Question: KIND REQUEST NOT TO ATTEND THE QUESTION IF ONLY ONE QUESTION IS GOING TO BE ANSWERED. IM AWARE OF POLICIES. PLEASE MAKE FOR OTHERS WHO

KIND REQUEST NOT TO ATTEND THE QUESTION IF ONLY ONE QUESTION IS GOING TO BE ANSWERED. IM AWARE OF POLICIES. PLEASE MAKE FOR OTHERS WHO CAN SOLVE ALL THE PARTS. WILL DISLIKE IF ONE QUESTION IS ANSWERED.

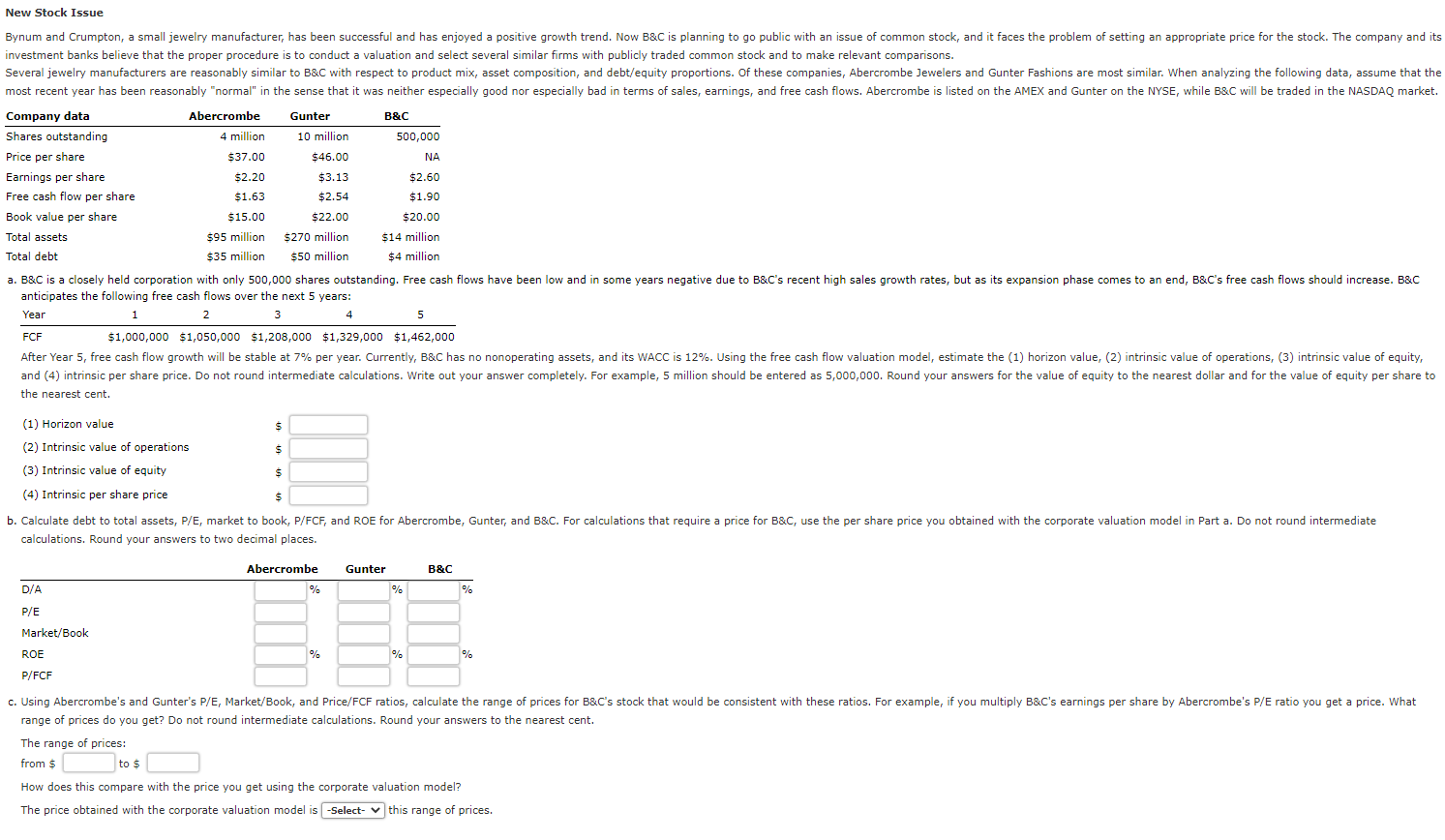

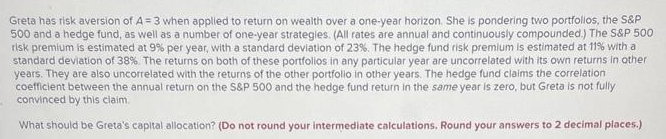

investment banks believe that the proper procedure is to conduct a valuation and select several similar firms with publicly traded common stock and to make relevant comparisons. anticipates the following free cash flows over the next 5 years: the nearest cent. calculations. Round your answers to two decimal places. range of prices do you get? Do not round intermediate calculations. Round your answers to the nearest cent. The range of prices: from $ to $ How does this compare with the price you get using the corporate valuation model? The price obtained with the corporate valuation model is this range of prices. Greta has risk aversion of A=3 when applled to return on wealth over a one-year horizon. She is pondering two portfollos, the S\&P 500 and a hedge fund, as well as a number of one-year strategles. (All rates are annual and continuously compounded.) The S\&P 500 risk premium is estimated at 9% per year, with a standard deviation of 23%. The hedge fund risk premlum is estimated at 11% with a standard deviation of 38%. The returns on both of these portfolios in any particular year are uncorrelated with its own returns in other years. They are also uncorrelated with the returns of the other portfollo in other years. The hedge fund claims the correlation coefficient between the annual return on the S\&P 500 and the hedge fund return in the same year is zero, but Greta is not fully corvinced by this claim. What should be Greta's capital allocation? (Do not round your intermediate calculations. Round your answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts