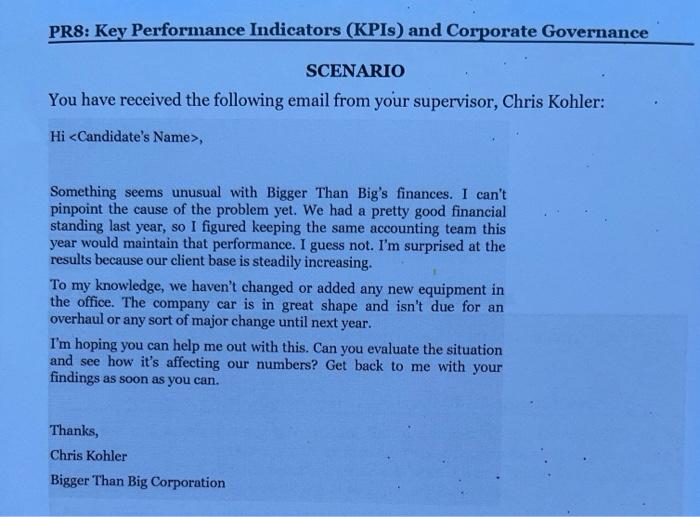

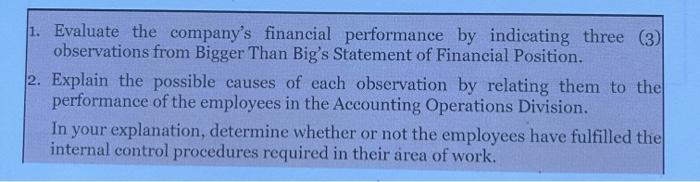

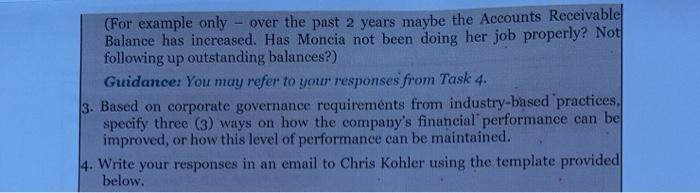

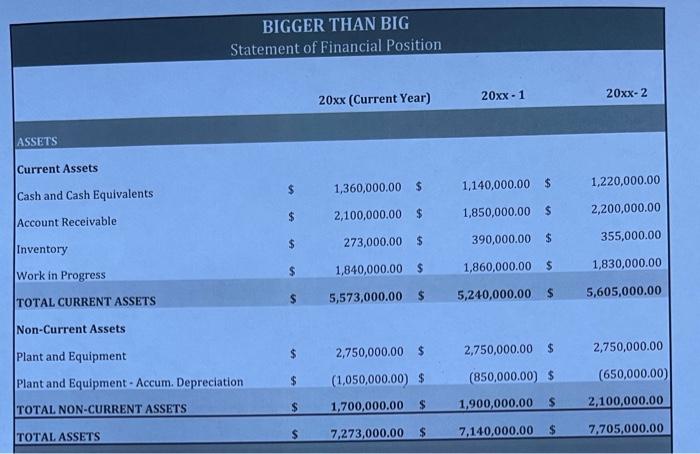

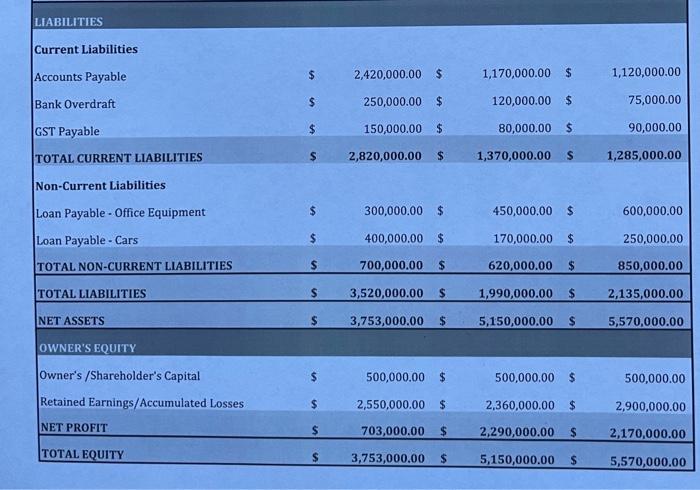

PR8: Key Performance Indicators (KPIs) and Corporate Governance SCENARIO You have received the following email from your supervisor, Chris Kohler: Hi , Something seems unusual with Bigger Than Big's finances. I can't pinpoint the cause of the problem yet. We had a pretty good financial standing last year, so I figured keeping the same accounting team this year would maintain that performance. I guess not. I'm surprised at the results because our client base is steadily increasing. To my knowledge, we haven't changed or added any new equipment in the office. The company car is in great shape and isn't due for an overhaul or any sort of major change until next year. I'm hoping you can help me out with this. Can you evaluate the situation and see how it's affecting our numbers? Get back to me with your findings as soon as you can. Thanks, Chris Kohler Bigger Than Big Corporation BIGGER THAN BIG Statement of Financial Position 20xx (Current Year) 20xx - 1 20xx-2 ASSETS Current Assets Cash and Cash Equivalents $ 1,360,000.00 $ 1,140,000.00 $ 1,220,000.00 Account Receivable $ 2,100,000.00 $ 1,850,000.00 $ 2,200,000.00 $ 273,000.00 $ 390,000.00 355,000.00 Inventory Work in Progress $ 1,840,000.00 $ 1,860,000.00 $ 1,830,000,00 TOTAL CURRENT ASSETS $ 5,573,000.00 $ 5,240,000.00 $ 5,605,000.00 Non-Current Assets Plant and Equipment $ 2,750,000.00 $ 2,750,000.00 $ 2,750,000.00 $ (1,050,000.00) $ (650,000.00 Plant and Equipment. Accum. Depreciation TOTAL NON-CURRENT ASSETS (850,000.00 $ 1,900,000.00 $ $ 1,700,000.00 $ 2,100,000.00 TOTAL ASSETS $ 7,273,000.00 $ 7,140,000.00 $ 7.705,000.00 LIABILITIES Current Liabilities Accounts Payable 2,420,000.00 $ 1,170,000.00 $ 1,120,000.00 Bank Overdraft $ 250,000.00 $ 120,000.00 $ 75,000.00 GST Payable $ 150,000.00 $ 80,000.00 $ 90,000.00 TOTAL CURRENT LIABILITIES $ 2,820,000.00 $ 1,370,000.00 $ 1,285,000.00 Non-Current Liabilities Loan Payable - Office Equipment $ 300,000.00 $ 450,000.00 $ 600,000.00 Loan Payable - Cars 400,000.00 $ 170,000.00 $ 250,000.00 TOTAL NON-CURRENT LIABILITIES s 700,000.00 $ 850,000.00 TOTAL LIABILITIES $ 3,520,000.00 $ 620,000.00 $ 1,990,000.00 $ 5,150,000.00 $ 2,135,000.00 NET ASSETS $ 3,753,000.00 $ 5,570,000.00 OWNER'S EQUITY owner's /Shareholder's Capital Retained Earnings/Accumulated Losses $ 500,000.00 $ 500,000.00 $ 500,000.00 $ 2,550,000.00 $ 2,360,000.00 $ 2,900,000.00 NET PROFIT 703,000.00 S 2,290,000.00 s 2,170,000.00 TOTAL EQUITY $ 3,753,000.00 $ 5,150,000.00 $ 5,570,000.00 1. Evaluate the company's financial performance by indicating three (3) observations from Bigger Than Big's Statement of Financial Position. 2. Explain the possible causes of each observation by relating them to the performance of the employees in the Accounting Operations Division. In your explanation, determine whether or not the employees have fulfilled the internal control procedures required in their area of work. (For example only - over the past 2 years maybe the Accounts Receivable Balance has increased. Has Moncia not been doing her job properly? Not following up outstanding balances?) 3. Based on corporate governance requirements from industry-based practices, specify three (3) ways on how the company's financial performance can be improved, or how this level of performance can be maintained. 4. Write your responses in an email to Chris Kohler using the template provided below. To: Chris Kohler Subject: Message: PR8: Key Performance Indicators (KPIS) and Corporate Governance SCENARIO You have received the following email from your supervisor, Chris Kohler: Hi , Something seems unusual with Bigger Than Big's finances. I can't pinpoint the cause of the problem yet. We had a pretty good financial standing last year, so I figured keeping the same accounting team this year would maintain that performance. I guess not. I'm surprised at the results because our client base is steadily increasing. To my knowledge, we haven't changed or added any new equipment in the office. The company car is in great shape and isn't due for an overhaul or any sort of major change until next year. I'm hoping you can help me out with this. Can you evaluate the situation and see how it's affecting our numbers? Get back to me with your findings as soon as you can. Thanks, Chris Kohler Bigger Than Big Corporation 1. Evaluate the company's financial performance by indicating three (3) observations from Bigger Than Big's Statement of Financial Position. 2. Explain the possible causes of each observation by relating them to the performance of the employees in the Accounting Operations Division. In your explanation, determine whether or not the employees have fulfilled the internal control procedures required in their area of work. (For example only over the past 2 years maybe the Accounts Receivable Balance has increased. Has Moncia not been doing her job properly? Not following up outstanding balances?) Guidance: You may refer to your responses from Task 4. 3. Based on corporate governance requirements from industry-based practices specify three (3) ways on how the company's financial performance can be improved, or how this level of performance can be maintained. 4. Write your responses in an email to Chris Kohler using the template provided below. To: Chris Kohler Subject: Message: open BIGGER THAN BIG Statement of Financial Position 20xx - 1 20xx-2 20xx (Current Year) ASSETS Current Assets $ 1,220,000.00 1,360,000.00 $ 1.140,000.00 $ Cash and Cash Equivalents $ 2,200,000.00 2,100,000.00 $ 1,850,000.00 $ Account Receivable $ 355,000.00 273,000.00 $ 390,000.00 $ Inventory $ Work in Progress 1,840,000.00 $ 1,860,000.00 $ 1,830,000.00 5,605,000.00 TOTAL CURRENT ASSETS 5,573,000.00 $ 5,240,000.00 $ S Non-Current Assets 2,750,000.00 $ Plant and Equipment 2,750,000.00 $ 2,750,000.00 $ Plant and Equipment - Accum. Depreciation (650,000.00) $ (850,000.00 $ (1,050,000.00 $ 1,700,000.00 $ TOTAL NON-CURRENT ASSETS 2,100,000.00 $ 1,900,000.00 $ TOTAL ASSETS $ 7.273,000.00 $ 7,140,000.00 $ 7.705,000.00 LIABILITIES Current Liabilities Accounts Payable $ 2,420,000.00 $ 1,170,000.00 $ 1,120,000.00 Bank Overdraft $ 250,000.00 $ 120,000.00 $ 75,000.00 GST Payable $ 150,000.00 $ 80,000.00 $ 90,000.00 TOTAL CURRENT LIABILITIES S 2,820,000.00 $ 1,370,000.00 S 1,285,000.00 Non-Current Liabilities Loan Payable - Office Equipment $ 300,000.00 $ 450,000.00 $ 600,000.00 Loan Payable - Cars $ 400,000.00 $ 170,000.00 $ 250,000.00 TOTAL NON-CURRENT LIABILITIES $ 700,000.00 $ 620,000.00 $ 850,000.00 TOTAL LIABILITIES S 3,520,000.00 S 1,990,000.00 $ 2,135,000.00 NET ASSETS $ 3,753,000.00 $ 5,150,000.00 $ 5,570,000.00 OWNER'S EQUITY 500,000.00 $ 500,000.00 $ 500,000.00 Owner's /Shareholder's Capital Retained Earnings/Accumulated Losses 2,550,000.00 $ 2,360,000.00 $ 2,900,000.00 NET PROFIT $ 703,000.00 $ 2,290,000.00 $ 2,170,000.00 TOTAL EQUITY $ 3,753,000.00 $ 5,150,000.00 $ 5,570,000.00 PR8: Key Performance Indicators (KPIs) and Corporate Governance SCENARIO You have received the following email from your supervisor, Chris Kohler: Hi , Something seems unusual with Bigger Than Big's finances. I can't pinpoint the cause of the problem yet. We had a pretty good financial standing last year, so I figured keeping the same accounting team this year would maintain that performance. I guess not. I'm surprised at the results because our client base is steadily increasing. To my knowledge, we haven't changed or added any new equipment in the office. The company car is in great shape and isn't due for an overhaul or any sort of major change until next year. I'm hoping you can help me out with this. Can you evaluate the situation and see how it's affecting our numbers? Get back to me with your findings as soon as you can. Thanks, Chris Kohler Bigger Than Big Corporation BIGGER THAN BIG Statement of Financial Position 20xx (Current Year) 20xx - 1 20xx-2 ASSETS Current Assets Cash and Cash Equivalents $ 1,360,000.00 $ 1,140,000.00 $ 1,220,000.00 Account Receivable $ 2,100,000.00 $ 1,850,000.00 $ 2,200,000.00 $ 273,000.00 $ 390,000.00 355,000.00 Inventory Work in Progress $ 1,840,000.00 $ 1,860,000.00 $ 1,830,000,00 TOTAL CURRENT ASSETS $ 5,573,000.00 $ 5,240,000.00 $ 5,605,000.00 Non-Current Assets Plant and Equipment $ 2,750,000.00 $ 2,750,000.00 $ 2,750,000.00 $ (1,050,000.00) $ (650,000.00 Plant and Equipment. Accum. Depreciation TOTAL NON-CURRENT ASSETS (850,000.00 $ 1,900,000.00 $ $ 1,700,000.00 $ 2,100,000.00 TOTAL ASSETS $ 7,273,000.00 $ 7,140,000.00 $ 7.705,000.00 LIABILITIES Current Liabilities Accounts Payable 2,420,000.00 $ 1,170,000.00 $ 1,120,000.00 Bank Overdraft $ 250,000.00 $ 120,000.00 $ 75,000.00 GST Payable $ 150,000.00 $ 80,000.00 $ 90,000.00 TOTAL CURRENT LIABILITIES $ 2,820,000.00 $ 1,370,000.00 $ 1,285,000.00 Non-Current Liabilities Loan Payable - Office Equipment $ 300,000.00 $ 450,000.00 $ 600,000.00 Loan Payable - Cars 400,000.00 $ 170,000.00 $ 250,000.00 TOTAL NON-CURRENT LIABILITIES s 700,000.00 $ 850,000.00 TOTAL LIABILITIES $ 3,520,000.00 $ 620,000.00 $ 1,990,000.00 $ 5,150,000.00 $ 2,135,000.00 NET ASSETS $ 3,753,000.00 $ 5,570,000.00 OWNER'S EQUITY owner's /Shareholder's Capital Retained Earnings/Accumulated Losses $ 500,000.00 $ 500,000.00 $ 500,000.00 $ 2,550,000.00 $ 2,360,000.00 $ 2,900,000.00 NET PROFIT 703,000.00 S 2,290,000.00 s 2,170,000.00 TOTAL EQUITY $ 3,753,000.00 $ 5,150,000.00 $ 5,570,000.00 1. Evaluate the company's financial performance by indicating three (3) observations from Bigger Than Big's Statement of Financial Position. 2. Explain the possible causes of each observation by relating them to the performance of the employees in the Accounting Operations Division. In your explanation, determine whether or not the employees have fulfilled the internal control procedures required in their area of work. (For example only - over the past 2 years maybe the Accounts Receivable Balance has increased. Has Moncia not been doing her job properly? Not following up outstanding balances?) 3. Based on corporate governance requirements from industry-based practices, specify three (3) ways on how the company's financial performance can be improved, or how this level of performance can be maintained. 4. Write your responses in an email to Chris Kohler using the template provided below. To: Chris Kohler Subject: Message: PR8: Key Performance Indicators (KPIS) and Corporate Governance SCENARIO You have received the following email from your supervisor, Chris Kohler: Hi , Something seems unusual with Bigger Than Big's finances. I can't pinpoint the cause of the problem yet. We had a pretty good financial standing last year, so I figured keeping the same accounting team this year would maintain that performance. I guess not. I'm surprised at the results because our client base is steadily increasing. To my knowledge, we haven't changed or added any new equipment in the office. The company car is in great shape and isn't due for an overhaul or any sort of major change until next year. I'm hoping you can help me out with this. Can you evaluate the situation and see how it's affecting our numbers? Get back to me with your findings as soon as you can. Thanks, Chris Kohler Bigger Than Big Corporation 1. Evaluate the company's financial performance by indicating three (3) observations from Bigger Than Big's Statement of Financial Position. 2. Explain the possible causes of each observation by relating them to the performance of the employees in the Accounting Operations Division. In your explanation, determine whether or not the employees have fulfilled the internal control procedures required in their area of work. (For example only over the past 2 years maybe the Accounts Receivable Balance has increased. Has Moncia not been doing her job properly? Not following up outstanding balances?) Guidance: You may refer to your responses from Task 4. 3. Based on corporate governance requirements from industry-based practices specify three (3) ways on how the company's financial performance can be improved, or how this level of performance can be maintained. 4. Write your responses in an email to Chris Kohler using the template provided below. To: Chris Kohler Subject: Message: open BIGGER THAN BIG Statement of Financial Position 20xx - 1 20xx-2 20xx (Current Year) ASSETS Current Assets $ 1,220,000.00 1,360,000.00 $ 1.140,000.00 $ Cash and Cash Equivalents $ 2,200,000.00 2,100,000.00 $ 1,850,000.00 $ Account Receivable $ 355,000.00 273,000.00 $ 390,000.00 $ Inventory $ Work in Progress 1,840,000.00 $ 1,860,000.00 $ 1,830,000.00 5,605,000.00 TOTAL CURRENT ASSETS 5,573,000.00 $ 5,240,000.00 $ S Non-Current Assets 2,750,000.00 $ Plant and Equipment 2,750,000.00 $ 2,750,000.00 $ Plant and Equipment - Accum. Depreciation (650,000.00) $ (850,000.00 $ (1,050,000.00 $ 1,700,000.00 $ TOTAL NON-CURRENT ASSETS 2,100,000.00 $ 1,900,000.00 $ TOTAL ASSETS $ 7.273,000.00 $ 7,140,000.00 $ 7.705,000.00 LIABILITIES Current Liabilities Accounts Payable $ 2,420,000.00 $ 1,170,000.00 $ 1,120,000.00 Bank Overdraft $ 250,000.00 $ 120,000.00 $ 75,000.00 GST Payable $ 150,000.00 $ 80,000.00 $ 90,000.00 TOTAL CURRENT LIABILITIES S 2,820,000.00 $ 1,370,000.00 S 1,285,000.00 Non-Current Liabilities Loan Payable - Office Equipment $ 300,000.00 $ 450,000.00 $ 600,000.00 Loan Payable - Cars $ 400,000.00 $ 170,000.00 $ 250,000.00 TOTAL NON-CURRENT LIABILITIES $ 700,000.00 $ 620,000.00 $ 850,000.00 TOTAL LIABILITIES S 3,520,000.00 S 1,990,000.00 $ 2,135,000.00 NET ASSETS $ 3,753,000.00 $ 5,150,000.00 $ 5,570,000.00 OWNER'S EQUITY 500,000.00 $ 500,000.00 $ 500,000.00 Owner's /Shareholder's Capital Retained Earnings/Accumulated Losses 2,550,000.00 $ 2,360,000.00 $ 2,900,000.00 NET PROFIT $ 703,000.00 $ 2,290,000.00 $ 2,170,000.00 TOTAL EQUITY $ 3,753,000.00 $ 5,150,000.00 $ 5,570,000.00