Question: Kindly help in solving this question. Thank you (i) Using mean-variance portfolio theory, prove that the efficient frontier becomes a straight line in the presence

Kindly help in solving this question. Thank you

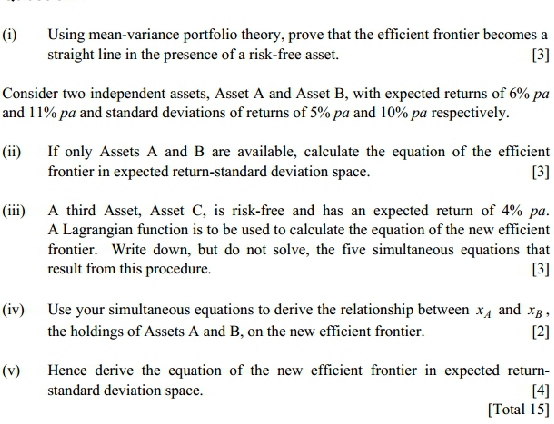

(i) Using mean-variance portfolio theory, prove that the efficient frontier becomes a straight line in the presence of a risk-free asset. [3] Consider two independent assets, Asset A and Asset B, with expected returns of 6% pa and 11% pa and standard deviations of returns of 5% pa and 10% pa respectively. (ii) If only Assets A and B are available, calculate the equation of the efficient frontier in expected return-standard deviation space. [3] (iii) A third Asset, Asset C, is risk-free and has an expected return of 4% pa. A Lagrangian function is to be used to calculate the equation of the new efficient frontier. Write down, but do not solve, the five simultaneous equations that result from this procedure. (3] (iv) Use your simultaneous equations to derive the relationship between x, and x6, the holdings of Assets A and B, on the new efficient frontier. [2] (v) Hence derive the equation of the new efficient frontier in expected return- standard deviation space. [4] [Total 15]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts