Question: KIND REQUEST NOT TO ATTEND THE QUESTION IF ONLY ONE QUESTION IS GOING TO BE ANSWERED. IM AWARE OF POLICIES. PLEASE MAKE FOR OTHERS WHO

KIND REQUEST NOT TO ATTEND THE QUESTION IF ONLY ONE QUESTION IS GOING TO BE ANSWERED. IM AWARE OF POLICIES. PLEASE MAKE FOR OTHERS WHO CAN SOLVE ALL THE PARTS. WILL DISLIKE IF ONE QUESTION IS ANSWERED.

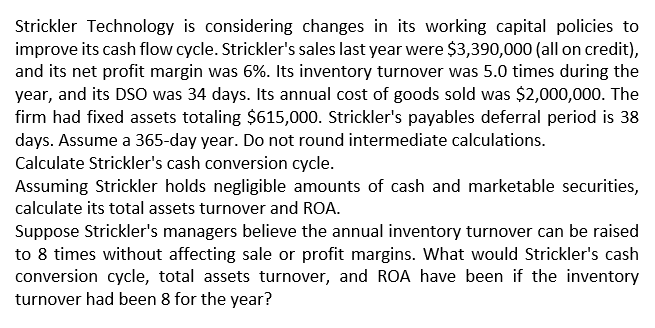

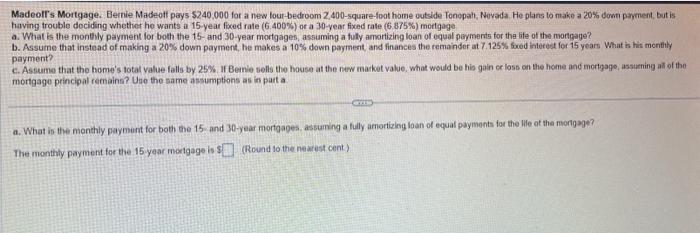

Strickler Technology is considering changes in its working capital policies to improve its cash flow cycle. Strickler's sales last year were $3,390,000 (all on credit), and its net profit margin was 6%. Its inventory turnover was 5.0 times during the year, and its DSO was 34 days. Its annual cost of goods sold was $2,000,000. The firm had fixed assets totaling $615,000. Strickler's payables deferral period is 38 days. Assume a 365-day year. Do not round intermediate calculations. Calculate Strickler's cash conversion cycle. Assuming Strickler holds negligible amounts of cash and marketable securities, calculate its total assets turnover and ROA. Suppose Strickler's managers believe the annual inventory turnover can be raised to 8 times without affecting sale or profit margins. What would Strickler's cash conversion cycle, total assets turnover, and ROA have been if the inventory turnover had been 8 for the year? Madeofr's Mortgage. Bernie Madeoff pays 5240,000 for a new lour-bedroom 2,400-square-foot home outside Tonopah, Novada. He plans to make a 20\% dont payment, but is having trouble deciding whether he wants a 15 -year ficed rate (6.400%) or a 30 -year fixed rate (6.875%) mertgage a. What is the monthly payment lor both the 15 -and 30-year mortgages, assuming a fully amortizing loan of equal payraents for the bife of the morthage? b. Assume that instead of making a 20% down payment, he makes a 10% down payment, and finances the remainder at 7.125% soed intorest for 15 yoars What is his mortily payment? c. Assume that the home's total value falls by 25%. If Bemle tielt the house at the new makkot value, what would be his gain or loss on the home and mortgage, assurning at of tho mortgago principal remains? Une the tame assumptions as in part a a. What is the monthly paymunt for both the 15 and 30 -year mortgapes, assuming a fully amortizing loan of equal paymonts for the life of the morigage? The monthly payment for the 15 year motgage is (Round lo the nearest cent)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts